ill decrease by $5,000 this year b

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 11P: The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are...

Related questions

Question

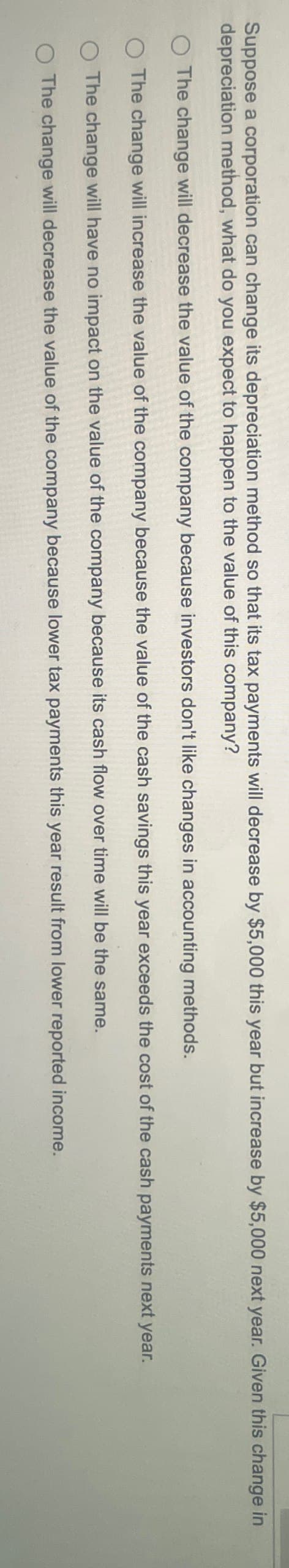

Transcribed Image Text:Suppose a corporation can change its depreciation method so that its tax payments will decrease by $5,000 this year but increase by $5,000 next year. Given this change in

depreciation method, what do you expect to happen to the value of this company?

O The change will decrease the value of the company because investors don't like changes in accounting methods.

O The change will increase the value of the company because the value of the cash savings this year exceeds the cost of the cash payments next year.

O The change will have no impact on the value of the company because its cash flow over time will be the same.

The change will decrease the value of the company because lower tax payments this year result from lower reported income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT