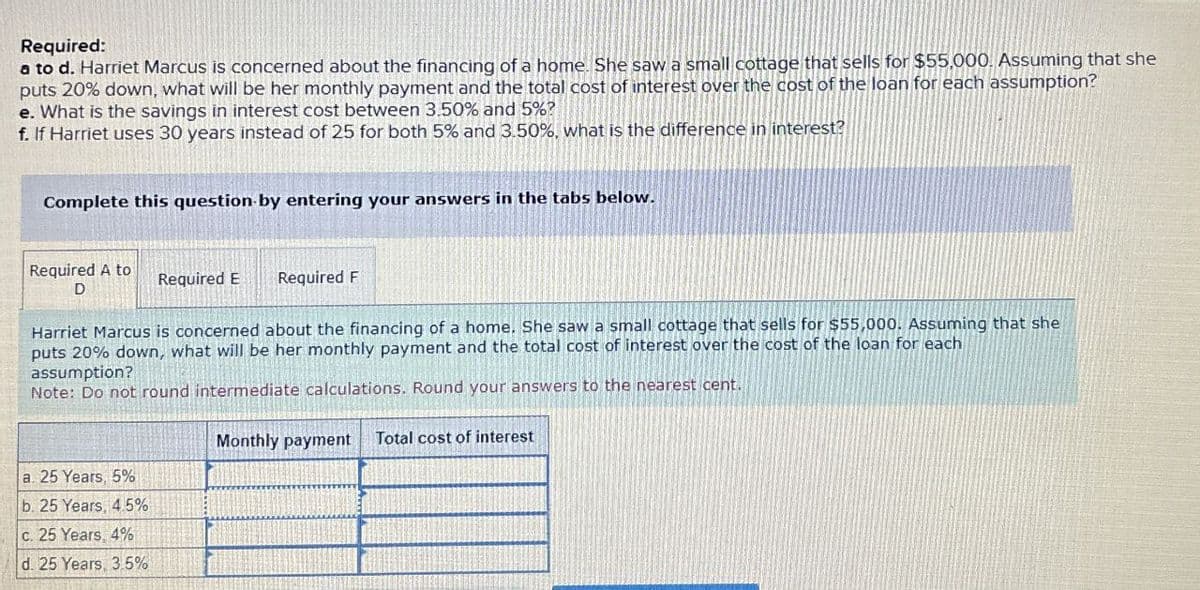

Required: a to d. Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? e. What is the savings in interest cost between 3.50% and 5%? f. If Harriet uses 30 years instead of 25 for both 5% and 3.50%, what is the difference in interest? Complete this question by entering your answers in the tabs below. Required A to Required E Required F D Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? Note: Do not round intermediate calculations. Round your answers to the nearest cent. Monthly payment Total cost of interest a. 25 Years, 5% b. 25 Years, 4.5% c. 25 Years, 4% d. 25 Years, 3.5%

Required: a to d. Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? e. What is the savings in interest cost between 3.50% and 5%? f. If Harriet uses 30 years instead of 25 for both 5% and 3.50%, what is the difference in interest? Complete this question by entering your answers in the tabs below. Required A to Required E Required F D Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? Note: Do not round intermediate calculations. Round your answers to the nearest cent. Monthly payment Total cost of interest a. 25 Years, 5% b. 25 Years, 4.5% c. 25 Years, 4% d. 25 Years, 3.5%

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Question

Transcribed Image Text:Required:

a to d. Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she

puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption?

e. What is the savings in interest cost between 3.50% and 5%?

f. If Harriet uses 30 years instead of 25 for both 5% and 3.50%, what is the difference in interest?

Complete this question by entering your answers in the tabs below.

Required A to

Required E

Required F

D

Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $55,000. Assuming that she

puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each

assumption?

Note: Do not round intermediate calculations. Round your answers to the nearest cent.

Monthly payment Total cost of interest

a. 25 Years, 5%

b. 25 Years, 4.5%

c. 25 Years, 4%

d. 25 Years, 3.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning