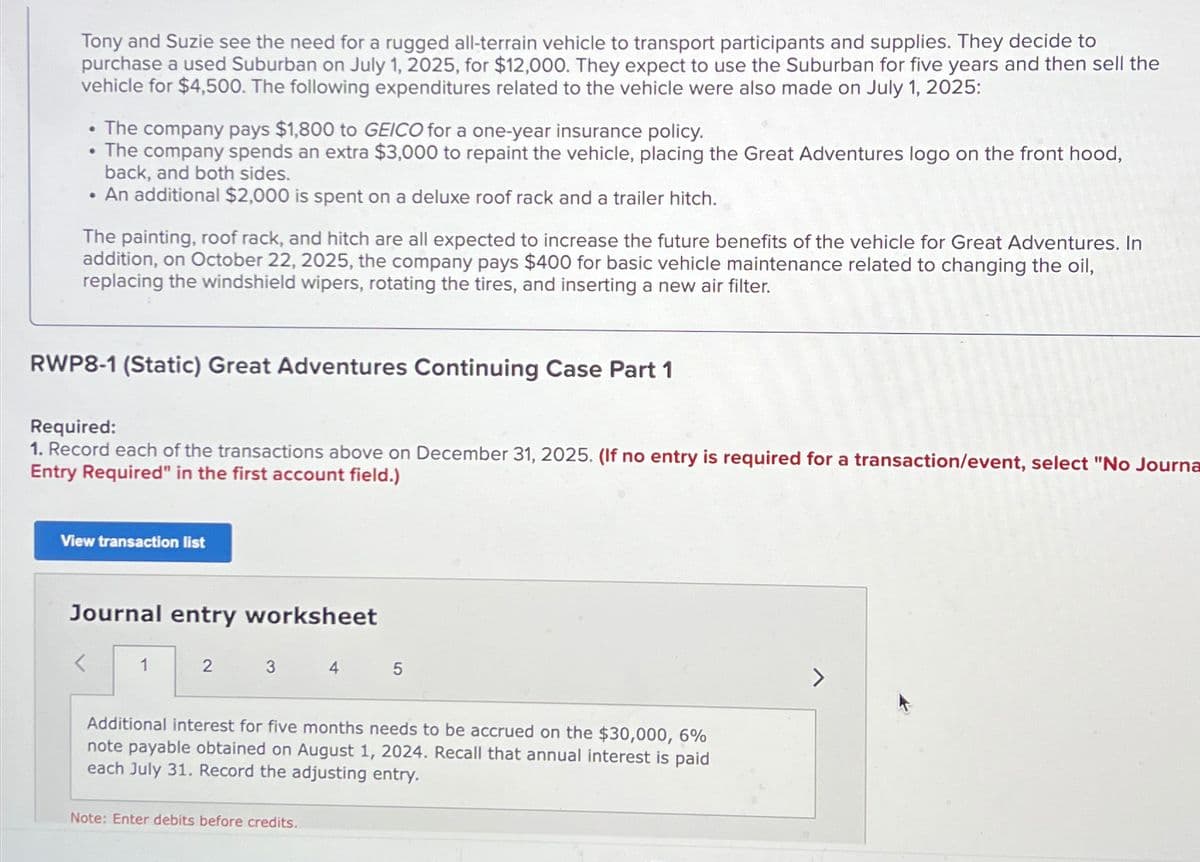

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12,000. They expect to use the Suburban for five years and then sell the vehicle for $4,500. The following expenditures related to the vehicle were also made on July 1, 2025: .The company pays $1,800 to GEICO for a one-year insurance policy. ⚫ The company spends an extra $3,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. . An additional $2,000 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $400 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. RWP8-1 (Static) Great Adventures Continuing Case Part 1 Required: 1. Record each of the transactions above on December 31, 2025. (If no entry is required for a transaction/event, select "No Journ Entry Required" in the first account field.)

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12,000. They expect to use the Suburban for five years and then sell the vehicle for $4,500. The following expenditures related to the vehicle were also made on July 1, 2025: .The company pays $1,800 to GEICO for a one-year insurance policy. ⚫ The company spends an extra $3,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. . An additional $2,000 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $400 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. RWP8-1 (Static) Great Adventures Continuing Case Part 1 Required: 1. Record each of the transactions above on December 31, 2025. (If no entry is required for a transaction/event, select "No Journ Entry Required" in the first account field.)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 50P

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

jlp.3

Transcribed Image Text:Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to

purchase a used Suburban on July 1, 2025, for $12,000. They expect to use the Suburban for five years and then sell the

vehicle for $4,500. The following expenditures related to the vehicle were also made on July 1, 2025:

• The company pays $1,800 to GEICO for a one-year insurance policy.

•

The company spends an extra $3,000 to repaint the vehicle, placing the Great Adventures logo on the front hood,

back, and both sides.

• An additional $2,000 is spent on a deluxe roof rack and a trailer hitch.

The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In

addition, on October 22, 2025, the company pays $400 for basic vehicle maintenance related to changing the oil,

replacing the windshield wipers, rotating the tires, and inserting a new air filter.

RWP8-1 (Static) Great Adventures Continuing Case Part 1

Required:

1. Record each of the transactions above on December 31, 2025. (If no entry is required for a transaction/event, select "No Journa

Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

>

1

2

3

4

5

Additional interest for five months needs to be accrued on the $30,000, 6%

note payable obtained on August 1, 2024. Recall that annual interest is paid

each July 31. Record the adjusting entry.

Note: Enter debits before credits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT