What are the forms of cash dividends?

To discuss: The forms of cash dividend.

Introduction:

A portion of profits payable to the shareholders by the company on a regular period is termed as dividend. The members of board of the company declare these dividends.

The different forms of dividends are as follows:

- Cash dividend

- Bonus shares

- Share repurchase

- Property dividend

- Scrip dividend

- Liquidating dividend

Explanation of Solution

Regular cash dividend:

Regular cash dividends are payable four times a year on a regular basis. These cash dividends are payable directly to the shareholders.

Extra dividends:

A onetime payment made to the shareholders of the company on a quarterly or various ranges of periods are termed as extra dividends. These dividends may or may not be declared for the upcoming years.

Special dividends:

Special dividends are those, which are same as extra dividend, but they cannot be declared again. Thus, this payment is the onetime payment.

Liquidating dividends:

These are the dividends which are payable during the liquidation period. The dividends paid at the time of complete or partial closure of business is termed as liquidating dividends.

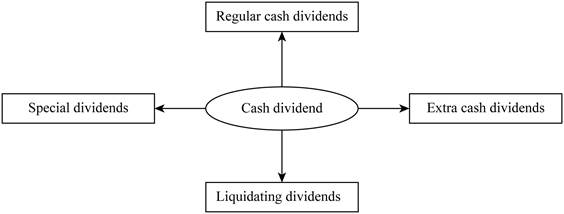

Pictorial representation:

The forms of cash dividend are as follows:

Thus, the above-mentioned are the various forms of cash dividends declared by the board of company and taxable as income to the beneficiary.

Want to see more full solutions like this?

Chapter 14 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning