For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2023. Traditional IRA Contribution 6,000 X a. Juan, age 41, earns qualified plan. His wife, Agnes, generates no earned income. salary of $58,000 and is not an active participant in any other b. Abby, age 29, reports earned income of $45,000, and her husband, Sam, reports earned income of $4,600. They are not active participants in any other qualified plan. c. Leo's employer makes a contribution of $3,500 to Leo's simplified employee pension plan. Leo is single, he reports earned income of $70,000, and his AGI is $55,000. 10,600 x 6,000 x

For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2023. Traditional IRA Contribution 6,000 X a. Juan, age 41, earns qualified plan. His wife, Agnes, generates no earned income. salary of $58,000 and is not an active participant in any other b. Abby, age 29, reports earned income of $45,000, and her husband, Sam, reports earned income of $4,600. They are not active participants in any other qualified plan. c. Leo's employer makes a contribution of $3,500 to Leo's simplified employee pension plan. Leo is single, he reports earned income of $70,000, and his AGI is $55,000. 10,600 x 6,000 x

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 42P

Related questions

Question

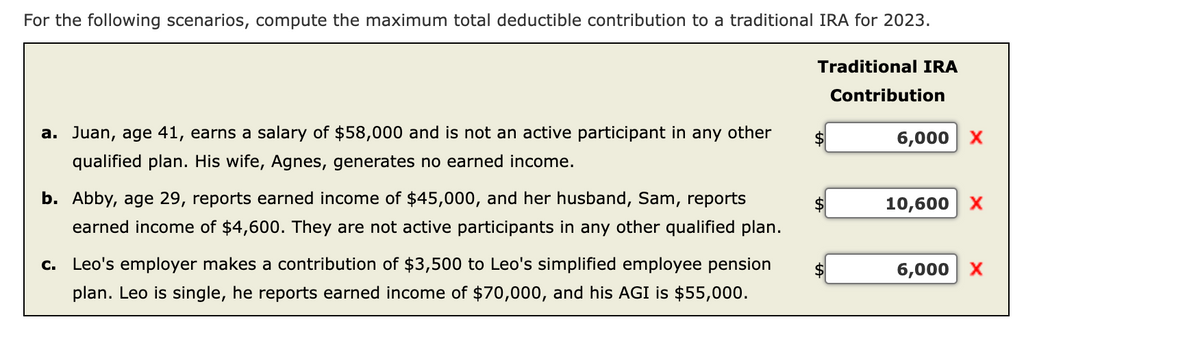

Transcribed Image Text:For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2023.

Traditional IRA

a. Juan, age 41, earns a salary of $58,000 and is not an active participant in any other

qualified plan. His wife, Agnes, generates no earned income.

b. Abby, age 29, reports earned income of $45,000, and her husband, Sam, reports

earned income of $4,600. They are not active participants in any other qualified plan.

Leo's employer makes a contribution of $3,500 to Leo's simplified employee pension

plan. Leo is single, he reports earned income of $70,000, and his AGI is $55,000.

$

Contribution

6,000 X

10,600 X

6,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT