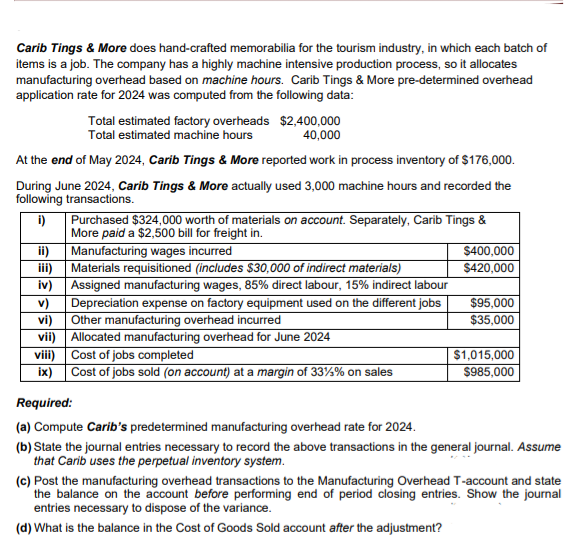

Carib Tings & More does hand-crafted memorabilia for the tourism industry, in which each batch of items is a job. The company has a highly machine intensive production process, so it allocates manufacturing overhead based on machine hours. Carib Tings & More pre-determined overhead application rate for 2024 was computed from the following data: Total estimated factory overheads $2,400,000 Total estimated machine hours 40,000 At the end of May 2024, Carib Tings & More reported work in process inventory of $176,000. During June 2024, Carib Tings & More actually used 3,000 machine hours and recorded the following transactions. Purchased $324,000 worth of materials on account. Separately, Carib Tings & More paid a $2,500 bill for freight in. i) ii) Manufacturing wages incurred $400,000 iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000 iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour v) vi) Depreciation expense on factory equipment used on the different jobs Other manufacturing overhead incurred $95,000 $35,000 vii) Allocated manufacturing overhead for June 2024 viii) Cost of jobs completed ix) Cost of jobs sold (on account) at a margin of 33%% on sales $1,015,000 $985,000 Required: (a) Compute Carib's predetermined manufacturing overhead rate for 2024. (b) State the journal entries necessary to record the above transactions in the general journal. Assume that Carib uses the perpetual inventory system. (c) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account and state the balance on the account before performing end of period closing entries. Show the journal entries necessary to dispose of the variance. (d) What is the balance in the Cost of Goods Sold account after the adjustment?

Carib Tings & More does hand-crafted memorabilia for the tourism industry, in which each batch of items is a job. The company has a highly machine intensive production process, so it allocates manufacturing overhead based on machine hours. Carib Tings & More pre-determined overhead application rate for 2024 was computed from the following data: Total estimated factory overheads $2,400,000 Total estimated machine hours 40,000 At the end of May 2024, Carib Tings & More reported work in process inventory of $176,000. During June 2024, Carib Tings & More actually used 3,000 machine hours and recorded the following transactions. Purchased $324,000 worth of materials on account. Separately, Carib Tings & More paid a $2,500 bill for freight in. i) ii) Manufacturing wages incurred $400,000 iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000 iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour v) vi) Depreciation expense on factory equipment used on the different jobs Other manufacturing overhead incurred $95,000 $35,000 vii) Allocated manufacturing overhead for June 2024 viii) Cost of jobs completed ix) Cost of jobs sold (on account) at a margin of 33%% on sales $1,015,000 $985,000 Required: (a) Compute Carib's predetermined manufacturing overhead rate for 2024. (b) State the journal entries necessary to record the above transactions in the general journal. Assume that Carib uses the perpetual inventory system. (c) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account and state the balance on the account before performing end of period closing entries. Show the journal entries necessary to dispose of the variance. (d) What is the balance in the Cost of Goods Sold account after the adjustment?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter5: Product And Service Costing: Job-order System

Section: Chapter Questions

Problem 27P: Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming...

Related questions

Question

Transcribed Image Text:Carib Tings & More does hand-crafted memorabilia for the tourism industry, in which each batch of

items is a job. The company has a highly machine intensive production process, so it allocates

manufacturing overhead based on machine hours. Carib Tings & More pre-determined overhead

application rate for 2024 was computed from the following data:

Total estimated factory overheads $2,400,000

Total estimated machine hours

40,000

At the end of May 2024, Carib Tings & More reported work in process inventory of $176,000.

During June 2024, Carib Tings & More actually used 3,000 machine hours and recorded the

following transactions.

Purchased $324,000 worth of materials on account. Separately, Carib Tings &

More paid a $2,500 bill for freight in.

i)

ii)

Manufacturing wages incurred

$400,000

iii)

Materials requisitioned (includes $30,000 of indirect materials)

$420,000

iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour

v)

vi)

Depreciation expense on factory equipment used on the different jobs

Other manufacturing overhead incurred

$95,000

$35,000

vii)

Allocated manufacturing overhead for June 2024

viii)

Cost of jobs completed

ix)

Cost of jobs sold (on account) at a margin of 33%% on sales

$1,015,000

$985,000

Required:

(a) Compute Carib's predetermined manufacturing overhead rate for 2024.

(b) State the journal entries necessary to record the above transactions in the general journal. Assume

that Carib uses the perpetual inventory system.

(c) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account and state

the balance on the account before performing end of period closing entries. Show the journal

entries necessary to dispose of the variance.

(d) What is the balance in the Cost of Goods Sold account after the adjustment?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub