TB MC Qu. 08-173 (Static) Martin Company purchases a machine... Martin Company purchases a machine at the beginning of the year at a cost of $60,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 4 years with a $5,000 salvage value. Depreciation expense in year 4 is: Multiple Choice $15,000. O O O $13,750. $55,000. $60,000. $0.

TB MC Qu. 08-173 (Static) Martin Company purchases a machine... Martin Company purchases a machine at the beginning of the year at a cost of $60,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 4 years with a $5,000 salvage value. Depreciation expense in year 4 is: Multiple Choice $15,000. O O O $13,750. $55,000. $60,000. $0.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 9MCQ: Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a...

Related questions

Question

Transcribed Image Text:ces

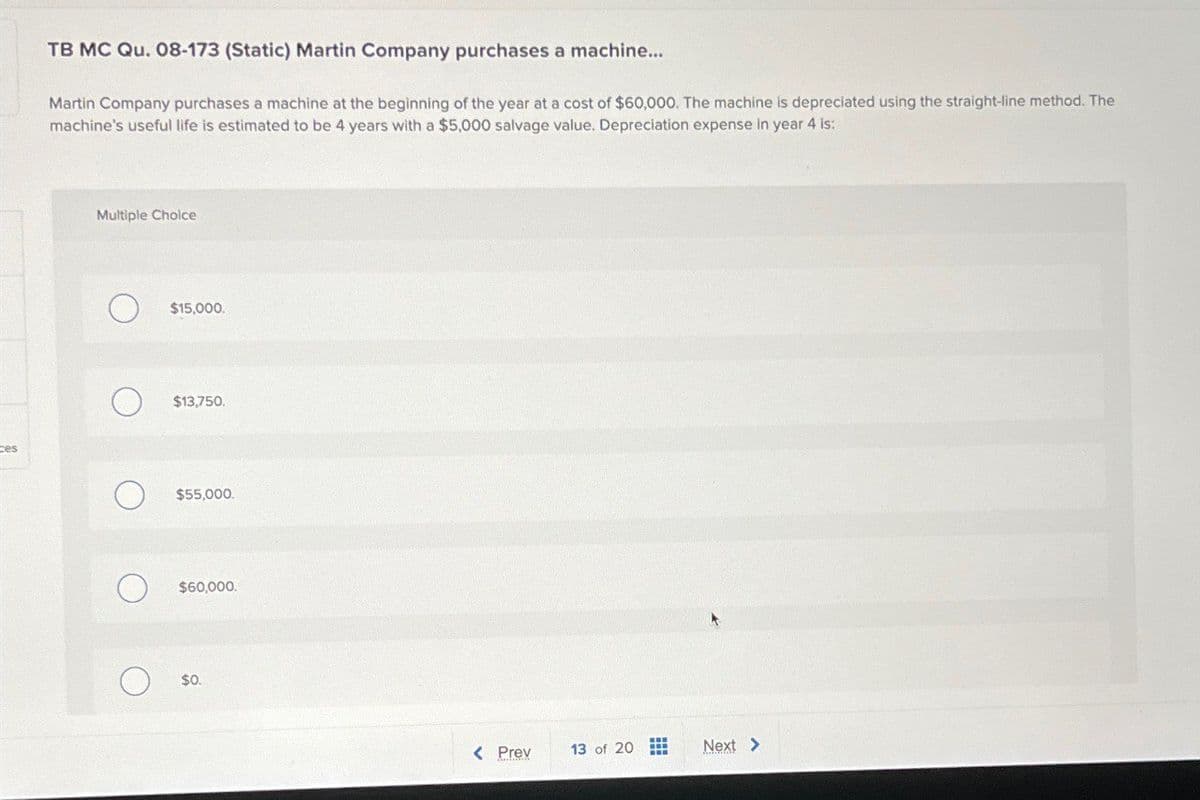

TB MC Qu. 08-173 (Static) Martin Company purchases a machine....

Martin Company purchases a machine at the beginning of the year at a cost of $60,000. The machine is depreciated using the straight-line method. The

machine's useful life is estimated to be 4 years with a $5,000 salvage value. Depreciation expense in year 4 is:

Multiple Choice

$15,000.

$13,750.

$55,000.

$60,000.

О

$0.

< Prev

13 of 20

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College