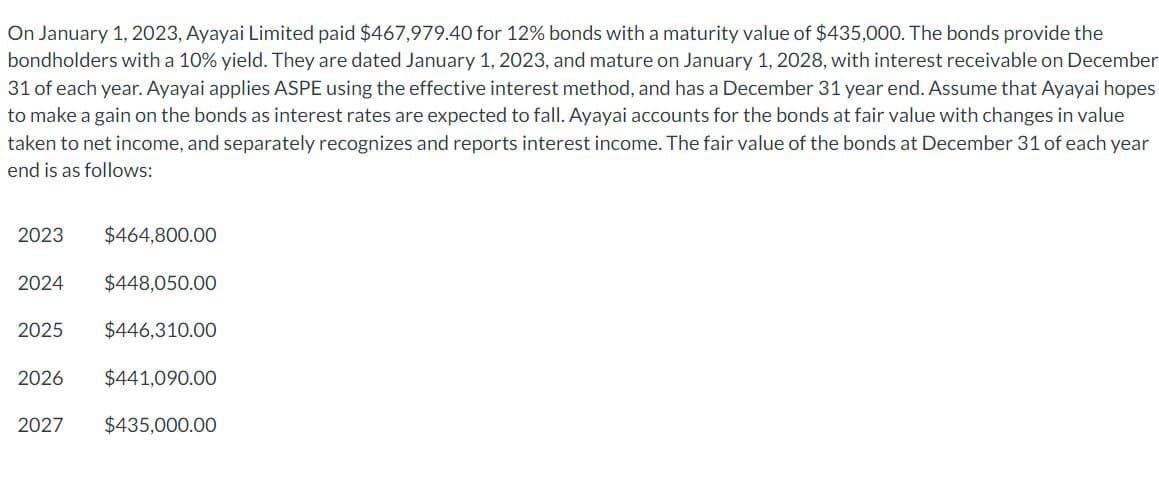

On January 1, 2023, Ayayai Limited paid $467,979.40 for 12% bonds with a maturity value of $435,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2023, and mature on January 1, 2028, with interest receivable on December 31 of each year. Ayayai applies ASPE using the effective interest method, and has a December 31 year end. Assume that Ayayai hopes to make a gain on the bonds as interest rates are expected to fall. Ayayai accounts for the bonds at fair value with changes in value taken to net income, and separately recognizes and reports interest income. The fair value of the bonds at December 31 of each year end is as follows: 2023 $464,800.00 2024 $448,050.00 2025 $446,310.00 2026 $441,090.00 2027 $435,000.00

On January 1, 2023, Ayayai Limited paid $467,979.40 for 12% bonds with a maturity value of $435,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2023, and mature on January 1, 2028, with interest receivable on December 31 of each year. Ayayai applies ASPE using the effective interest method, and has a December 31 year end. Assume that Ayayai hopes to make a gain on the bonds as interest rates are expected to fall. Ayayai accounts for the bonds at fair value with changes in value taken to net income, and separately recognizes and reports interest income. The fair value of the bonds at December 31 of each year end is as follows: 2023 $464,800.00 2024 $448,050.00 2025 $446,310.00 2026 $441,090.00 2027 $435,000.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 5P: Bats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and...

Related questions

Question

make journal entries for recording interest income and interest received and recognition of FV at dec31, 2023, 2024, and 2025.

the entries should be:

to record interest collected (3 lines)

to record Fair value adjustment

to record interest collected (3 lines)

to record Fair value adjustment

to record interest collected (3 lines)

to record gain or loss

Dont use AI Tools. Thank you

Transcribed Image Text:On January 1, 2023, Ayayai Limited paid $467,979.40 for 12% bonds with a maturity value of $435,000. The bonds provide the

bondholders with a 10% yield. They are dated January 1, 2023, and mature on January 1, 2028, with interest receivable on December

31 of each year. Ayayai applies ASPE using the effective interest method, and has a December 31 year end. Assume that Ayayai hopes

to make a gain on the bonds as interest rates are expected to fall. Ayayai accounts for the bonds at fair value with changes in value

taken to net income, and separately recognizes and reports interest income. The fair value of the bonds at December 31 of each year

end is as follows:

2023

$464,800.00

2024 $448,050.00

2025 $446,310.00

2026 $441,090.00

2027 $435,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT