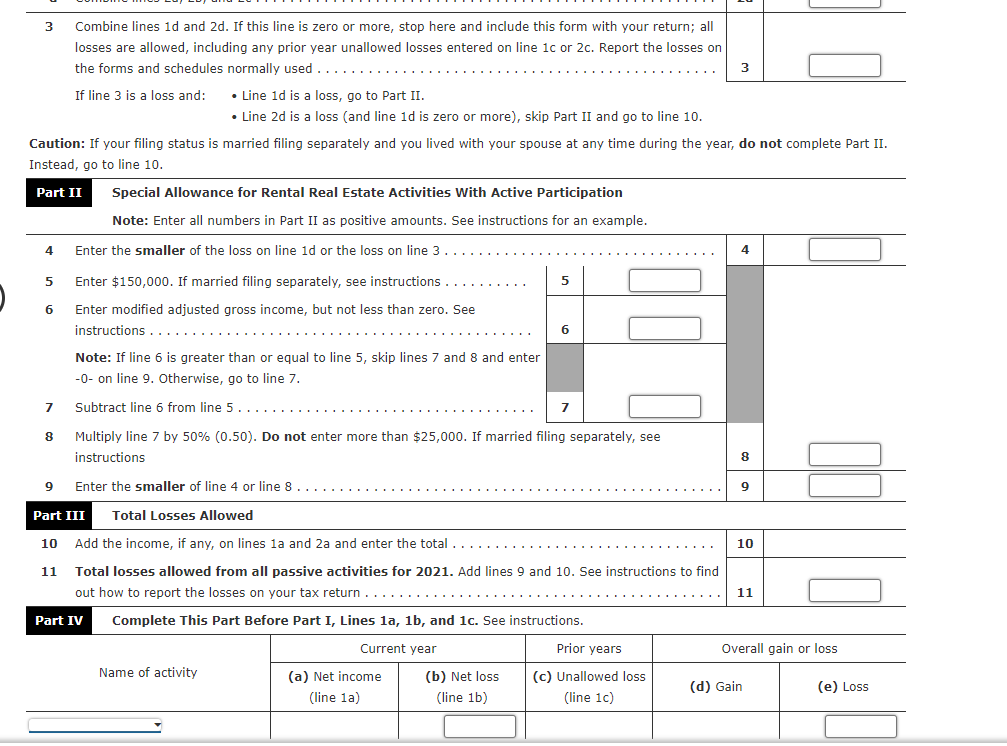

5 6 Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II. Instead, go to line 10. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part II as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 3 7 Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. Report the losses on the forms and schedules normally used If line 3 is a loss and: 8 • Line 1d is a loss, go to Part II. • Line 2d is a loss (and line 1d is zero or more), skip Part II and go to line 10. Enter $150,000. If married filing separately, see instructions Enter modified adjusted gross income, but not less than zero. See instructions.. Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter -0- on line 9. Otherwise, go to line 7. Subtract line 6 from line 5 Multiply line 7 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions Enter the smaller of line 4 or line 8. Name of activity 5 (a) Net income (line 1a) (b) Net loss (line 1b) 6 9 Part III Total Losses Allowed 10 Add the income, if any, on lines 1a and 2a and enter the total 11 Total losses allowed from all passive activities for 2021. Add lines 9 and 10. See instructions to find out how to report the losses on your tax return Part IV Complete This Part Before Part I, Lines 1a, 1b, and 1c. See instructions. Current year 100 7 3 Prior years (c) Unallowed loss (line 1c) 4 8 9 10 11 Overall gain or loss (d) Gain (e) Loss

5 6 Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II. Instead, go to line 10. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part II as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 3 7 Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. Report the losses on the forms and schedules normally used If line 3 is a loss and: 8 • Line 1d is a loss, go to Part II. • Line 2d is a loss (and line 1d is zero or more), skip Part II and go to line 10. Enter $150,000. If married filing separately, see instructions Enter modified adjusted gross income, but not less than zero. See instructions.. Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter -0- on line 9. Otherwise, go to line 7. Subtract line 6 from line 5 Multiply line 7 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions Enter the smaller of line 4 or line 8. Name of activity 5 (a) Net income (line 1a) (b) Net loss (line 1b) 6 9 Part III Total Losses Allowed 10 Add the income, if any, on lines 1a and 2a and enter the total 11 Total losses allowed from all passive activities for 2021. Add lines 9 and 10. See instructions to find out how to report the losses on your tax return Part IV Complete This Part Before Part I, Lines 1a, 1b, and 1c. See instructions. Current year 100 7 3 Prior years (c) Unallowed loss (line 1c) 4 8 9 10 11 Overall gain or loss (d) Gain (e) Loss

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:3

4

5

Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II.

Instead, go to line 10.

Part II Special Allowance for Rental Real Estate Activities With Active Participation

Note: Enter all numbers in Part II as positive amounts. See instructions for an example.

Enter the smaller of the loss on line 1d or the loss on line 3.

6

7

8

Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all

losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. Report the losses on

the forms and schedules normally used

If line 3 is a loss and:

9

• Line 1d is a loss, go to Part II.

• Line 2d is a loss (and line 1d is zero or more), skip Part II and go to line 10.

Enter $150,000. If married filing separately, see instructions

Enter modified adjusted gross income, but not less than zero. See

instructions..

Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter

-0- on line 9. Otherwise, go to line 7.

Subtract line 6 from line 5

Multiply line 7 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see

instructions

Name of activity

Enter the smaller of line 4 or line 8..

Part III

Total Losses Allowed

10 Add the income, if any, on lines 1a and 2a and enter the total

11 Total losses allowed from all passive activities for 2021. Add lines 9 and 10. See instructions to find

out how to report the losses on your tax return.

Part IV

Complete This Part Before Part I, Lines 1a, 1b, and 1c. See instructions.

Current year

5

(a) Net income

(line 1a)

(b) Net loss

(line 1b)

7

3

Prior years

(c) Unallowed loss

(line 1c)

4

8

9

10

11

Overall gain or loss

(d) Gain

(e) Loss

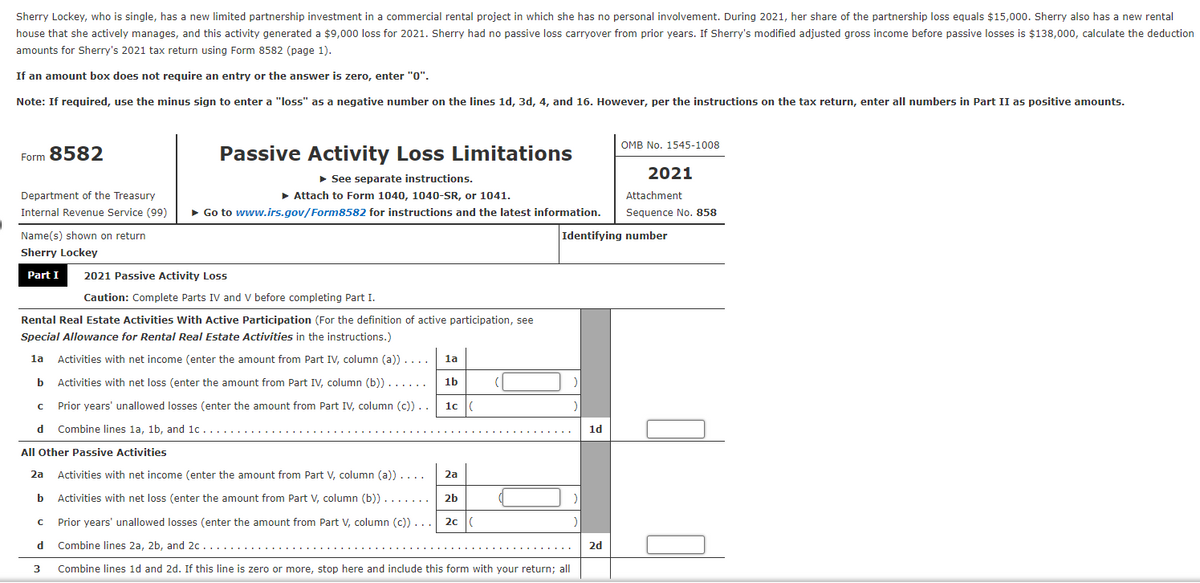

Transcribed Image Text:Sherry Lockey, who is single, has a new limited partnership investment in a commercial rental project in which she has no personal involvement. During 2021, her share of the partnership loss equals $15,000. Sherry also has a new rental

house that she actively manages, and this activity generated a $9,000 loss for 2021. Sherry had no passive loss carryover from prior years. If Sherry's modified adjusted gross income before passive losses is $138,000, calculate the deduction

amounts for Sherry's 2021 tax return using Form 8582 (page 1).

If an amount box does not require an entry or the answer is zero, enter "0".

Note: If required, use the minus sign to enter a "loss" as a negative number on the lines 1d, 3d, 4, and 16. However, per the instructions on the tax return, enter all numbers in Part II as positive amounts.

Form 8582

Department of the Treasury

Internal Revenue Service (99)

Name(s) shown on return

Sherry Lockey

Part I 2021 Passive Activity Loss

Caution: Complete Parts IV and V before completing Part I.

Rental Real Estate Activities With Active Participation (For the definition of active participation, see

Special Allowance for Rental Real Estate Activities in the instructions.)

1a Activities with net income (enter the amount from Part IV, column (a)). . . .

Activities with net loss (enter the amount from Part IV, column (b))..

Prior years' unallowed losses (enter the amount from Part IV, column (c))..

d Combine lines 1a, 1b, and 1c....

b

с

Passive Activity Loss Limitations

► See separate instructions.

▶ Attach to Form 1040, 1040-SR, or 1041.

Go to www.irs.gov/Form8582 for instructions and the latest information.

2a

b

1a

1b

1c (

All Other Passive Activities

Activities with net income (enter the amount from Part V, column (a))....

Activities with net loss (enter the amount from Part V, column (b))

с Prior years' unallowed losses (enter the amount from Part V, column (c)) ..

d

Combine lines 2a, 2b, and 2c.....

3 Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all

2a

2b

2c (

)

)

Identifying number

)

)

1d

OMB No. 1545-1008

2d

2021

Attachment

Sequence No. 858

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT