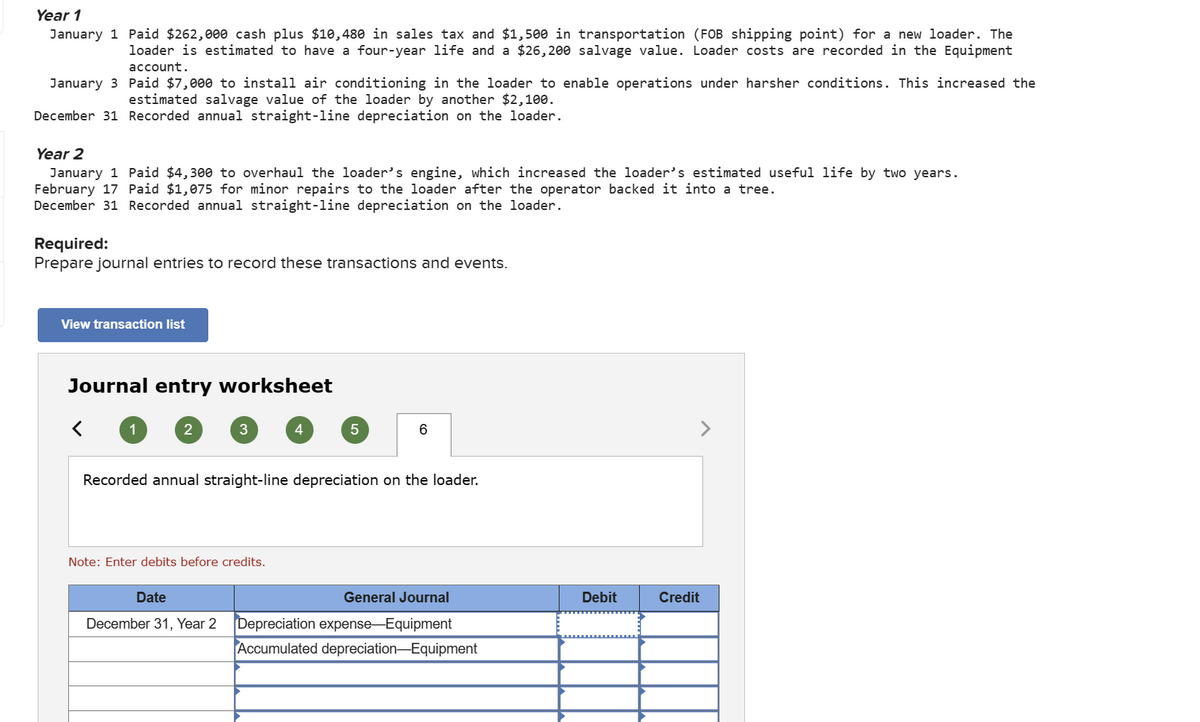

Year 1 account. January 1 Paid $262,000 cash plus $10,480 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $26,200 salvage value. Loader costs are recorded in the Equipment January 3 Paid $7,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $2,100. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,300 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $1,075 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events.

Year 1 account. January 1 Paid $262,000 cash plus $10,480 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $26,200 salvage value. Loader costs are recorded in the Equipment January 3 Paid $7,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $2,100. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,300 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $1,075 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

Transcribed Image Text:Year 1

account.

January 1 Paid $262,000 cash plus $10,480 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The

loader is estimated to have a four-year life and a $26,200 salvage value. Loader costs are recorded in the Equipment

January 3 Paid $7,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the

estimated salvage value of the loader by another $2,100.

December 31 Recorded annual straight-line depreciation on the loader.

Year 2

January 1 Paid $4,300 to overhaul the loader's engine, which increased the loader's estimated useful life by two years.

February 17 Paid $1,075 for minor repairs to the loader after the operator backed it into a tree.

December 31 Recorded annual straight-line depreciation on the loader.

Required:

Prepare journal entries to record these transactions and events.

View transaction list

Journal entry worksheet

>

1

2

3

4

5

6

Recorded annual straight-line depreciation on the loader.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December 31, Year 2

Depreciation expense-Equipment

Accumulated depreciation-Equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub