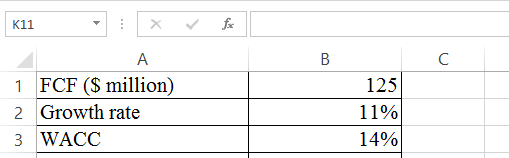

Young & Liu Inc.'s free cash flow during the just-ended year (t = 0) was $125 million, and FCF is expected to grow at a constant rate of 11% in the future. If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions? (Round your answer to 2 decimal places.)

Q: The MoMi Corporation's cash flow from operations before interest and taxes was $4.2 million in the…

A: Free cash flow is the cash flow which is available with the firm to distribute to the shareholders.…

Q: Zycad has sales of $110 million a year. If Zycad reduces their processing float by 3 days, what is…

A: The computation of increase in firm’s average cash balance is as follows:

Q: Suppose you are valuing a company that is growing its free cash flows at a stable 1.6% annual rate…

A: In this problem we have to calculate present value of cash flow and find out value of equity.

Q: Kinkead Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be −$10…

A: Value of Firm = FCF1/(1+WACC)^1 +FCF2/(1+WACC)^2 +Terminal Flow/(1+WACC)^2 FCF1 = -$10 million FCF2…

Q: Milton Gaming Company currently has assets of P3,000,000 and accounts payable of P200,000. The…

A: External funds are those funds and amounts which are required for business and which are being…

Q: The following are the projected cash flows to the firm over the next five years: Year Cash…

A: Cost of capital = 12% Growth rate = 4%

Q: The firm’s enterprise value (in millions) at the end of 2012 is equal to: The firm’s equity value…

A: Free Cash Flow = Cash FLow From Operations - Capital Expenditure

Q: A stock market analyst has forecasted the following year-end numbers for Raedebe Technology. Sales…

A: Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to…

Q: Ms. Ga Ling projected the following data for GWAPO Corporation: (amounts in millions of Pesos) Year…

A: Initial investmenr is P50,000,000 Life 10 years Annual CAPEX requirement is P2,000,000 Outstanding…

Q: The Retail Company currently has assets of P3,000,000 and accounts payable of P200,000. The firm's…

A: External Funds Needed is calculated with the help of following formula External Funds Needed =…

Q: Barnette Inc.'s free cash flows are expected to be unstable during the next few years while the…

A: To calculate Horizon value, free cashflow of that respective year is to be divided by the difference…

Q: Value in Valuation, Inc. is assessing the value of two companies, Company A and Company B, which…

A: The question is related Valuation of business. First we will calculate the capitalised value of both…

Q: Compute the value of a firm with free cash flows of $1,000, $2,500, and $3,000 over the next three…

A: Value of firm = present value of future cash inflows discounted at Unlevered cost of capital of 15%

Q: Gere Furniture forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects…

A: In the Given question we are required to calculate the terminal value of operations in millions at t…

Q: The business plan for Knowlt, LLC, a start-up company that manufactures portable multigas detectors,…

A: Required: To compute the interest rate used to yield equivalent annual cash flows of $400,000 per…

Q: MC Corporation’s current free cash flow is $400,000 and is expected to grow at a constant rate of…

A: Data given: Free cash flow (FCF) = $400,000 Expected growth at a constant rate (g)= 5% WACC= 12%…

Q: The free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average…

A: Financial Management: Financial management comprises of two words i.e. Finance and management.…

Q: The following are the projected cash flows to the firm over the next five years: Year Cash Flows to…

A: Value of firm = Present value of cash inflows + Perpetual cash inflow / ( WACC - Growth rate ) * ( 1…

Q: Afterpay Ltd’s current year’s free cash flow is $20 million. It is projected to grow at 12% per year…

A: For terminal cash flow/horizontal value:-CF6/(ke-g) where ke=7%,and g=3%…

Q: You expect ATM Corporation to generate the following free cash flows over the next five years:…

A: A model that helps to evaluate the value of the firm by discounting the future cash flow of the firm…

Q: A company is forecasted to generate free cash flows of $64 million for the next three years. After…

A: Free cash flow valuation model for value of equity consider the present value of all future cash…

Q: ABC currently produces annual free cash flows of 5 billion a year. The company has long-term debt of…

A: Enterprise value of a firm is calculated as Equity value plus debt minus cash as follows: Present…

Q: Miller Brothers is considering a project that will produce cash inflows of $61,500, $72,800,…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: You expect Apple Corporation to generate the following free cash flows over the next five years:…

A: Enterprise value is the value of the firm consisting of the stock, debt, and preferred share.…

Q: A firm expects to generate $100 million in free cash flow in a year. This free cash flow is…

A: Value of a firm refers to the value of both debt and equity. Present value of all expected free cash…

Q: A firm’s current profits are P550,000. These profits are expected to grow indefinitely at a constant…

A: Firm Value: The value of a company, sometimes referred to as Firm Value (FV) or Enterprise Value…

Q: A company has annual after-tax operating cash flows of P2,000,000 per year which are expected to…

A: After-tax operating cash flows = P 2,000,000 After tax WACC = 8%

Q: Heavy Metal Corporation is expected to generate the following free cash flows over the next five…

A: Formulae: Value of the business (enterprise value) = FCF/(1+r) + FCF2/(1+r)^2 + ...... + FCF/(1+r)^n…

Q: The following are the projected cash flows to the firm over the next five years: Year Cash…

A: WACC is 12% Expected growth rate is 4% To Find(only by using excel):- Value of the firm today…

Q: A company is forecasted to generate free cash flows of $29 million next year and $29 million the…

A: The total cash that a company has to pay off to its liabilities and dividend to its shareholders is…

Q: The financial manager of the company SFT Inc. made the following forecasts concerning the free cash…

A: To find the residual value of the company in XX+4, we will use The Gordon Growth Model GGM model.…

Q: Galeshouse Gas Stations, Inc ., expects to increase from $1,500,000 to $1,700,000 nect year. Mr.…

A: Solution:- Introduction:- The following information given in the problem as follows:- Expected…

Q: A company’s most recent free cash flow was $600 and is expectedto grow at a constant rate of 4%…

A: Growth rate(g)=4%WACC=10%Recent cashflow(FCF0)=$600

Q: The MoMi Corporation’s cash flow from operations before interest and taxes was $2 million in the…

A: Cash flow from operations =operations before Interest and tax + Growth rate * operations before…

Q: Ryan Enterprises forecasts the free cash flows (in millions) shown below. Assume the firm has zero…

A: In the given question we need to calculate the firm's total corporate value (in millions). Firm's…

Q: STARS Inc. forecasts a positive Free Cash Flow for the coming year, with FCF1 = $10,000,000, and it…

A: Calculations are as below-

Q: The projected cash flow for the next year for Minesuah Inc. is $125,000, and FCF is expected to grow…

A: The value of the firm can be expressed using a different formulas. An organization may use the…

Q: Suppose Leonard, Nixon, & Shull Corporation’s projected free cash flow (FCF) for next year is…

A: Value of operations = Expected FCF/(cost of capital - growth rate)

Q: Suppose a company’s most recent free cash flow (i.e., FCF0) was $100 million and is expected to grow…

A: FCF0 = $100 million Growth rate (g) = 5% WACC (r) = 15%

Q: The MoMi Corporation’s cash flow from operations before interest and taxes was $2.2 million in the…

A: Given information: EBIDTA $2.2 million Growth rate is 5% Tax rate is 35% Depreciation $210,000…

Q: Suppose a company’s current free cash flow (i.e. FCF0) is $100 million and is expected to grow at a…

A: Using free cash-flows there are two approaches for valuation: 1.To find the total value of the firm:…

Q: Kinkead Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be -$18…

A: Cashflow means inflow or outflow of cash. There are 2 types of cashflow i.e. positive cashflow and…

Q: Luthor Corp. is expected to generate a free cash flow (FCF) of $14,950.00 million this year (FCF: =…

A: given, WACC = 3.54% FCF 1=14950 million FCF2= 14950 x (1+23.8%) = $18508.1 million (as it grows at…

Q: The Netflix Corporation's cash flow from operations before interest and taxes was $5.25 milion in…

A: Calculation of Price per share:The price per share is $9.39.Excel Spreadsheet:

Q: A firm has $600,00 in current assets and $150,000 in current liabilities. If it uses cash to pay…

A: Given information in question Current assets = $600,000 Current liability =…

Q: Keraz Inc. has recently reported a Free Cash Flow (FCF) of $21.5 million. The CFO expects that FCF…

A: The question is based on the concept of valuation of project based on the constant growth model.…

Young & Liu Inc.'s

(Round your answer to 2 decimal places.)

The question gives the following information:

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- Young & Liu Inc.'s free cash flow during the just-ended year (t = o) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? a. $998 O b. $1,050 Oc$1,158 Od. $948 Oe. $1,103Young & Liu Inc.'s free cash flow during the just-ended year (t = 0) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions?Kinkead Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be −$10 million, but its FCF at t = 2 will be $20 million. After Year 2, FCF is expected to grow at a constant rate of 4% forever. If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions? a. $167 b. $158 c. $193 d. $175 e. $18

- Kinkead Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be -$18 million, but its FCF at t = 2 will be $40 million. After Year 2, FCF is expected to grow at a constant rate of 5% forever. If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions? Year: 1 2 Free cash flow: ($18) $40 (Round your answer to 2 decimal places.)Suppose a company’s most recent free cash flow (i.e., FCF0)was $100 million and is expected to grow at a constant rate of 5percent. If the company’s weighted average cost of capital is 15percent, what is the current value from operations?Kinkead Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be −$10 million, but its FCF at t = 2 will be $20 million. After Year 2, FCF is expected to grow at a constant rate of 4% forever. If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions?

- 13. The firm's free cash flow during the just-ended year (t = 0) was P 100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? a. 948 d. 1,103 c. 1,050 f. 1,987 b. 998 e. 1,158 14. The projected cash flow for the next year is P 1,000,000, and FCF is expected to grow at a constant rate of 6%. If the company's weighted average cost of capital is 12%, what is the value of its operations? b. 16,666,667 e. 2,100,000 a. 1,714,750 d. 2,000,000 с. 8,833,333 f. 8,333,333Heath and Logan Inc. forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions? Year: 1 2 3 Free cash flow: ($20) $15 $45 (Round your answer to 2 decimal places.)Misra Inc. forecasts a free cash flow of $55 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5.5% thereafter. If the weighted average cost of capital (WACC) is 10.0% and the cost of equity is 15.0%, then what is the horizon, or continuing, value in millions att = 3? a. $1,212 b. $1,083 O c. $1,186 O d. $1,148 O e. $1,289

- A company forecasts a free cash flow of $55 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5.5% thereafter. If the weighted average cost of capital (WACC) is 10.0% and the cost of equity is 15.0%, then what is the horizon, or continuing, value in millions at t = 3? Group of answer choices $1,083 $1,148 $1,289 $1,186 $1,212Kollo Enterprises has a beta of 0.80, the real risk-free rate is 2.20%, investors expect a 3.00% future inflation rate, and the market risk premium is 4.70%. What is Kollo's required rate of return? Do not round your intermediate calculations. a. 8.86% O b. 8.96% O c. 7.92% d. 8.36% O e. 6.76%The projected cash flow for the next year for Minesuah Inc. is $125,000, and FCF is expected to grow at a constant rate of 6.8%. If the company's weighted average cost of capital is 15.7%, what is the value of its operations?