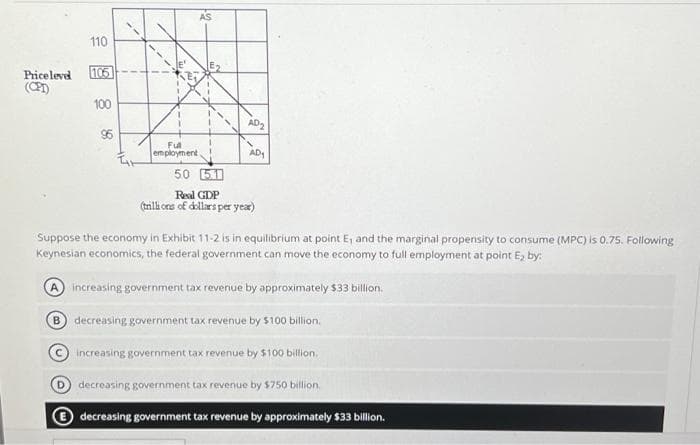

110 Price level 105 (CPT) 100 96 y. AS Ful employment 50 151 Real GDP AD AD₁ (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by: increasing government tax revenue by approximately $33 billion. B decreasing government tax revenue by $100 billion. increasing government tax revenue by $100 billion. decreasing government tax revenue by $750 billion. decreasing government tax revenue by approximately $33 billion.

110 Price level 105 (CPT) 100 96 y. AS Ful employment 50 151 Real GDP AD AD₁ (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by: increasing government tax revenue by approximately $33 billion. B decreasing government tax revenue by $100 billion. increasing government tax revenue by $100 billion. decreasing government tax revenue by $750 billion. decreasing government tax revenue by approximately $33 billion.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter24: The Aggregate Demand/aggregate Supply Model

Section: Chapter Questions

Problem 61P: Table 24.4 describes Santhers economy. Plot the AD/AS curves and identify the equilibrium. Would you...

Related questions

Question

Transcribed Image Text:Price level

(CPT)

110

105

100

95

AS

Ful

employment,

50 151

Real GDP

AD₁

(trillions of dollars per year)

Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following

Keynesian economics, the federal government can move the economy to full employment at point E₂ by:

A increasing government tax revenue by approximately $33 billion.

B decreasing government tax revenue by $100 billion.

increasing government tax revenue by $100 billion.

decreasing government tax revenue by $750 billion.

decreasing government tax revenue by approximately $33 billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax