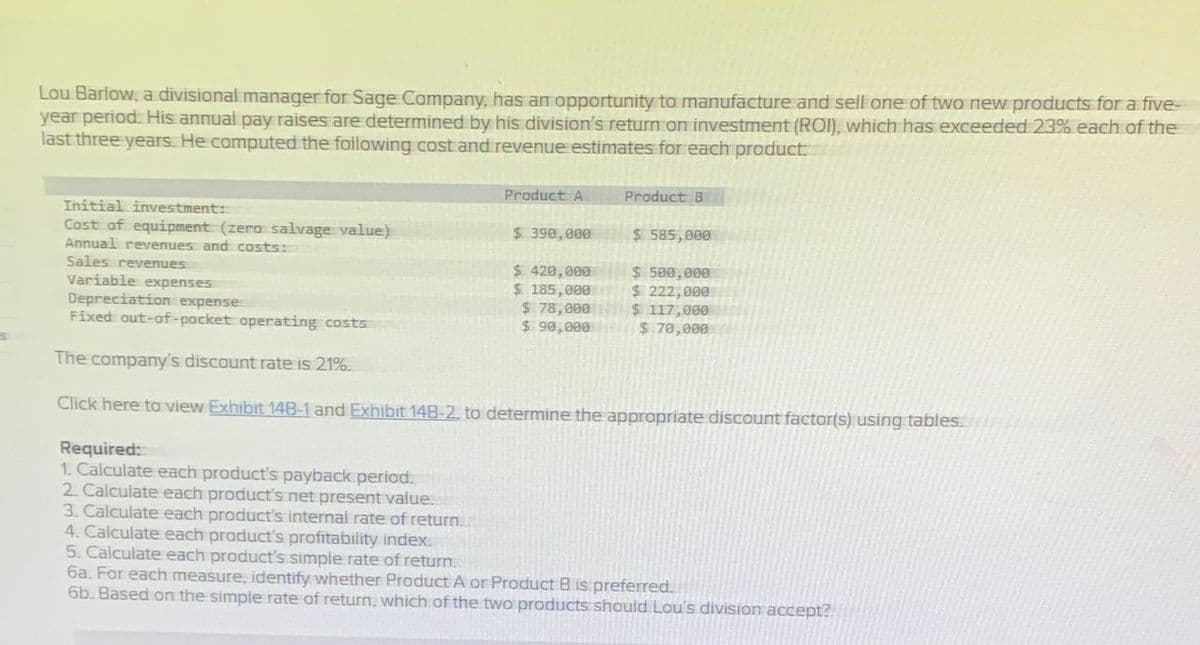

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 23% each of the last three years. He computed the following cost and revenue estimates for each product Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 390,000 $ 585,000 Annual revenues and costs: Sales revenues $ 420,000 $ 500,000 Variable expenses $ 185,000 $ 222,000 Depreciation expense $ 78,000 $ 117,000 Fixed out-of-pocket operating costs $ 90,000 $ 70,000 The company's discount rate is 21% Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5. Calculate each product's simple rate of return 6a. For each measure, identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, which of the two products should Lou's division accept?

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 23% each of the last three years. He computed the following cost and revenue estimates for each product Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 390,000 $ 585,000 Annual revenues and costs: Sales revenues $ 420,000 $ 500,000 Variable expenses $ 185,000 $ 222,000 Depreciation expense $ 78,000 $ 117,000 Fixed out-of-pocket operating costs $ 90,000 $ 70,000 The company's discount rate is 21% Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5. Calculate each product's simple rate of return 6a. For each measure, identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, which of the two products should Lou's division accept?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter14: Quality And Environmental Cost Management

Section: Chapter Questions

Problem 43P: The following environmental cost reports for 20x3, 20x4, and 20x5 (year end December 31) are for the...

Related questions

Question

None

Transcribed Image Text:Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-

year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 23% each of the

last three years. He computed the following cost and revenue estimates for each product

Product A

Product B

Initial investment:

Cost of equipment (zero salvage value)

$ 390,000

$ 585,000

Annual revenues and costs:

Sales revenues

$ 420,000

$ 500,000

Variable expenses

$ 185,000

$ 222,000

Depreciation expense

$ 78,000

$ 117,000

Fixed out-of-pocket operating costs

$ 90,000

$ 70,000

The company's discount rate is 21%

Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables

Required:

1. Calculate each product's payback period.

2. Calculate each product's net present value.

3. Calculate each product's internal rate of return.

4. Calculate each product's profitability index.

5. Calculate each product's simple rate of return

6a. For each measure, identify whether Product A or Product B is preferred.

6b. Based on the simple rate of return, which of the two products should Lou's division accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning