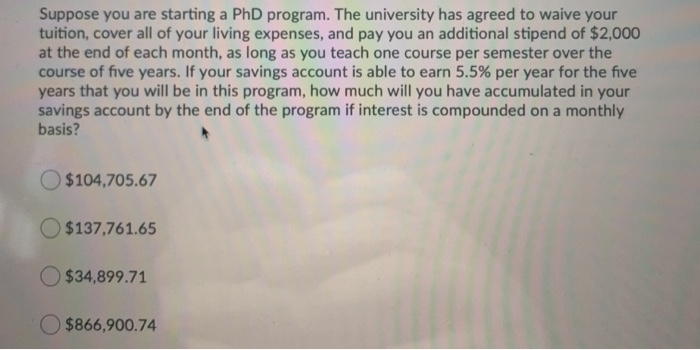

Suppose you are starting a PhD program. The university has agreed to waive your tuition, cover all of your living expenses, and pay you an additional stipend of $2,000 at the end of each month, as long as you teach one course per semester over the course of five years. If your savings account is able to earn 5.5% per year for the five years that you will be in this program, how much will you have accumulated in your savings account by the end of the program if interest is compounded on a monthly basis? $104,705.67 $137,761.65 $34,899.71 $866,900.74

Suppose you are starting a PhD program. The university has agreed to waive your tuition, cover all of your living expenses, and pay you an additional stipend of $2,000 at the end of each month, as long as you teach one course per semester over the course of five years. If your savings account is able to earn 5.5% per year for the five years that you will be in this program, how much will you have accumulated in your savings account by the end of the program if interest is compounded on a monthly basis? $104,705.67 $137,761.65 $34,899.71 $866,900.74

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Suppose you are starting a PhD program. The university has agreed to waive your

tuition, cover all of your living expenses, and pay you an additional stipend of $2,000

at the end of each month, as long as you teach one course per semester over the

course of five years. If your savings account is able to earn 5.5% per year for the five

years that you will be in this program, how much will you have accumulated in your

savings account by the end of the program if interest is compounded on a monthly

basis?

$104,705.67

$137,761.65

$34,899.71

$866,900.74

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning