Estimate the Benefit, Salvage Value, and Useful Life for each alternative. Harry Broderick (HB) owns Jettison Scrap and Salvage Company (JSSC). HB wants to buy a ship to salvage debris from the Great Pacific Garbage Patch for 5 years then quit. The following are projections for the project: Project MARR = 10% Inflation is a constant 2% All Monies x $IK Capital Cost Useful Life (Years) OPT MOST OPT Benefit Alternatives Salvage (per Year) MOST ОРТ MOST 1A 200 100 120 100 200 10 15 2B 225 150 190 100 225 11 17 30 300 200 225 140 300 15 20 Probabilities ?? OPTimistic 70% | MOST likely

Estimate the Benefit, Salvage Value, and Useful Life for each alternative. Harry Broderick (HB) owns Jettison Scrap and Salvage Company (JSSC). HB wants to buy a ship to salvage debris from the Great Pacific Garbage Patch for 5 years then quit. The following are projections for the project: Project MARR = 10% Inflation is a constant 2% All Monies x $IK Capital Cost Useful Life (Years) OPT MOST OPT Benefit Alternatives Salvage (per Year) MOST ОРТ MOST 1A 200 100 120 100 200 10 15 2B 225 150 190 100 225 11 17 30 300 200 225 140 300 15 20 Probabilities ?? OPTimistic 70% | MOST likely

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13EB: Conestoga Plumbing plans to invest in a new pump that is anticipated to provide annual savings for...

Related questions

Question

question is in the picture

Transcribed Image Text:Estimate the Benefit, Salvage Value, and Useful Life for each alternative.

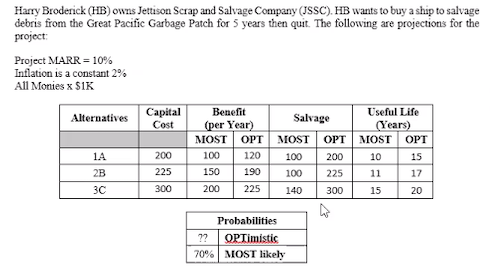

Transcribed Image Text:Harry Broderick (HB) owns Jettison Scrap and Salvage Company (JSSC). HB wants to buy a ship to salvage

debris from the Great Pacific Garbage Patch for 5 years then quit. The following are projections for the

project:

Project MARR = 10%

Inflation is a constant 2%

All Monies x $IK

Capital

Cost

Useful Life

(Years)

OPT MOST OPT

Benefit

Alternatives

Salvage

(per Year)

MOST

ОРТ

MOST

1A

200

100

120

100

200

10

15

2B

225

150

190

100

225

11

17

30

300

200

225

140

300

15

20

Probabilities

??

OPTimistic

70% | MOST likely

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning