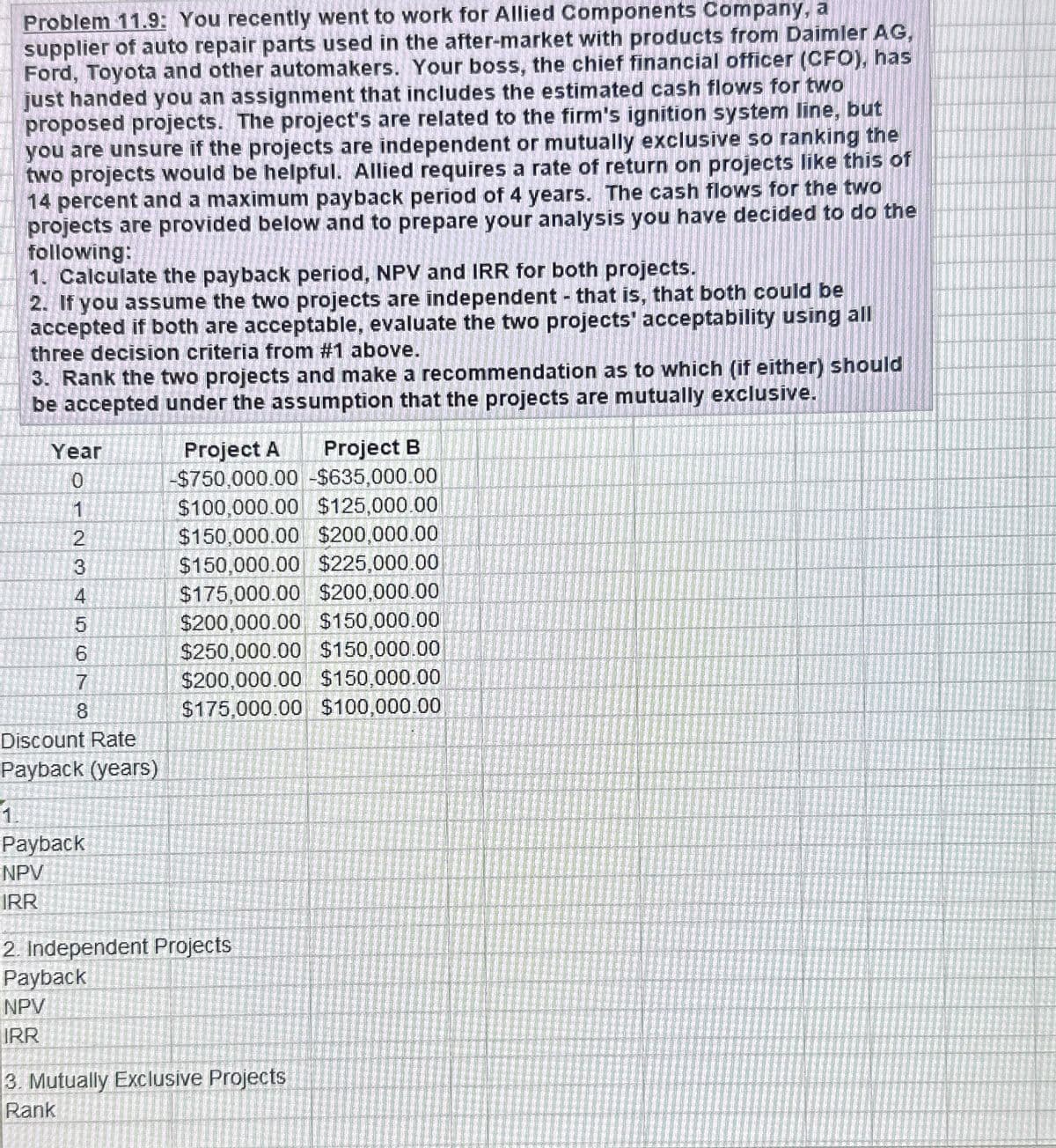

Problem 11.9: You recently went to work for Allied Components Company, a supplier of auto repair parts used in the after-market with products from Daimler AG, Ford, Toyota and other automakers. Your boss, the chief financial officer (CFO), has just handed you an assignment that includes the estimated cash flows for two proposed projects. The project's are related to the firm's ignition system line, but you are unsure if the projects are independent or mutually exclusive so ranking the two projects would be helpful. Allied requires a rate of return on projects like this of 14 percent and a maximum payback period of 4 years. The cash flows for the two projects are provided below and to prepare your analysis you have decided to do the following: 1. Calculate the payback period, NPV and IRR for both projects. 2. If you assume the two projects are independent - that is, that both could be accepted if both are acceptable, evaluate the two projects' acceptability using all three decision criteria from #1 above. 3. Rank the two projects and make a recommendation as to which (if either) should be accepted under the assumption that the projects are mutually exclusive. Year 0 1 23455 6 Project A Project B -$750,000.00-$635,000.00 $100,000.00 $125,000.00 $150,000.00 $200,000.00 $150,000.00 $225,000.00 $175,000.00 $200,000.00 $200,000.00 $150,000.00 $250,000.00 $150,000.00 7 8 Discount Rate Payback (years) 1 Payback NPV $200,000.00 $150,000.00 $175,000.00 $100,000.00 RR 2 Independent Projects Payback NPV IRR 3. Mutually Exclusive Projects Rank

Problem 11.9: You recently went to work for Allied Components Company, a supplier of auto repair parts used in the after-market with products from Daimler AG, Ford, Toyota and other automakers. Your boss, the chief financial officer (CFO), has just handed you an assignment that includes the estimated cash flows for two proposed projects. The project's are related to the firm's ignition system line, but you are unsure if the projects are independent or mutually exclusive so ranking the two projects would be helpful. Allied requires a rate of return on projects like this of 14 percent and a maximum payback period of 4 years. The cash flows for the two projects are provided below and to prepare your analysis you have decided to do the following: 1. Calculate the payback period, NPV and IRR for both projects. 2. If you assume the two projects are independent - that is, that both could be accepted if both are acceptable, evaluate the two projects' acceptability using all three decision criteria from #1 above. 3. Rank the two projects and make a recommendation as to which (if either) should be accepted under the assumption that the projects are mutually exclusive. Year 0 1 23455 6 Project A Project B -$750,000.00-$635,000.00 $100,000.00 $125,000.00 $150,000.00 $200,000.00 $150,000.00 $225,000.00 $175,000.00 $200,000.00 $200,000.00 $150,000.00 $250,000.00 $150,000.00 7 8 Discount Rate Payback (years) 1 Payback NPV $200,000.00 $150,000.00 $175,000.00 $100,000.00 RR 2 Independent Projects Payback NPV IRR 3. Mutually Exclusive Projects Rank

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 24IC: BASICS OF CAPITAL BUDGETING You recently went to work for Allied Components Company, a supplier of...

Related questions

Question

Transcribed Image Text:Problem 11.9: You recently went to work for Allied Components Company, a

supplier of auto repair parts used in the after-market with products from Daimler AG,

Ford, Toyota and other automakers. Your boss, the chief financial officer (CFO), has

just handed you an assignment that includes the estimated cash flows for two

proposed projects. The project's are related to the firm's ignition system line, but

you are unsure if the projects are independent or mutually exclusive so ranking the

two projects would be helpful. Allied requires a rate of return on projects like this of

14 percent and a maximum payback period of 4 years. The cash flows for the two

projects are provided below and to prepare your analysis you have decided to do the

following:

1. Calculate the payback period, NPV and IRR for both projects.

2. If you assume the two projects are independent - that is, that both could be

accepted if both are acceptable, evaluate the two projects' acceptability using all

three decision criteria from #1 above.

3. Rank the two projects and make a recommendation as to which (if either) should

be accepted under the assumption that the projects are mutually exclusive.

Year

0

Project A Project B

-$750,000.00 -$635,000.00

8

123456700

$100,000.00 $125,000.00

$150,000.00 $200,000.00

$150,000.00 $225,000.00

$175,000.00 $200,000.00

$200,000.00 $150,000.00

$250,000.00 $150,000.00

$200,000.00 $150,000.00

$175,000.00 $100,000.00

Discount Rate

Payback (years)

1.

Payback

NPV

IRR

2. Independent Projects

Payback

NPV

IRR

3. Mutually Exclusive Projects

Rank

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 7 images

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning