QUESTION 1 Given the following information Please calculate the Free Cash Flow to Equity EBIT Net Income Tax rate Depreciation Capital expenditure 2207.9 1513.5 21.80% 1807.1 954.6 Change in non-cash Working Capital -2176.3 Change in long term debt Interest Expense Liabilities Total Long Term debt Total Assets 4755 5470 3902 5628 927.6 395.3 24511.8 13220.6 26168.2

QUESTION 1 Given the following information Please calculate the Free Cash Flow to Equity EBIT Net Income Tax rate Depreciation Capital expenditure 2207.9 1513.5 21.80% 1807.1 954.6 Change in non-cash Working Capital -2176.3 Change in long term debt Interest Expense Liabilities Total Long Term debt Total Assets 4755 5470 3902 5628 927.6 395.3 24511.8 13220.6 26168.2

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 9EP

Related questions

Question

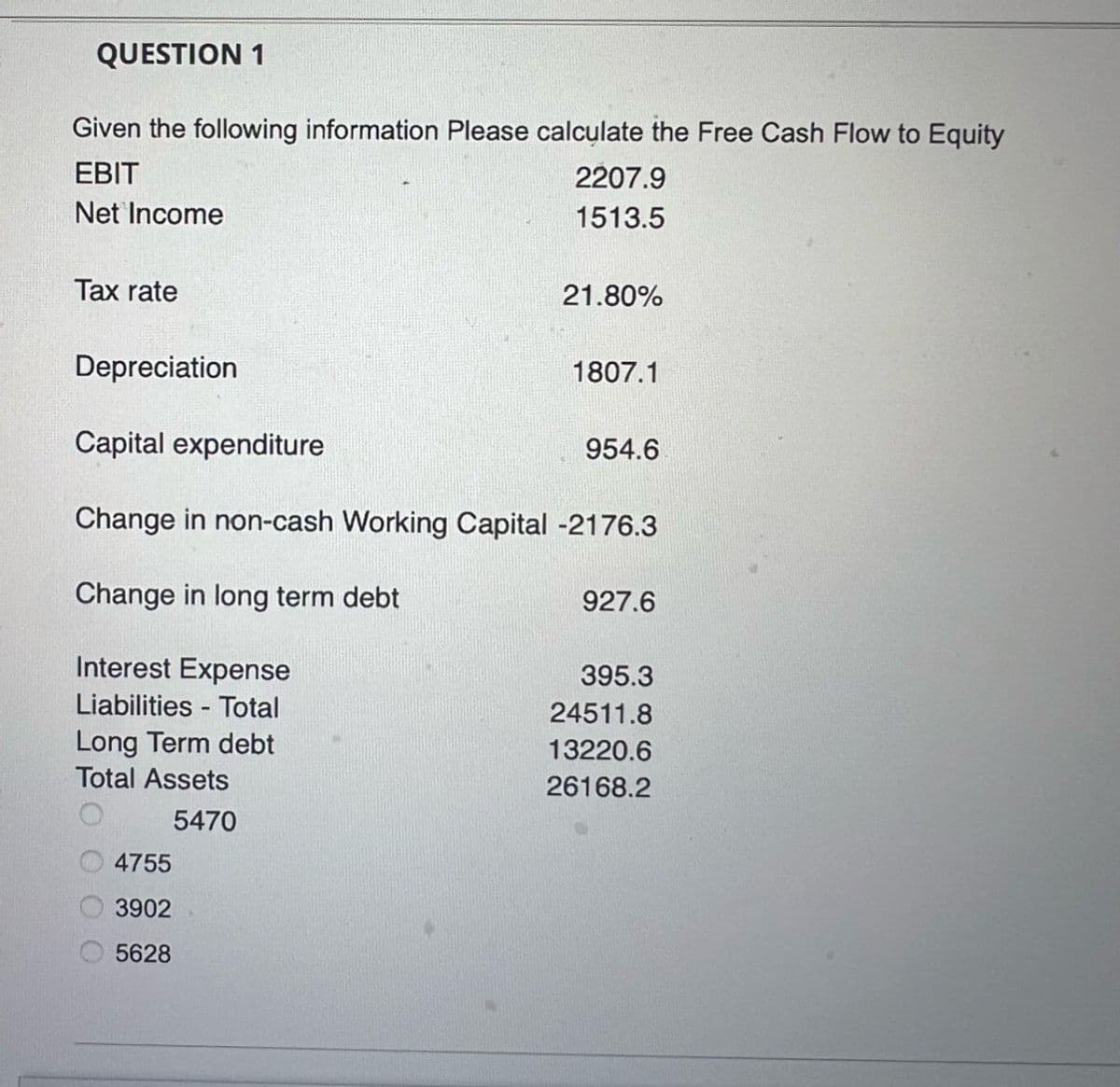

Transcribed Image Text:QUESTION 1

Given the following information Please calculate the Free Cash Flow to Equity

EBIT

Net Income

Tax rate

Depreciation

Capital expenditure

2207.9

1513.5

21.80%

1807.1

954.6

Change in non-cash Working Capital -2176.3

Change in long term debt

Interest Expense

Liabilities

Total

Long Term debt

Total Assets

4755

5470

3902

5628

927.6

395.3

24511.8

13220.6

26168.2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning