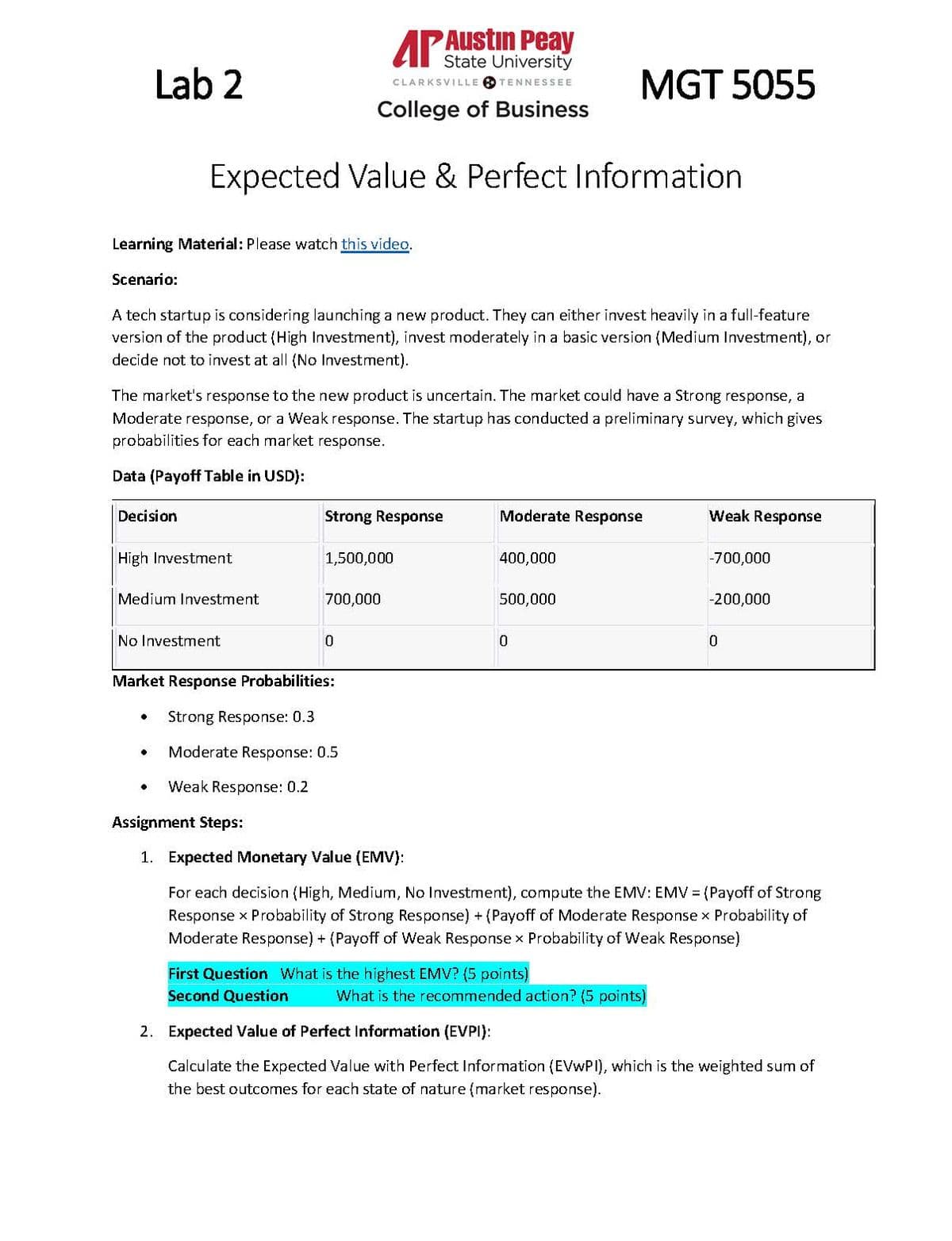

Lab 2 AP Austin Peay State University CLARKSVILLE TENNESSEE College of Business MGT 5055 Expected Value & Perfect Information Learning Material: Please watch this video. Scenario: A tech startup is considering launching a new product. They can either invest heavily in a full-feature version of the product (High Investment), invest moderately in a basic version (Medium Investment), or decide not to invest at all (No Investment). The market's response to the new product is uncertain. The market could have a Strong response, a Moderate response, or a Weak response. The startup has conducted a preliminary survey, which gives probabilities for each market response. Data (Payoff Table in USD): Decision High Investment Medium Investment No Investment Strong Response Moderate Response Weak Response 1,500,000 400,000 -700,000 700,000 500,000 -200,000 10 0 0 Market Response Probabilities: • Strong Response: 0.3 Moderate Response: 0.5 • Weak Response: 0.2 Assignment Steps: 1. Expected Monetary Value (EMV): For each decision (High, Medium, No Investment), compute the EMV: EMV = (Payoff of Strong Response × Probability of Strong Response) + (Payoff of Moderate Response × Probability of Moderate Response) + (Payoff of Weak Response x Probability of Weak Response) First Question What is the highest EMV? (5 points) Second Question What is the recommended action? (5 points) 2. Expected Value of Perfect Information (EVPI): Calculate the Expected Value with Perfect Information (EVWPI), which is the weighted sum of the best outcomes for each state of nature (market response). Lab 2 AP Austin Peay State University CLARKSVILLE TENNESSEE College of Business MGT 5055 EVPI = EVWPI - EVwOPI (Expected Value without Perfect Information, i.e., the highest EMV from step 1) Third Question What is the Expected Value of Perfect Information (EVPI)? (5 points)

Lab 2 AP Austin Peay State University CLARKSVILLE TENNESSEE College of Business MGT 5055 Expected Value & Perfect Information Learning Material: Please watch this video. Scenario: A tech startup is considering launching a new product. They can either invest heavily in a full-feature version of the product (High Investment), invest moderately in a basic version (Medium Investment), or decide not to invest at all (No Investment). The market's response to the new product is uncertain. The market could have a Strong response, a Moderate response, or a Weak response. The startup has conducted a preliminary survey, which gives probabilities for each market response. Data (Payoff Table in USD): Decision High Investment Medium Investment No Investment Strong Response Moderate Response Weak Response 1,500,000 400,000 -700,000 700,000 500,000 -200,000 10 0 0 Market Response Probabilities: • Strong Response: 0.3 Moderate Response: 0.5 • Weak Response: 0.2 Assignment Steps: 1. Expected Monetary Value (EMV): For each decision (High, Medium, No Investment), compute the EMV: EMV = (Payoff of Strong Response × Probability of Strong Response) + (Payoff of Moderate Response × Probability of Moderate Response) + (Payoff of Weak Response x Probability of Weak Response) First Question What is the highest EMV? (5 points) Second Question What is the recommended action? (5 points) 2. Expected Value of Perfect Information (EVPI): Calculate the Expected Value with Perfect Information (EVWPI), which is the weighted sum of the best outcomes for each state of nature (market response). Lab 2 AP Austin Peay State University CLARKSVILLE TENNESSEE College of Business MGT 5055 EVPI = EVWPI - EVwOPI (Expected Value without Perfect Information, i.e., the highest EMV from step 1) Third Question What is the Expected Value of Perfect Information (EVPI)? (5 points)

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Transcribed Image Text:Lab 2

AP Austin Peay

State University

CLARKSVILLE TENNESSEE

College of Business

MGT 5055

Expected Value & Perfect Information

Learning Material: Please watch this video.

Scenario:

A tech startup is considering launching a new product. They can either invest heavily in a full-feature

version of the product (High Investment), invest moderately in a basic version (Medium Investment), or

decide not to invest at all (No Investment).

The market's response to the new product is uncertain. The market could have a Strong response, a

Moderate response, or a Weak response. The startup has conducted a preliminary survey, which gives

probabilities for each market response.

Data (Payoff Table in USD):

Decision

High Investment

Medium Investment

No Investment

Strong Response

Moderate Response

Weak Response

1,500,000

400,000

-700,000

700,000

500,000

-200,000

10

0

0

Market Response Probabilities:

•

Strong Response: 0.3

Moderate Response: 0.5

•

Weak Response: 0.2

Assignment Steps:

1. Expected Monetary Value (EMV):

For each decision (High, Medium, No Investment), compute the EMV: EMV = (Payoff of Strong

Response × Probability of Strong Response) + (Payoff of Moderate Response × Probability of

Moderate Response) + (Payoff of Weak Response x Probability of Weak Response)

First Question What is the highest EMV? (5 points)

Second Question

What is the recommended action? (5 points)

2. Expected Value of Perfect Information (EVPI):

Calculate the Expected Value with Perfect Information (EVWPI), which is the weighted sum of

the best outcomes for each state of nature (market response).

Transcribed Image Text:Lab 2

AP Austin Peay

State University

CLARKSVILLE TENNESSEE

College of Business

MGT 5055

EVPI = EVWPI - EVwOPI (Expected Value without Perfect Information, i.e., the highest EMV from

step 1)

Third Question What is the Expected Value of Perfect Information (EVPI)? (5 points)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON