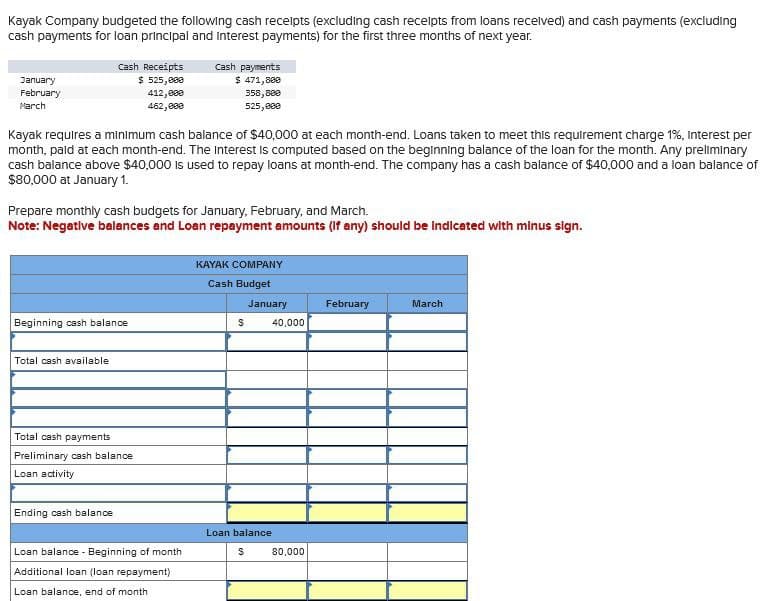

Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and Interest payments) for the first three months of next year. January February March Cash Receipts $525,000 412,000 462,000 Cash payments $ 471,888 358,800 525,000 Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Beginning cash balance Total cash available Total cash payments Preliminary cash balance Loan activity Ending cash balance Loan balance - Beginning of month Additional loan (loan repayment) Loan balance, end of month KAYAK COMPANY Cash Budget January February March S 40,000 Loan balance S 80,000

Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and Interest payments) for the first three months of next year. January February March Cash Receipts $525,000 412,000 462,000 Cash payments $ 471,888 358,800 525,000 Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Beginning cash balance Total cash available Total cash payments Preliminary cash balance Loan activity Ending cash balance Loan balance - Beginning of month Additional loan (loan repayment) Loan balance, end of month KAYAK COMPANY Cash Budget January February March S 40,000 Loan balance S 80,000

Chapter6: Managing Cash Flow

Section: Chapter Questions

Problem 1EP

Related questions

Question

None

Transcribed Image Text:Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding

cash payments for loan principal and Interest payments) for the first three months of next year.

January

February

March

Cash Receipts

$525,000

412,000

462,000

Cash payments

$ 471,888

358,800

525,000

Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per

month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary

cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of

$80,000 at January 1.

Prepare monthly cash budgets for January, February, and March.

Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.

Beginning cash balance

Total cash available

Total cash payments

Preliminary cash balance

Loan activity

Ending cash balance

Loan balance - Beginning of month

Additional loan (loan repayment)

Loan balance, end of month

KAYAK COMPANY

Cash Budget

January

February

March

S

40,000

Loan balance

S

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT