Quatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%, and the bonds are sold for $799,828. 1. What is the amount of the premium on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds.

Quatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%, and the bonds are sold for $799,828. 1. What is the amount of the premium on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 7C

Related questions

Question

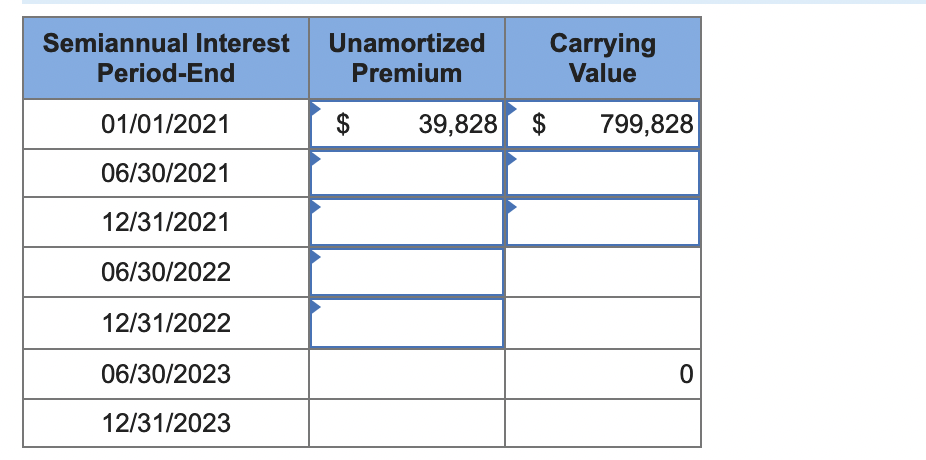

Transcribed Image Text:Semiannual Interest Unamortized

Premium

Period-End

01/01/2021

06/30/2021

12/31/2021

06/30/2022

12/31/2022

06/30/2023

12/31/2023

$ 39,828 $

Carrying

Value

799,828

0

Transcribed Image Text:Quatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and

interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of

issuance is 8%, and the bonds are sold for $799,828.

1. What is the amount of the premium on these bonds at issuance?

2. How much total bond interest expense will be recognized over the life of these bonds?

3. Prepare a straight-line amortization table for these bonds.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Prepare a straight-line amortization table for these bonds.

Note: Round your intermediate calculations to the nearest dollar amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT