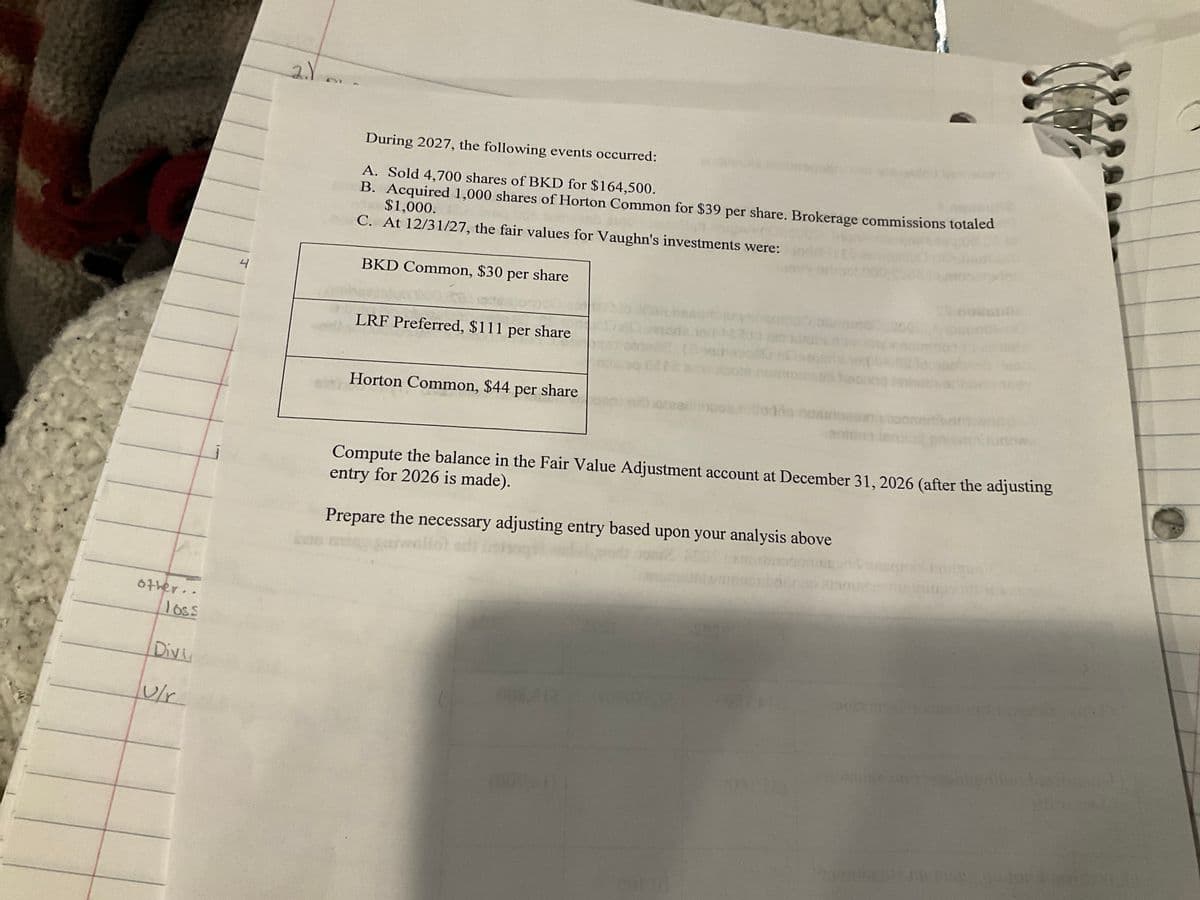

During 2027, the following events occurred: A. Sold 4,700 shares of BKD for $164,500. B. Acquired 1,000 shares of Horton Common for $39 per share. Brokerage commissions totaled $1,000. C. At 12/31/27, the fair values for Vaughn's investments were: BKD Common, $30 per share LRF Preferred, $111 per share Horton Common, $44 per share Compute the balance in the Fair Value Adjustment account at December 31, 2026 (after the adjusting entry for 2026 is made). Prepare the necessary adjusting entry based upon your analysis above

During 2027, the following events occurred: A. Sold 4,700 shares of BKD for $164,500. B. Acquired 1,000 shares of Horton Common for $39 per share. Brokerage commissions totaled $1,000. C. At 12/31/27, the fair values for Vaughn's investments were: BKD Common, $30 per share LRF Preferred, $111 per share Horton Common, $44 per share Compute the balance in the Fair Value Adjustment account at December 31, 2026 (after the adjusting entry for 2026 is made). Prepare the necessary adjusting entry based upon your analysis above

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15GI: Jordan Company recognized a 5,000 unrealized holding gain on investment in Starbuckss common stock...

Related questions

Question

Transcribed Image Text:thout making journal entries.

this

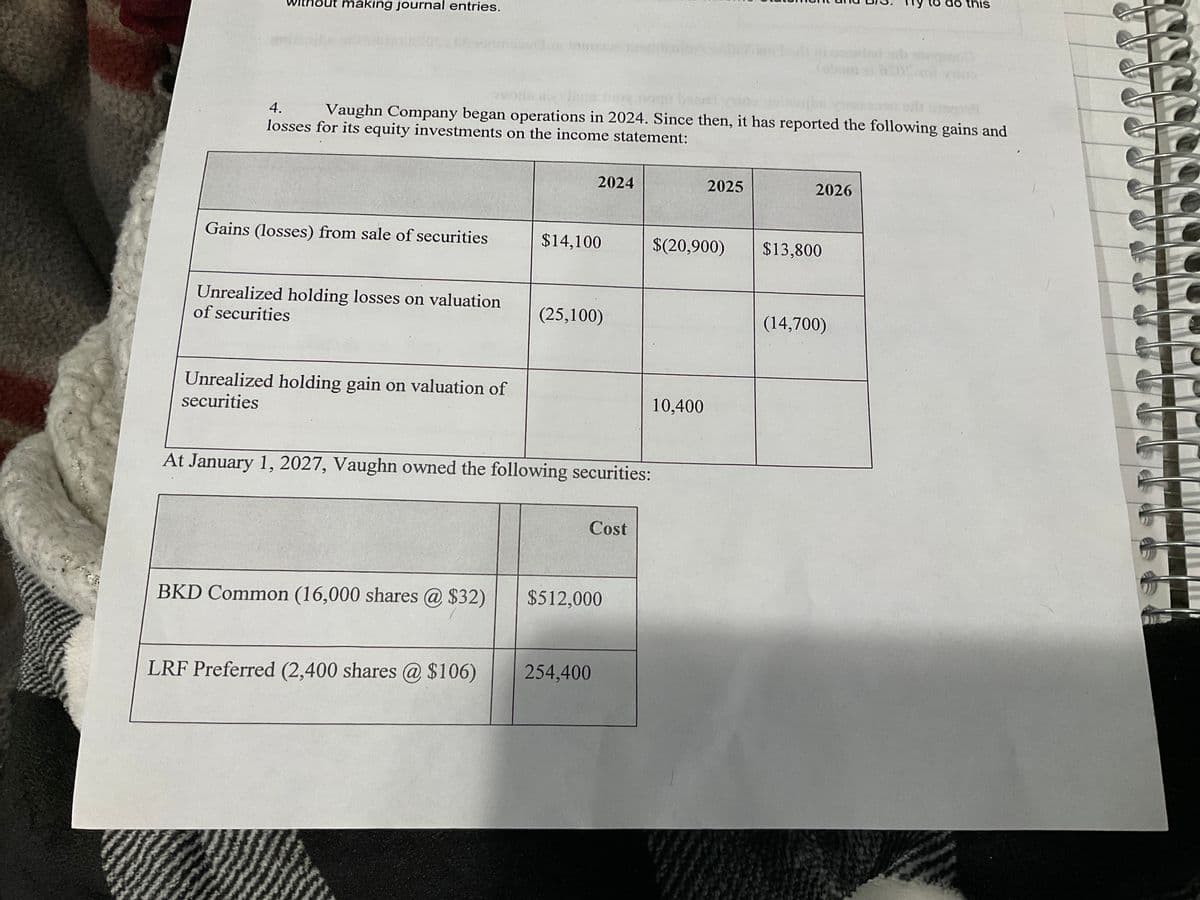

4.

Vaughn Company began operations in 2024. Since then, it has reported the following gains and

losses for its equity investments on the income statement:

2024

2025

2026

Gains (losses) from sale of securities

$14,100

$(20,900)

$13,800

Unrealized holding losses on valuation

of securities

(25,100)

Unrealized holding gain on valuation of

securities

At January 1, 2027, Vaughn owned the following securities:

Cost

BKD Common (16,000 shares @ $32)

$512,000

LRF Preferred (2,400 shares @ $106)

254,400

10,400

(14,700)

Transcribed Image Text:thout making journal entries.

this

4.

Vaughn Company began operations in 2024. Since then, it has reported the following gains and

losses for its equity investments on the income statement:

2024

2025

2026

Gains (losses) from sale of securities

$14,100

$(20,900)

$13,800

Unrealized holding losses on valuation

of securities

(25,100)

Unrealized holding gain on valuation of

securities

At January 1, 2027, Vaughn owned the following securities:

Cost

BKD Common (16,000 shares @ $32)

$512,000

LRF Preferred (2,400 shares @ $106)

254,400

10,400

(14,700)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning