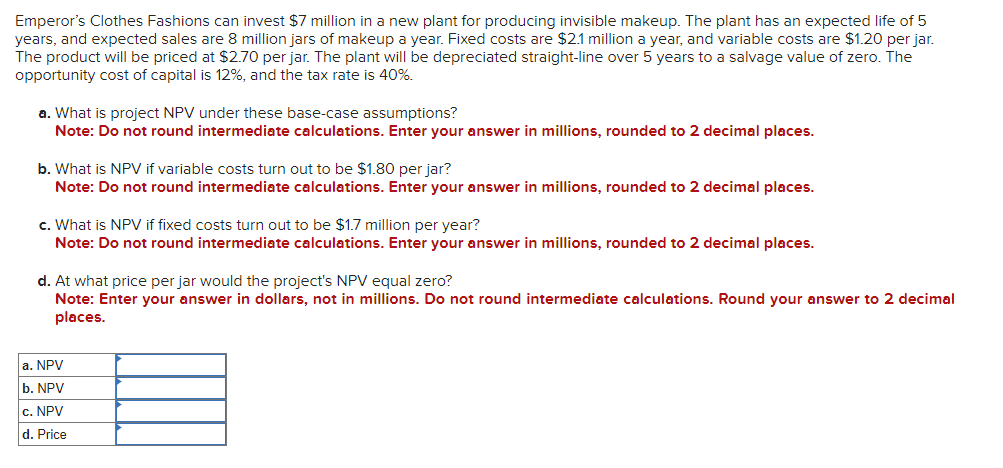

Emperor's Clothes Fashions can invest $7 million in a new plant for producing invisible makeup. The plant has an expected life of 5 years, and expected sales are 8 million jars of makeup a year. Fixed costs are $2.1 million a year, and variable costs are $1.20 per jar. The product will be priced at $2.70 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The opportunity cost of capital is 12%, and the tax rate is 40%. a. What is project NPV under these base-case assumptions? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. b. What is NPV if variable costs turn out to be $1.80 per jar? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. c. What is NPV if fixed costs turn out to be $1.7 million per year? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. d. At what price per jar would the project's NPV equal zero? Note: Enter your answer in dollars, not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places. a. NPV b NPV

Emperor's Clothes Fashions can invest $7 million in a new plant for producing invisible makeup. The plant has an expected life of 5 years, and expected sales are 8 million jars of makeup a year. Fixed costs are $2.1 million a year, and variable costs are $1.20 per jar. The product will be priced at $2.70 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The opportunity cost of capital is 12%, and the tax rate is 40%. a. What is project NPV under these base-case assumptions? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. b. What is NPV if variable costs turn out to be $1.80 per jar? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. c. What is NPV if fixed costs turn out to be $1.7 million per year? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. d. At what price per jar would the project's NPV equal zero? Note: Enter your answer in dollars, not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places. a. NPV b NPV

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1gM

Related questions

Question

Transcribed Image Text:Emperor's Clothes Fashions can invest $7 million in a new plant for producing invisible makeup. The plant has an expected life of 5

years, and expected sales are 8 million jars of makeup a year. Fixed costs are $2.1 million a year, and variable costs are $1.20 per jar.

The product will be priced at $2.70 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The

opportunity cost of capital is 12%, and the tax rate is 40%.

a. What is project NPV under these base-case assumptions?

Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places.

b. What is NPV if variable costs turn out to be $1.80 per jar?

Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places.

c. What is NPV if fixed costs turn out to be $1.7 million per year?

Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places.

d. At what price per jar would the project's NPV equal zero?

Note: Enter your answer in dollars, not in millions. Do not round intermediate calculations. Round your answer to 2 decimal

places.

a. NPV

b. NPV

c. NPV

d. Price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning