Required: Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8.

Required: Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6E

Related questions

Question

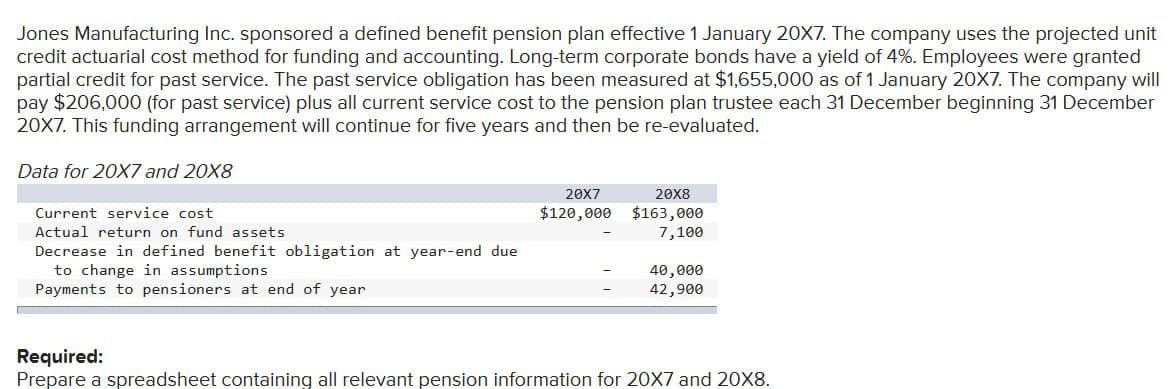

Transcribed Image Text:Jones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The company uses the projected unit

credit actuarial cost method for funding and accounting. Long-term corporate bonds have a yield of 4%. Employees were granted

partial credit for past service. The past service obligation has been measured at $1,655,000 as of 1 January 20X7. The company will

pay $206,000 (for past service) plus all current service cost to the pension plan trustee each 31 December beginning 31 December

20X7. This funding arrangement will continue for five years and then be re-evaluated.

Data for 20X7 and 20X8

Current service cost

Actual return on fund assets

Decrease in defined benefit obligation at year-end due

to change in assumptions

Payments to pensioners at end of year

20X7

$120,000

20X8

$163,000

7,100

40,000

42,900

Required:

Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT