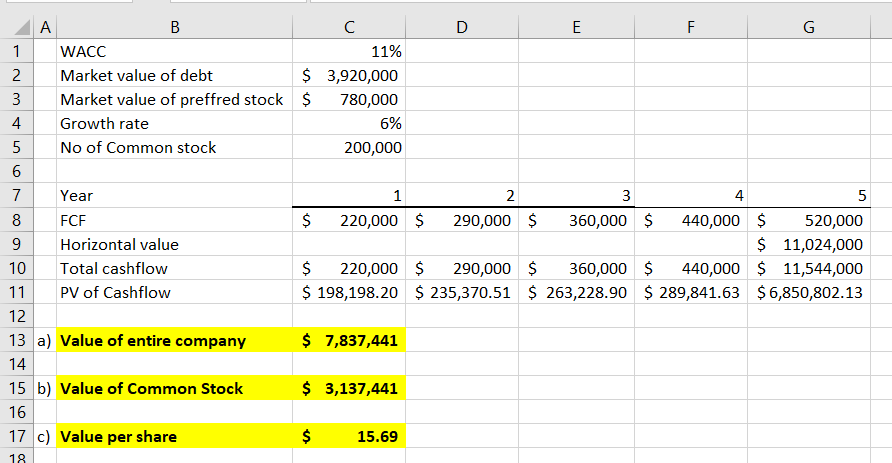

a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share?

Q: There is 6 percent probability of recession, 21 percent probability of a poor economy, 47 percent…

A: Data for expected return calculation Probability Return 6% -20.80% 21% 4.40% 47% 12.20%…

Q: What are some considerations a company should take into account when establishing dividend policy?

A: A company's dividend policy is an important financial decision that can impact the company's…

Q: You observe a one-year discount US Treasury bond in the market with the following characteristics:…

A: The implied one year interest rate is the interest rate that is calculated from the prices of…

Q: The notion that money has time value is based on the existence of a non–zero opportunity rate (i.e.,…

A: The concept of the time value of money is based on the idea that money has different values at…

Q: Assume you are working with the foundation to fund a scholarship in your name. Currently, the…

A: Since payment is due for indefinite period, we need to use PV of perpetuity formula to calculate…

Q: The offering price of an open-end fund is $16.70 per share and the fund is sold with a front-end…

A: Open-end funds are those funds that issues or redeems its shares at net asset value.

Q: City Street Fund has a portfolio of $200 million and liabilities of $25 million. If there are 10…

A: Net asset value is the market value of a mutual fund, or hedge fund that an investor holds., in…

Q: XYZ stock is currently selling at $15 having a required return of 12%. The dividend next year is…

A: Given, D0= $2 Ke=12% g=Year 1=5% Year 2=9% Year 3=12% Year 4 onwards constant=9% D1=…

Q: Subject: Islamic banking Q): Financing Amount : Rs 100mn (Jan 1), Profit Rate : 16% p.a. Tenor…

A: Financing amount "PV" - Rs. 100 mn Profit rate = 16% p.a Tenor = 1 Now, 4 equal payments in a year…

Q: The zero coupon bonds of JK Industries have a market price of $511.26, a face value of $1,000, and a…

A: Bonds are fixed-income assets that serve as a representation of investor loans to borrowers…

Q: rachel has a new credit card with an apr of 14.99% and a credit limit of $1600. the minimum monthly…

A: Data given: APR=14.99% Purchase =$250 Required: Rachels new balance at the end of the month.

Q: A couple wishes to borrow money using the equity in their home for collateral. A loan company will…

A: Let L is the amount loaned out. L= 80% of initial value (20% already paid out) L= 80% of $61,760 L=…

Q: Bartling Energy Systems recently reported $9,250 of sales, $5,750 of operating costs other than…

A: Net income is a financial metric that represents the amount of profit a company has earned after…

Q: Compare M&M Theorem Proposition 1 and Proposition 2 in perfectly efficient market and in the real…

A: The Modigliani-Miller (M&M) theorem is a fundamental concept in finance that explains how the…

Q: Filter Corp. has a project available with the following cash flows: Year Cash Flow 0 −$15,900 1…

A: Data for IRR calculation Year Cash flow 0 -15900 1 5300 2 6600 3 6000 4 4400

Q: A project is expected to generate annual revenues of $117,700, with variable costs of $74,800, and…

A: Importance of operating cash flows Because cash flow indicators eliminate some accounting…

Q: Last year, Harrington Inc. had sales of $325,000 and a net income of $19,000. Its year-end assets…

A: Total calculate the return on equity we will use the below formula ROE = Net income/Equity Where…

Q: purchase property that has an annual net income of 587000 and want to ear 8.25% on investment what…

A: It will be calculated using formula of Present Value : Present Value = Annual Income1 + rn…

Q: The disposable income from my part-time job in 2021 was $12,000. In 2020, I borrowed $580 at 15…

A: Funds available for spending = Disposable income - loan*(1+interest rate)

Q: Given the following information, what is expected loss of a $200,000 loan in percent?…

A: Hi student Since there are multiple questions, we will answer only first question. Probability of…

Q: Why should financial decision makers obtain a good estimate of a firm’s cost of capital? What are…

A: The cost of capital is the cost of using the funds in the business. The funds may be in form of debt…

Q: the concept "pay yourself first". With this in mind, what is your advice to someone on paying off…

A: The concept of "pay yourself first" is an important financial principle that encourages people to…

Q: 10. Suppose the interest rate is 8% APR with monthly compounding. What is the present value of an…

A: The concept of money's time worth reveals that any sum is currently worth more than what it will be…

Q: In preparing a cash budget, what use is made of the number: cost of goods sold as a percentage of…

A: Cash budget is an important budget in finance. It shows the different sources of cash receipts…

Q: Blink of an Eye Company is evaluating a 5-year project that will provide cash flows of $39,300,…

A: Calculation of NPV is one of the technique used in capital budgeting, under which present value of…

Q: Mrs. Turner died this year at age 83. On the date of death, the FMV of Mrs. Turner's property was…

A: since the answer to question 1 is not required, the answer to the second question will be given…

Q: Explain why risk adjustments are important and how they can affect firm value.

A: Risk adjustments are a critical component of financial analysis and investment decision-making,…

Q: World Travel has 7.2 percent, semiannual, coupon bonds outstanding with a current market price of…

A: Semiannual coupon payment = (Coupon rate/2)*Par value = (0.072/2)×$1000 = 0.036×$1000 = $36…

Q: Which of the following is true about credit cards? A) when you use one, the money is taken directly…

A: A) False. When you use a credit card, the money is not taken directly from your bank account.…

Q: Directors are under a duty to exercise independent judgment. What does this mean? Why do floating…

A: Directors of a company have a duty to exercise independent judgment, which is a fundamental…

Q: You are given the following information for Troy Pizza Company: Sales = $70,000; Costs = $31,900;…

A: Data given: Sales = $70,000 Costs = $31,900 Addition to retained earnings = $6,300 Dividends paid =…

Q: ou are evaluating the potential purchase of a small business with no debt or preferred stock that is…

A: The discounted cash flow approach will be used and applied here. As per the discounted cash flow…

Q: Pastel Interiors is currently an all-equity firm that has an annual projected BIT of $136,900. The…

A: Value of firm The market value of a company is determined by adding the market values of all…

Q: An investment promises the following cash flow stream: $1,000 at Time 0; $2,000 at the end of Year 1…

A: The present value of a series of cash flows refers to the current value of a future stream of cash…

Q: You are expecting a tax refund of $2,000 in 10 weeks. A tax preparer offers you an "interest-free"…

A: When lender issue loans to borrowers for a certain time period. He charges some interest on the…

Q: A 5-year annuity of ten $11,000 semiannual payments will begin 10 years from now, with the first…

A: The nominal rate is the stated rate of interest, while the effective rate is the actual rate that…

Q: Nativity is a relatively small, privately owned firm. Last year the company had after-tax income of…

A: The market value of a share refers to the price of the securities being traded in the stock…

Q: Assume the new investor sells the 420 shares. What is his profit? What is the annualized return The…

A: Annualized return refers to the expected return by the investors on the investment made. It…

Q: Compute the equivalent rate of 5% compounded semi-annually to a rate compounded quarterly. A.…

A: As per the given information: The original interest rate is compounded semi-annually, so the…

Q: einford Group has total assets of $5161127, short-term debt of $681174, long-term debt of $964979,…

A: The debt ratio is a financial ratio used to determine a company's leverage. A high debt ratio…

Q: Kelsey Construction has purchased a crane that comes with a 3-year warranty. Repair costs are…

A: Present worth A sort of credit facility offered by banks is a credit card, which enables users to…

Q: A stock had returns of 18.58 percent, −5.58 percent, and 20.81 percent for the past three years.…

A: Any sum infused into multiple avenues available in the market to earn income and create wealth is an…

Q: A bond has 10 years until maturity, a coupon rate of 9%, and sells for $1,100. Interest is paid…

A: Bonds are issued by borrowers to attract capital from investors ready to extend a loan to them for a…

Q: what size payments should occur when 8000 is borrowed at 8% per year compounded quarterly and the…

A: Present value = pv = 8000 Time = t = 24 months Interest rate = r = (1 + (0.08 / 4))^(4/12) - 1 = (1…

Q: Your father is about to retire, and wants to buy an annuity that will provide him with $50,000 of…

A: Present value is the current worth of a future sum of money, given a specific interest rate or…

Q: The Browning family of Colorado wants to buy a $102,000 house. (a) If they can get a loan of 80% of…

A: Step 1 The Federal Housing Administration insures private lenders who make FHA loans. The FHA does…

Q: A loan of $370,000 is amortized over 30 years with payments at the end of each month and an interest…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: The idea that changes in dividend policy reflects managers' views about the firm's future earnings…

A: A company pays dividends to its shareholders as a way to share its profits with them. Dividends are…

Q: Determine the periodic payments on the given loan or mortgage. HINT [See Example 5.] (Round your…

A: The question is based on the concept of Annuity in Financial Management. Annuity refers to the…

Q: The Closed Fund is a closed-end investment company with a portfolio currently worth $190 million. It…

A: NAV of the Fund The total value of the assets owned less the total liabilities equals the Net Asset…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. After year the firm expects its free cash flow to grow by 5% The firm's weighted average cost of capital is 13%, and it has $2,220,000 of debt at market value and $440,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, are given in the table, annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what is…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 12 %, and it has $3,060,000 of debt at market value and $610,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 6 % annually. Year (t) Free Cash Flow (FCF) 2020 $260,000 2021 $330,000 2022 $380,000 2023 $430,000 2024 $480,000 a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b.…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 11%, and it has $4,080,000 of debt at market value and $820,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, are given in the table, After year 5, the firm expects its free cash flow to grow by 6% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what…

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,720,000 of debt at market value and $340,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, 1 230,0002 270,0003 330,0004 360,0005 420,000After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 11%, and it has $3,500,000 of debt at market value and $700,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, E. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 6% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 14%, and it has $1,920,000 of debt at market value and $380,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, Beyond 2024 to infinity, the firm expects its free cash flow to grow by 5% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of…

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their owr estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $2,150,000 of debt at market value and $430,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table E. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 4% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 15 %, and it has $ 1,670,000 of debt at market value and $ 330,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, Year (t) Free cash flow (FCF) 2020 $230,000 2021 $260,000 2022 $330,000 2023 $370,000 2024 $440,000 Beyond 2024 to infinity, the firm expects its free cash flow to grow by 5% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a,…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,760,000 of debt at market value and $350,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, are given in the table, After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what…

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 14 %, and it has $1,820,000 of debt at market value and $360,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, are given in the table. After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock,…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,820,000 of debt at market value and $360,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, Beyond 2024 to infinity, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,580,000 of debt at market value and $320,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, are given in the table, . After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock,…