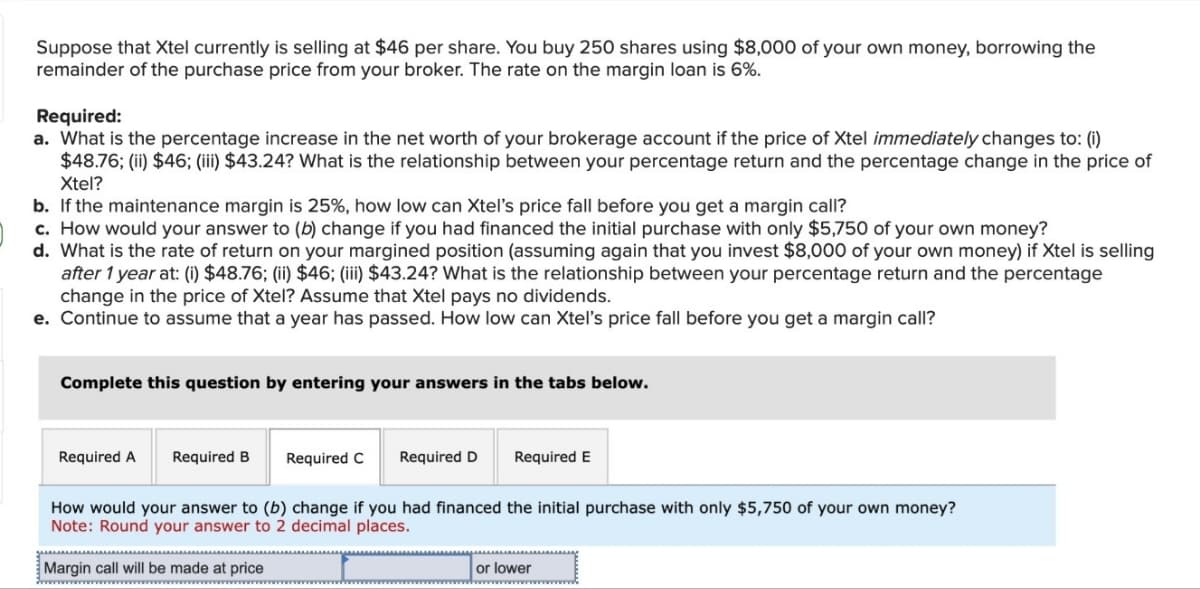

Suppose that Xtel currently is selling at $46 per share. You buy 250 shares using $8,000 of your own money, borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 6%. Required: a. What is the percentage increase in the net worth of your brokerage account if the price of Xtel immediately changes to: (i) $48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage change in the price of Xtel? b. If the maintenance margin is 25%, how low can Xtel's price fall before you get a margin call? c. How would your answer to (b) change if you had financed the initial purchase with only $5,750 of your own money? d. What is the rate of return on your margined position (assuming again that you invest $8,000 of your own money) if Xtel is selling after 1 year at: (i) $48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage change in the price of Xtel? Assume that Xtel pays no dividends. e. Continue to assume that a year has passed. How low can Xtel's price fall before you get a margin call? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E

Suppose that Xtel currently is selling at $46 per share. You buy 250 shares using $8,000 of your own money, borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 6%. Required: a. What is the percentage increase in the net worth of your brokerage account if the price of Xtel immediately changes to: (i) $48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage change in the price of Xtel? b. If the maintenance margin is 25%, how low can Xtel's price fall before you get a margin call? c. How would your answer to (b) change if you had financed the initial purchase with only $5,750 of your own money? d. What is the rate of return on your margined position (assuming again that you invest $8,000 of your own money) if Xtel is selling after 1 year at: (i) $48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage change in the price of Xtel? Assume that Xtel pays no dividends. e. Continue to assume that a year has passed. How low can Xtel's price fall before you get a margin call? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

Transcribed Image Text:Suppose that Xtel currently is selling at $46 per share. You buy 250 shares using $8,000 of your own money, borrowing the

remainder of the purchase price from your broker. The rate on the margin loan is 6%.

Required:

a. What is the percentage increase in the net worth of your brokerage account if the price of Xtel immediately changes to: (i)

$48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage change in the price of

Xtel?

b. If the maintenance margin is 25%, how low can Xtel's price fall before you get a margin call?

c. How would your answer to (b) change if you had financed the initial purchase with only $5,750 of your own money?

d. What is the rate of return on your margined position (assuming again that you invest $8,000 of your own money) if Xtel is selling

after 1 year at: (i) $48.76; (ii) $46; (iii) $43.24? What is the relationship between your percentage return and the percentage

change in the price of Xtel? Assume that Xtel pays no dividends.

e. Continue to assume that a year has passed. How low can Xtel's price fall before you get a margin call?

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C Required D

Required E

How would your answer to (b) change if you had financed the initial purchase with only $5,750 of your own money?

Note: Round your answer to 2 decimal places.

Margin call will be made at price

or lower

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning