File AutoSave Off << NP_E... Aaliyah Thagard AT Home Insert Page Layout Formulas Data Review View Automate Help 1 W AutoSave Off Instructions... v Aaliyah Thagard AT File Home Insert Draw Desig Layou Refer Mailin Review View Help - Viewing % Conditional Formatting Clipboard Font Alignment Number Format as Table Cells Editing Add-ins > Cell Styles Styles C2 X✓ fx B E F + Moreland Hospital - Neighborhood Nurse Van 1 2 Projections 3 4 5 al grants 6 grants 2025 2026 2027 2028 Add-ins 2029 $ 25,000 $ 28,750 $ 32,500 $ 36,250 $ 40,000 72,000 345,000 58,000 58,000 55,000 7 ce reimbursements 55,000 550,000 8 venue 9 10 s 11 $442,000 $ 86,750 $ 90,500 $ 91,250 $ 645,000 Chart Area $ 108,000 $110,000 $112,000 $ 115,000 $ 118,000 127,000 129,625 Enable Editing Be careful-files from the Internet can contain viruses. Unless you need to PROTECTED VIEW edit, it's safer to stay in Protected View. expense data on the worksheet. She knows the income from municipal grants will be $25,000 in 2025, and estimates it will be $40,000 in 2029. She needs to calculate the income from municipal grants in the years 2026-2028. The grants should increase at a constant amount from year to year. Project the income from Municipal grants for 2026-2028 (cells D5:F5) using a Linear Trend interpolation. 10. Pranjali also needs to calculate the income from insurance reimbursements in the years 2026-2028. She knows the starting amount and has estimated the amount in 2029. She thinks this income will increase by a constant percentage. Project the income from Insurance reimbursements for 2026-2028(cells D7:F7) using a Growth Trend interpolation. 11. Pranjali needs to calculate the payroll expenses in the years 2026-2029. She knows the payroll will be $140,000 in 2025 and will increase by at least five percent per year. Project the payroll expenses as follows: a. Project the expenses for Payroll for 2026-2029 (cells D13:G13) using a Growth Trend extrapolation. b. Use 1.05 (a 5 percent increase) as the step value. 12. The Projected Revenue line chart in the range H4:Q19 shows the revenue Pranjali estimates in the years 2025-2029. She wants to extend the projection into 2030. Modify the Projected Revenue line chart as follows to forecast the future trend: a. Add a Linear Trendline to the Projected Revenue line chart. 12 ceuticals 13 14 ance 15 te 16 ing 17 neral Expenses 18 19 rnings 20 Ready 59° Depreciation 132,250 134,875 137,500 140,000 2,500 2,500 2,500 3,000 2,800 2,800 2,800 3,100 10,500 10,500 10,500 10,500 3,000 3,100 10,500 $ 390,800 $ 255,425 $260,050 $266,475 $272,100 $ 51,200 $(168,675) $(169,550) $(175,225) $372,900 b. Format the trendline to forecast 1 period forward. 13. The Revenue Trend scatter chart in the range A21:G40 is based on monthly revenue estimates listed on the Monthly Revenue Projections worksheet. Pranjali wants to include a trendline for this chart that shows how revenues increase quickly at first and then level CENGAGE Earnings Projections Monthly Re + + 100% Page 3 of 8 1622 words Text Predictions: On Focus + 100% L 9:10 PM 3/24/2024

File AutoSave Off << NP_E... Aaliyah Thagard AT Home Insert Page Layout Formulas Data Review View Automate Help 1 W AutoSave Off Instructions... v Aaliyah Thagard AT File Home Insert Draw Desig Layou Refer Mailin Review View Help - Viewing % Conditional Formatting Clipboard Font Alignment Number Format as Table Cells Editing Add-ins > Cell Styles Styles C2 X✓ fx B E F + Moreland Hospital - Neighborhood Nurse Van 1 2 Projections 3 4 5 al grants 6 grants 2025 2026 2027 2028 Add-ins 2029 $ 25,000 $ 28,750 $ 32,500 $ 36,250 $ 40,000 72,000 345,000 58,000 58,000 55,000 7 ce reimbursements 55,000 550,000 8 venue 9 10 s 11 $442,000 $ 86,750 $ 90,500 $ 91,250 $ 645,000 Chart Area $ 108,000 $110,000 $112,000 $ 115,000 $ 118,000 127,000 129,625 Enable Editing Be careful-files from the Internet can contain viruses. Unless you need to PROTECTED VIEW edit, it's safer to stay in Protected View. expense data on the worksheet. She knows the income from municipal grants will be $25,000 in 2025, and estimates it will be $40,000 in 2029. She needs to calculate the income from municipal grants in the years 2026-2028. The grants should increase at a constant amount from year to year. Project the income from Municipal grants for 2026-2028 (cells D5:F5) using a Linear Trend interpolation. 10. Pranjali also needs to calculate the income from insurance reimbursements in the years 2026-2028. She knows the starting amount and has estimated the amount in 2029. She thinks this income will increase by a constant percentage. Project the income from Insurance reimbursements for 2026-2028(cells D7:F7) using a Growth Trend interpolation. 11. Pranjali needs to calculate the payroll expenses in the years 2026-2029. She knows the payroll will be $140,000 in 2025 and will increase by at least five percent per year. Project the payroll expenses as follows: a. Project the expenses for Payroll for 2026-2029 (cells D13:G13) using a Growth Trend extrapolation. b. Use 1.05 (a 5 percent increase) as the step value. 12. The Projected Revenue line chart in the range H4:Q19 shows the revenue Pranjali estimates in the years 2025-2029. She wants to extend the projection into 2030. Modify the Projected Revenue line chart as follows to forecast the future trend: a. Add a Linear Trendline to the Projected Revenue line chart. 12 ceuticals 13 14 ance 15 te 16 ing 17 neral Expenses 18 19 rnings 20 Ready 59° Depreciation 132,250 134,875 137,500 140,000 2,500 2,500 2,500 3,000 2,800 2,800 2,800 3,100 10,500 10,500 10,500 10,500 3,000 3,100 10,500 $ 390,800 $ 255,425 $260,050 $266,475 $272,100 $ 51,200 $(168,675) $(169,550) $(175,225) $372,900 b. Format the trendline to forecast 1 period forward. 13. The Revenue Trend scatter chart in the range A21:G40 is based on monthly revenue estimates listed on the Monthly Revenue Projections worksheet. Pranjali wants to include a trendline for this chart that shows how revenues increase quickly at first and then level CENGAGE Earnings Projections Monthly Re + + 100% Page 3 of 8 1622 words Text Predictions: On Focus + 100% L 9:10 PM 3/24/2024

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

I need help with Number 10 pertaining to how to enter it as a formula

Transcribed Image Text:File

AutoSave Off

<<

NP_E...

Aaliyah Thagard AT

Home Insert Page Layout Formulas Data Review View Automate Help

1

W

AutoSave

Off

Instructions... v

Aaliyah Thagard AT

File

Home Insert Draw Desig Layou Refer Mailin Review View Help

-

Viewing

%

Conditional Formatting

Clipboard

Font

Alignment

Number

Format as Table

Cells Editing

Add-ins >

Cell Styles

Styles

C2

X✓ fx

B

E

F

+ Moreland Hospital - Neighborhood Nurse Van

1

2 Projections

3

4

5 al grants

6 grants

2025

2026

2027

2028

Add-ins

2029

$ 25,000 $ 28,750 $ 32,500 $ 36,250 $ 40,000

72,000

345,000

58,000

58,000

55,000

7 ce reimbursements

55,000

550,000

8 venue

9

10 s

11

$442,000 $ 86,750 $ 90,500 $ 91,250 $ 645,000

Chart Area

$ 108,000 $110,000 $112,000 $ 115,000 $ 118,000

127,000 129,625

Enable Editing

Be careful-files from the Internet can contain viruses. Unless you need to

PROTECTED VIEW

edit, it's safer to stay in Protected View.

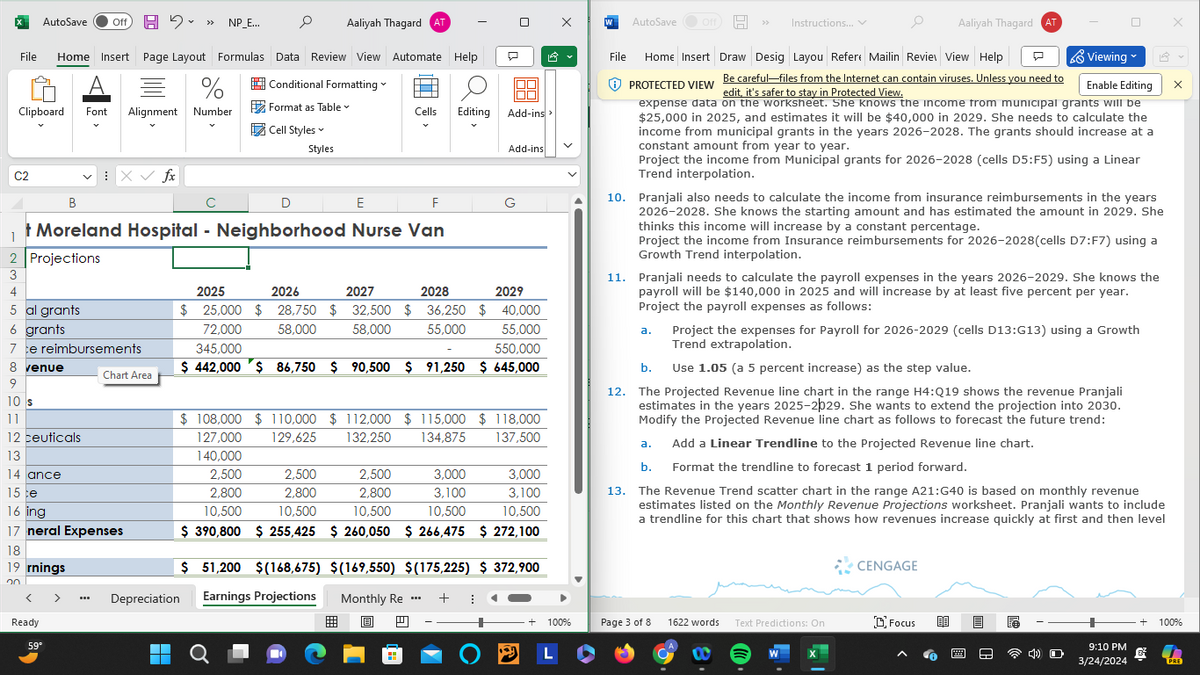

expense data on the worksheet. She knows the income from municipal grants will be

$25,000 in 2025, and estimates it will be $40,000 in 2029. She needs to calculate the

income from municipal grants in the years 2026-2028. The grants should increase at a

constant amount from year to year.

Project the income from Municipal grants for 2026-2028 (cells D5:F5) using a Linear

Trend interpolation.

10. Pranjali also needs to calculate the income from insurance reimbursements in the years

2026-2028. She knows the starting amount and has estimated the amount in 2029. She

thinks this income will increase by a constant percentage.

Project the income from Insurance reimbursements for 2026-2028(cells D7:F7) using a

Growth Trend interpolation.

11. Pranjali needs to calculate the payroll expenses in the years 2026-2029. She knows the

payroll will be $140,000 in 2025 and will increase by at least five percent per year.

Project the payroll expenses as follows:

a. Project the expenses for Payroll for 2026-2029 (cells D13:G13) using a Growth

Trend extrapolation.

b.

Use 1.05 (a 5 percent increase) as the step value.

12. The Projected Revenue line chart in the range H4:Q19 shows the revenue Pranjali

estimates in the years 2025-2029. She wants to extend the projection into 2030.

Modify the Projected Revenue line chart as follows to forecast the future trend:

a.

Add a Linear Trendline to the Projected Revenue line chart.

12 ceuticals

13

14 ance

15 te

16 ing

17 neral Expenses

18

19 rnings

20

Ready

59°

Depreciation

132,250

134,875

137,500

140,000

2,500

2,500

2,500

3,000

2,800

2,800

2,800

3,100

10,500

10,500

10,500

10,500

3,000

3,100

10,500

$ 390,800 $ 255,425 $260,050 $266,475 $272,100

$ 51,200 $(168,675) $(169,550) $(175,225) $372,900

b. Format the trendline to forecast 1 period forward.

13. The Revenue Trend scatter chart in the range A21:G40 is based on monthly revenue

estimates listed on the Monthly Revenue Projections worksheet. Pranjali wants to include

a trendline for this chart that shows how revenues increase quickly at first and then level

CENGAGE

Earnings Projections Monthly Re

+

+ 100%

Page 3 of 8

1622 words Text Predictions: On

Focus

+ 100%

L

9:10 PM

3/24/2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education