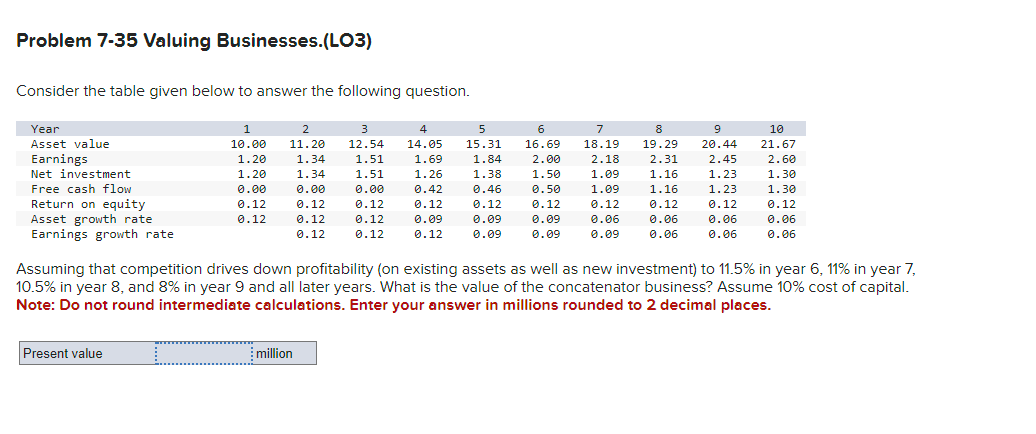

Problem 7-35 Valuing Businesses.(LO3) Consider the table given below to answer the following question. Year Asset value Earnings Net investment Free cash flow Return on equity Asset growth rate Earnings growth rate 2 3 5 6 11.20 12.54 14.05 15.31 16.69 1.51 1.69 1.84 2.00 1.51 1.26 1.38 0.42 0.46 0.12 0.12 0.09 0.09 0.12 0.09 Present value 1 10.00 1.20 1.34 1.20 1.34 0.00 0.00 0.00 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 1.50 0.50 0.12 0.09 0.09 million 7 18.19 2.18 8 19.29 2.31 1.09 1.16 1.09 1.16 0.12 0.12 0.06 0.06 0.09 0.06 9 20.44 10 21.67 2.60 1.30 1.30 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7, 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 10% cost of capital. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. 2.45 1.23 1.23 0.12 0.12 0.06 0.06 0.06 0.06

Problem 7-35 Valuing Businesses.(LO3) Consider the table given below to answer the following question. Year Asset value Earnings Net investment Free cash flow Return on equity Asset growth rate Earnings growth rate 2 3 5 6 11.20 12.54 14.05 15.31 16.69 1.51 1.69 1.84 2.00 1.51 1.26 1.38 0.42 0.46 0.12 0.12 0.09 0.09 0.12 0.09 Present value 1 10.00 1.20 1.34 1.20 1.34 0.00 0.00 0.00 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 1.50 0.50 0.12 0.09 0.09 million 7 18.19 2.18 8 19.29 2.31 1.09 1.16 1.09 1.16 0.12 0.12 0.06 0.06 0.09 0.06 9 20.44 10 21.67 2.60 1.30 1.30 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7, 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 10% cost of capital. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. 2.45 1.23 1.23 0.12 0.12 0.06 0.06 0.06 0.06

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 17P: CONCEPTUAL: RETURN ON EQUITY Which of the following statements is most correct? (Hint: Work Problem...

Related questions

Question

Transcribed Image Text:Problem 7-35 Valuing Businesses.(LO3)

Consider the table given below to answer the following question.

Year

Asset value

Earnings

Net investment

Free cash flow

Return on equity

Asset growth rate

Earnings growth rate

1

10.00

1.20

Present value

1.20

0.00

0.12

0.12

2

11.20

1.34

1.34

0.00

0.12

0.12

0.12

3

12.54

million

1.51

1.51

0.00

0.12

0.12

0.12

4

5

14.05 15.31

1.84

1.38

0.46

0.12

0.09

0.09

1.69

1.26

0.42

0.12

0.09

0.12

6

16.69

2.00

1.50

0.50

0.12

0.09

0.09

10

7

8

18.19 19.29

2.18

21.67

2.31

2.60

1.09

1.16

1.30

1.09

1.16

1.30

0.12

0.12

0.12

0.12

0.06

0.06

0.06

0.06 0.06 0.06

0.06

0.09

Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7,

10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 10% cost of capital.

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

9

20.44

2.45

1.23

1.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning