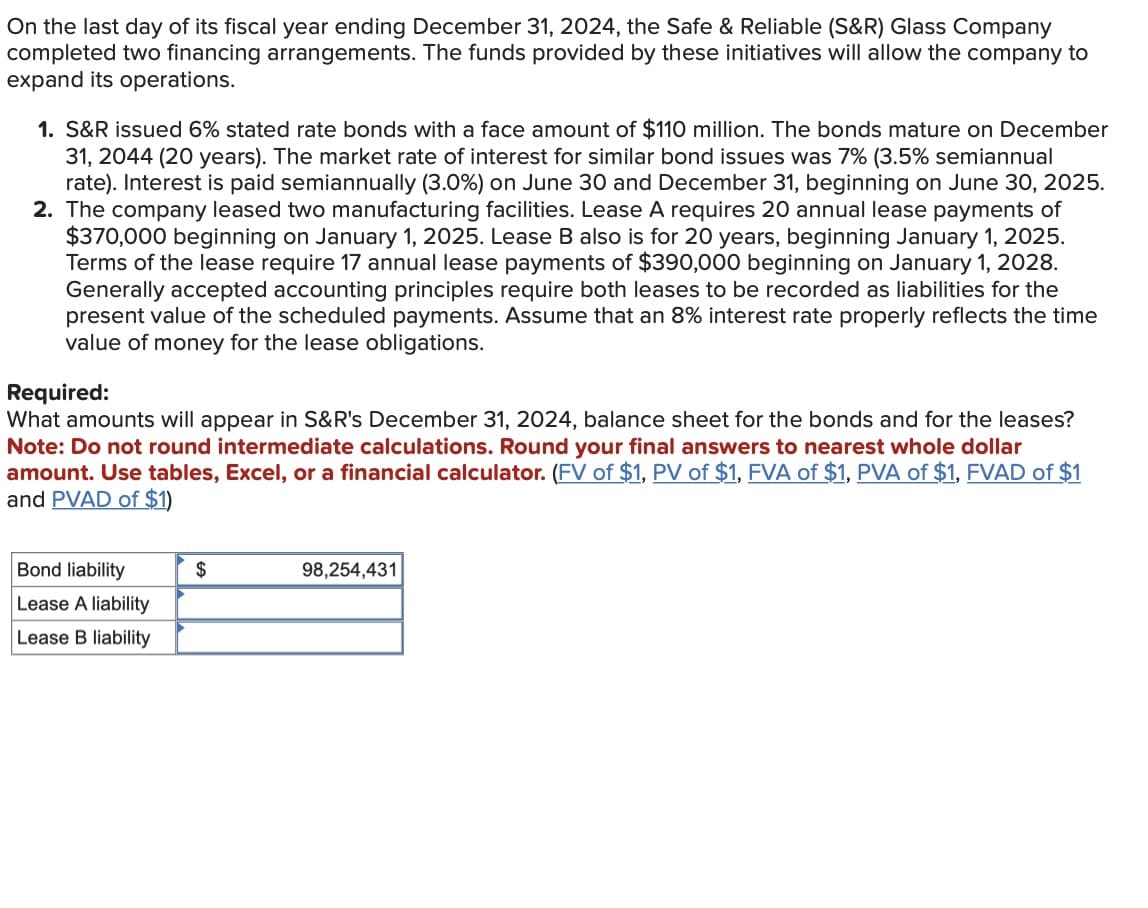

On the last day of its fiscal year ending December 31, 2024, the Safe & Reliable (S&R) Glass Company completed two financing arrangements. The funds provided by these initiatives will allow the company to expand its operations. 1. S&R issued 6% stated rate bonds with a face amount of $110 million. The bonds mature on December 31, 2044 (20 years). The market rate of interest for similar bond issues was 7% (3.5% semiannual rate). Interest is paid semiannually (3.0%) on June 30 and December 31, beginning on June 30, 2025. 2. The company leased two manufacturing facilities. Lease A requires 20 annual lease payments of $370,000 beginning on January 1, 2025. Lease B also is for 20 years, beginning January 1, 2025. Terms of the lease require 17 annual lease payments of $390,000 beginning on January 1, 2028. Generally accepted accounting principles require both leases to be recorded as liabilities for the present value of the scheduled payments. Assume that an 8% interest rate properly reflects the time value of money for the lease obligations. Required: What amounts will appear in S&R's December 31, 2024, balance sheet for the bonds and for the leases? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Bond liability Lease A liability Lease B liability $ 98,254,431

On the last day of its fiscal year ending December 31, 2024, the Safe & Reliable (S&R) Glass Company completed two financing arrangements. The funds provided by these initiatives will allow the company to expand its operations. 1. S&R issued 6% stated rate bonds with a face amount of $110 million. The bonds mature on December 31, 2044 (20 years). The market rate of interest for similar bond issues was 7% (3.5% semiannual rate). Interest is paid semiannually (3.0%) on June 30 and December 31, beginning on June 30, 2025. 2. The company leased two manufacturing facilities. Lease A requires 20 annual lease payments of $370,000 beginning on January 1, 2025. Lease B also is for 20 years, beginning January 1, 2025. Terms of the lease require 17 annual lease payments of $390,000 beginning on January 1, 2028. Generally accepted accounting principles require both leases to be recorded as liabilities for the present value of the scheduled payments. Assume that an 8% interest rate properly reflects the time value of money for the lease obligations. Required: What amounts will appear in S&R's December 31, 2024, balance sheet for the bonds and for the leases? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Bond liability Lease A liability Lease B liability $ 98,254,431

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:On the last day of its fiscal year ending December 31, 2024, the Safe & Reliable (S&R) Glass Company

completed two financing arrangements. The funds provided by these initiatives will allow the company to

expand its operations.

1. S&R issued 6% stated rate bonds with a face amount of $110 million. The bonds mature on December

31, 2044 (20 years). The market rate of interest for similar bond issues was 7% (3.5% semiannual

rate). Interest is paid semiannually (3.0%) on June 30 and December 31, beginning on June 30, 2025.

2. The company leased two manufacturing facilities. Lease A requires 20 annual lease payments of

$370,000 beginning on January 1, 2025. Lease B also is for 20 years, beginning January 1, 2025.

Terms of the lease require 17 annual lease payments of $390,000 beginning on January 1, 2028.

Generally accepted accounting principles require both leases to be recorded as liabilities for the

present value of the scheduled payments. Assume that an 8% interest rate properly reflects the time

value of money for the lease obligations.

Required:

What amounts will appear in S&R's December 31, 2024, balance sheet for the bonds and for the leases?

Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar

amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1

and PVAD of $1)

Bond liability

Lease A liability

Lease B liability

$

98,254,431

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College