Curity 5. Based on the following, compute BEPS and DEPS for Abe Corporation: a. On January 1, 200x, there were 300,000 shares of Common Stock outstanding. b. C. d. On January 1, 200x, Abe issued 40,000 shares of 9%, $100 par Cumulative Convertible Preferred Stock. The conversion ratio was 3 shares of common for 1 share of preferred. On January 1, 200x, Abe issued $1,000,000 of 5% Convertible Bonds at par. Each $1,000 bond is convertible into 50 shares of common stock. On January 1, 200x, Abe offered Stock Options to selected employees for 40,000 shares at an option price of $30 per share. e. The income tax rate was 60%. f. The average market price of the common stock during 200x was $80 per share. g. Net Income for 200x was $1,800,000.

Curity 5. Based on the following, compute BEPS and DEPS for Abe Corporation: a. On January 1, 200x, there were 300,000 shares of Common Stock outstanding. b. C. d. On January 1, 200x, Abe issued 40,000 shares of 9%, $100 par Cumulative Convertible Preferred Stock. The conversion ratio was 3 shares of common for 1 share of preferred. On January 1, 200x, Abe issued $1,000,000 of 5% Convertible Bonds at par. Each $1,000 bond is convertible into 50 shares of common stock. On January 1, 200x, Abe offered Stock Options to selected employees for 40,000 shares at an option price of $30 per share. e. The income tax rate was 60%. f. The average market price of the common stock during 200x was $80 per share. g. Net Income for 200x was $1,800,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:Security

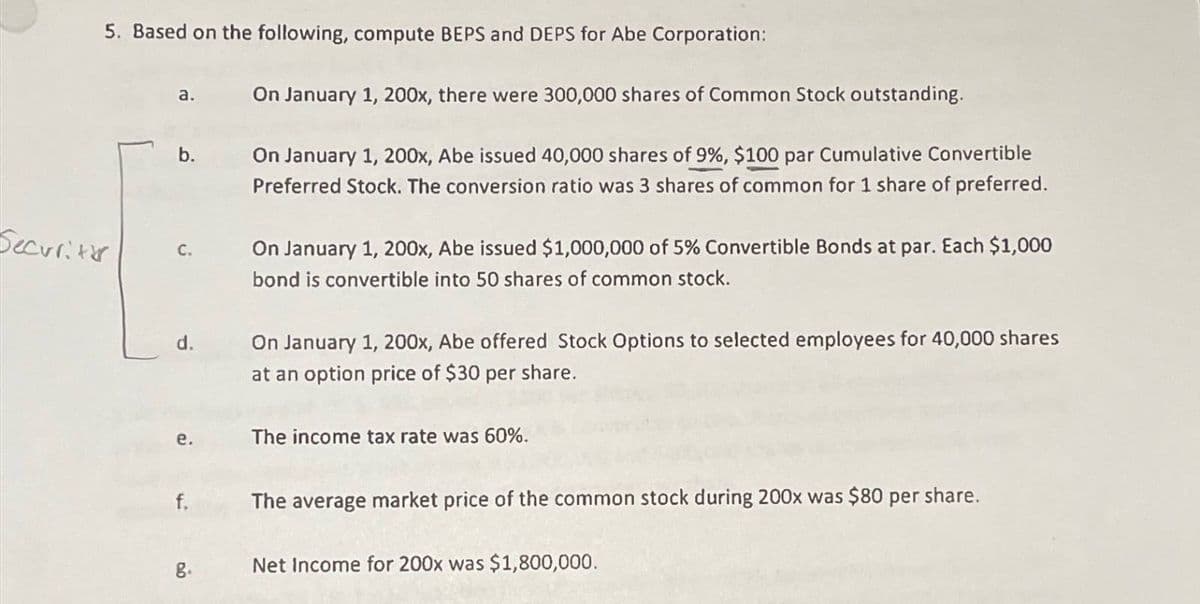

5. Based on the following, compute BEPS and DEPS for Abe Corporation:

a.

On January 1, 200x, there were 300,000 shares of Common Stock outstanding.

b.

C.

d.

On January 1, 200x, Abe issued 40,000 shares of 9%, $100 par Cumulative Convertible

Preferred Stock. The conversion ratio was 3 shares of common for 1 share of preferred.

On January 1, 200x, Abe issued $1,000,000 of 5% Convertible Bonds at par. Each $1,000

bond is convertible into 50 shares of common stock.

On January 1, 200x, Abe offered Stock Options to selected employees for 40,000 shares

at an option price of $30 per share.

e.

The income tax rate was 60%.

f.

The average market price of the common stock during 200x was $80 per share.

g.

Net Income for 200x was $1,800,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College