To the Internal Revenue Service (IRS), the reasonableness of total itemized deductions depends on the taxpayer's adjusted gross income. Large deductions, which include charity and medical deductions, are more reasonable for taxpayers with large adjusted gross incomes. If a taxpayer claims larger than average itemized deductions for a given level of income, the chances of an IRS audit are increased. Data (in thousands of dollars) on adjusted gross income and the average or reasonable amount of itemized deductions follow. Adjusted Gross Income Itemized Deductions ($1,000s) 22 ($1,000s) 9.6 27 9.6 32 10.1 48 11.1 65 11.5 85 19.7 120 25.5 (a) Develop a scatter diagram for these data with adjusted gross income as the independent variable. 301 30 § 30工 30T

To the Internal Revenue Service (IRS), the reasonableness of total itemized deductions depends on the taxpayer's adjusted gross income. Large deductions, which include charity and medical deductions, are more reasonable for taxpayers with large adjusted gross incomes. If a taxpayer claims larger than average itemized deductions for a given level of income, the chances of an IRS audit are increased. Data (in thousands of dollars) on adjusted gross income and the average or reasonable amount of itemized deductions follow. Adjusted Gross Income Itemized Deductions ($1,000s) 22 ($1,000s) 9.6 27 9.6 32 10.1 48 11.1 65 11.5 85 19.7 120 25.5 (a) Develop a scatter diagram for these data with adjusted gross income as the independent variable. 301 30 § 30工 30T

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Transcribed Image Text:$

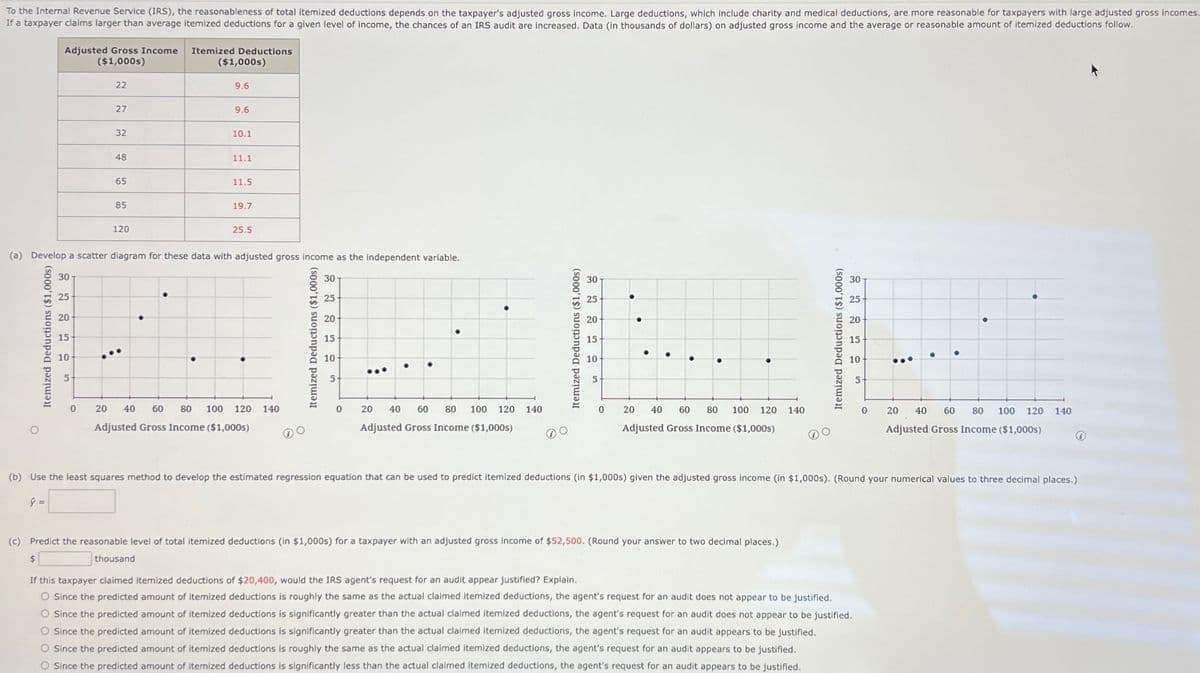

To the Internal Revenue Service (IRS), the reasonableness of total itemized deductions depends on the taxpayer's adjusted gross income. Large deductions, which include charity and medical deductions, are more reasonable for taxpayers with large adjusted gross incomes.

If a taxpayer claims larger than average itemized deductions for a given level of income, the chances of an IRS audit are increased. Data (in thousands of dollars) on adjusted gross income and the average or reasonable amount of itemized deductions follow.

Adjusted Gross Income Itemized Deductions

($1,000s)

22

($1,000s)

9.6

27

9.6

32

10.1

48

11.1

65

11.5

85

19.7

120

25.5

(a) Develop a scatter diagram for these data with adjusted gross income as the independent variable.

30-

25

20

15

Itemized Deductions ($1,000s)

10

5-

0

20 40

60 80 100 120 140

Adjusted Gross Income ($1,000s)

thousand

Itemized Deductions ($1,000s)

30

25

20

15

10

·

.

5

0

20 40 60 80 100 120 140

Adjusted Gross Income ($1,000s)

Itemized Deductions ($1,000s)

25

20

15

10

5

.

0

20 40 60 80 100 120

Adjusted Gross Income ($1,000s)

140

Itemized Deductions ($1,000s)

20

15

•

10

5

0

20 40 60 80 100 120 140

Adjusted Gross Income ($1,000s)

(b) Use the least squares method to develop the estimated regression equation that can be used to predict itemized deductions (in $1,000s) given the adjusted gross income (in $1,000s). (Round your numerical values to three decimal places.)

ŷ =

(c) Predict the reasonable level of total itemized deductions (in $1,000s) for a taxpayer with an adjusted gross income of $52,500. (Round your answer to two decimal places.)

If this taxpayer claimed itemized deductions of $20,400, would the IRS agent's request for an audit appear justified? Explain.

O Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit does not appear to be justified.

○ Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit does not appear to be justified.

O Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit appears to be justified.

○ Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit appears to be justified.

O Since the predicted amount of itemized deductions is significantly less than the actual claimed itemized deductions, the agent's request for an audit appears to be justified.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.