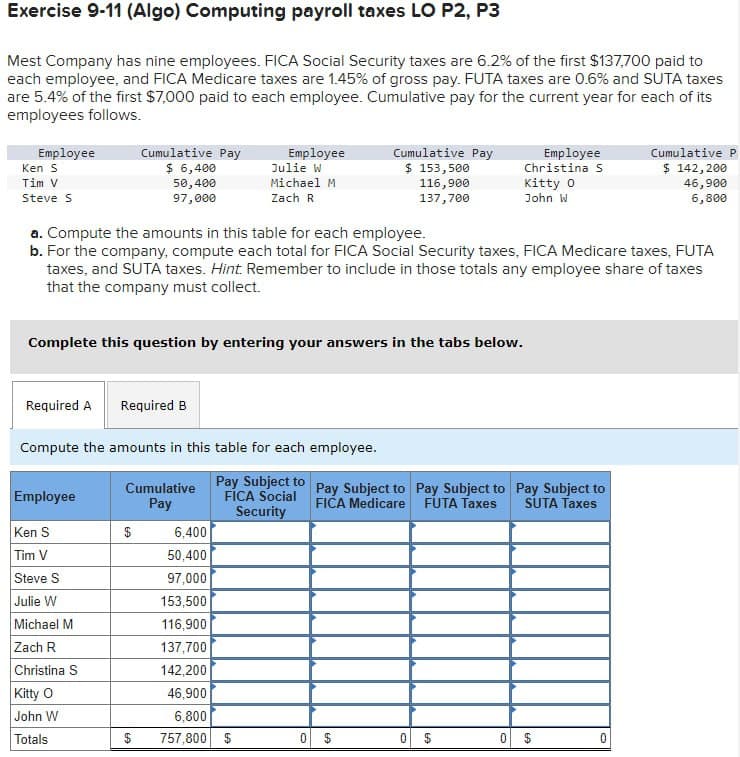

Exercise 9-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Ken S Tim V Steve S Cumulative Pay $ 6,400 50,400 97,000 Employee Julie W Michael M Zach R Cumulative Pay $ 153,500 116,900 137,700 Employee Christina S Kitty O Cumulative P $ 142,200 46,900 John W 6,800 a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint. Remember to include in those totals any employee share of taxes that the company must collect. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amounts in this table for each employee. Employee Cumulative Pay Pay Subject to FÍCA Social Pay Subject to Pay Subject to Pay Subject to FICA Medicare FUTA Taxes SUTA Taxes Security Ken S $ 6,400 Tim V 50,400 Steve S 97,000 Julie W 153,500 Michael M 116,900 Zach R 137,700 Christina S 142,200 Kitty O 46,900 John W 6,800 Totals $ 757,800 $ 0 0 0 0

Exercise 9-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Ken S Tim V Steve S Cumulative Pay $ 6,400 50,400 97,000 Employee Julie W Michael M Zach R Cumulative Pay $ 153,500 116,900 137,700 Employee Christina S Kitty O Cumulative P $ 142,200 46,900 John W 6,800 a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint. Remember to include in those totals any employee share of taxes that the company must collect. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amounts in this table for each employee. Employee Cumulative Pay Pay Subject to FÍCA Social Pay Subject to Pay Subject to Pay Subject to FICA Medicare FUTA Taxes SUTA Taxes Security Ken S $ 6,400 Tim V 50,400 Steve S 97,000 Julie W 153,500 Michael M 116,900 Zach R 137,700 Christina S 142,200 Kitty O 46,900 John W 6,800 Totals $ 757,800 $ 0 0 0 0

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.13EX

Related questions

Question

Transcribed Image Text:Exercise 9-11 (Algo) Computing payroll taxes LO P2, P3

Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to

each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes

are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its

employees follows.

Employee

Ken S

Tim V

Steve S

Cumulative Pay

$ 6,400

50,400

97,000

Employee

Julie W

Michael M

Zach R

Cumulative Pay

$ 153,500

116,900

137,700

Employee

Christina S

Kitty O

Cumulative P

$ 142,200

46,900

John W

6,800

a. Compute the amounts in this table for each employee.

b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA

taxes, and SUTA taxes. Hint. Remember to include in those totals any employee share of taxes

that the company must collect.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the amounts in this table for each employee.

Employee

Cumulative

Pay

Pay Subject to

FÍCA Social

Pay Subject to Pay Subject to Pay Subject to

FICA Medicare

FUTA Taxes

SUTA Taxes

Security

Ken S

$

6,400

Tim V

50,400

Steve S

97,000

Julie W

153,500

Michael M

116,900

Zach R

137,700

Christina S

142,200

Kitty O

46,900

John W

6,800

Totals

$

757,800 $

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning