(a) Using data tables, construct a model that shows the value of the portfolio with options and without options for a share price in six months between $20 and $29 per share in increments of $1.00. What is the benefit of the put options on the portfolio value for the different share prices? For subtractive or negative numbers use a minus sign even if there is a + sign before the blank (Example: -300). If you answer is zero, enter "0". Share Price Benefit of Options $20 $21 $22 $23 $24 $25 $26 $27 $28 $29 $ $ $ $ $ $ $ $ $

(a) Using data tables, construct a model that shows the value of the portfolio with options and without options for a share price in six months between $20 and $29 per share in increments of $1.00. What is the benefit of the put options on the portfolio value for the different share prices? For subtractive or negative numbers use a minus sign even if there is a + sign before the blank (Example: -300). If you answer is zero, enter "0". Share Price Benefit of Options $20 $21 $22 $23 $24 $25 $26 $27 $28 $29 $ $ $ $ $ $ $ $ $

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 35QA

Related questions

Question

Transcribed Image Text:signmen

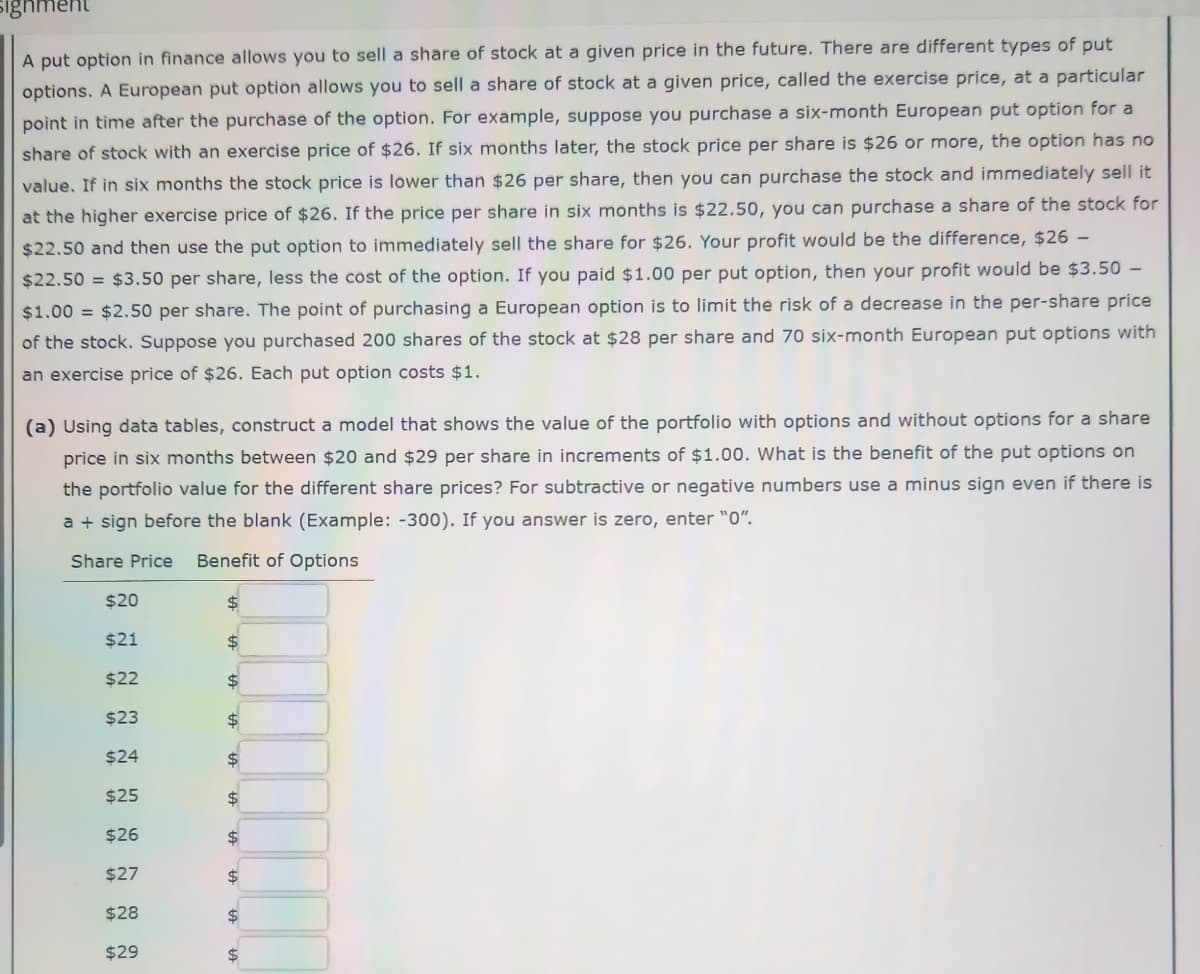

A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put

options. A European put option allows you to sell a share of stock at a given price, called the exercise price, at a particular

point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a

share of stock with an exercise price of $26. If six months later, the stock price per share is $26 or more, the option has no

value. If in six months the stock price is lower than $26 per share, then you can purchase the stock and immediately sell it

at the higher exercise price of $26. If the price per share in six months is $22.50, you can purchase a share of the stock for

$22.50 and then use the put option to immediately sell the share for $26. Your profit would be the difference, $26 -

$22.50 = $3.50 per share, less the cost of the option. If you paid $1.00 per put option, then your profit would be $3.50 -

$1.00 = $2.50 per share. The point of purchasing a European option is to limit the risk of a decrease in the per-share price

of the stock. Suppose you purchased 200 shares of the stock at $28 per share and 70 six-month European put options with

an exercise price of $26. Each put option costs $1.

(a) Using data tables, construct a model that shows the value of the portfolio with options and without options for a share

price in six months between $20 and $29 per share in increments of $1.00. What is the benefit of the put options on

the portfolio value for the different share prices? For subtractive or negative numbers use a minus sign even if there is

a + sign before the blank (Example: -300). If you answer is zero, enter "0".

Share Price Benefit of Options

$20

$21

$22

$23

$24

$25

$26

$27

$28

$29

$

$

$

$

$

$

$

$

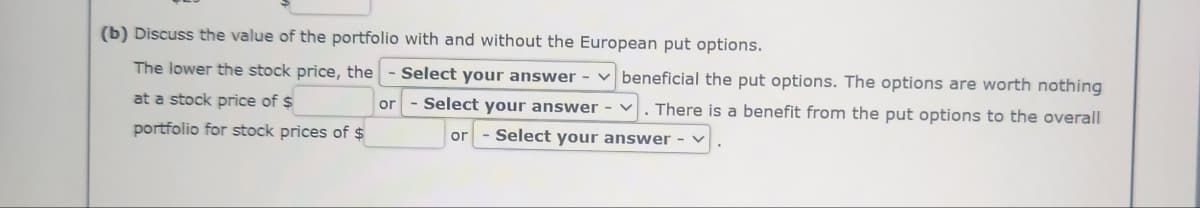

Transcribed Image Text:(b) Discuss the value of the portfolio with and without the European put options.

The lower the stock price, the - Select your answer - beneficial the put options. The options are worth nothing

at a stock price of $

Select your answer - There is a benefit from the put options to the overall

or

portfolio for stock prices of $

- Select your answer - ✓

or

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning