Bridgeport Corporation owned 15400 shares of Harper Corporation's $5 par value common stock. These shares were purchased 2020 for $326326. On May 4, 2022, Bridgeport declared a property dividend of one share of Harper for every twenty shares of Bridgeport stock held by a stockholder. On that date, when the market price of Harper was $35 per share, there were 308000 sha of Bridgeport outstanding. What net reduction in retained earnings would result from this property dividend? (Round intermediate calculations of cross rate to 2 decimal places e.g. 15.25.) O $539000 O $326326 O $154000

Bridgeport Corporation owned 15400 shares of Harper Corporation's $5 par value common stock. These shares were purchased 2020 for $326326. On May 4, 2022, Bridgeport declared a property dividend of one share of Harper for every twenty shares of Bridgeport stock held by a stockholder. On that date, when the market price of Harper was $35 per share, there were 308000 sha of Bridgeport outstanding. What net reduction in retained earnings would result from this property dividend? (Round intermediate calculations of cross rate to 2 decimal places e.g. 15.25.) O $539000 O $326326 O $154000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 1MC

Related questions

Question

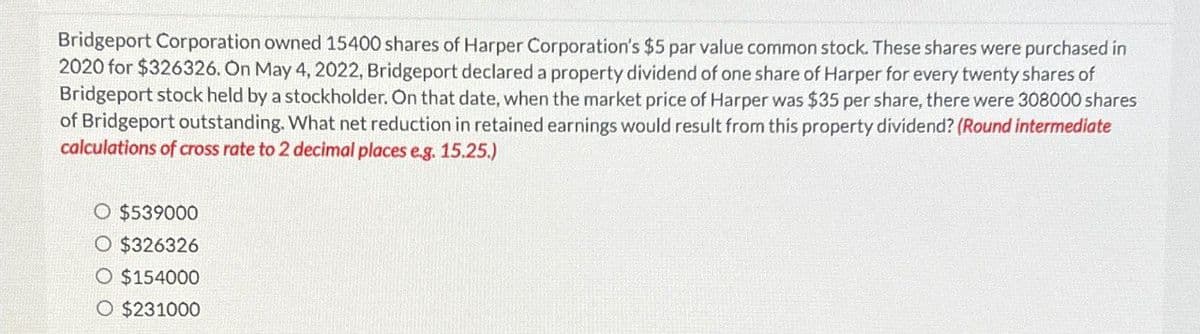

Transcribed Image Text:Bridgeport Corporation owned 15400 shares of Harper Corporation's $5 par value common stock. These shares were purchased in

2020 for $326326. On May 4, 2022, Bridgeport declared a property dividend of one share of Harper for every twenty shares of

Bridgeport stock held by a stockholder. On that date, when the market price of Harper was $35 per share, there were 308000 shares

of Bridgeport outstanding. What net reduction in retained earnings would result from this property dividend? (Round intermediate

calculations of cross rate to 2 decimal places e.g. 15.25.)

○ $539000

O $326326

○ $154000

O $231000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning