North Pole and South Pole are competitors in the same industry. Both companies face a 24 % income tax rate. Both companies are levered. (North Pole and South Pole had the sam Betas, 1.09, when they were still unlevered.) Their capital structures look like this North Pole South Pole Debt $2,940,000 $3,850,000 Equity $3,850,000 $2,940,000 For both companies, the Betas for their debt is zero.

North Pole and South Pole are competitors in the same industry. Both companies face a 24 % income tax rate. Both companies are levered. (North Pole and South Pole had the sam Betas, 1.09, when they were still unlevered.) Their capital structures look like this North Pole South Pole Debt $2,940,000 $3,850,000 Equity $3,850,000 $2,940,000 For both companies, the Betas for their debt is zero.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 16P

Related questions

Question

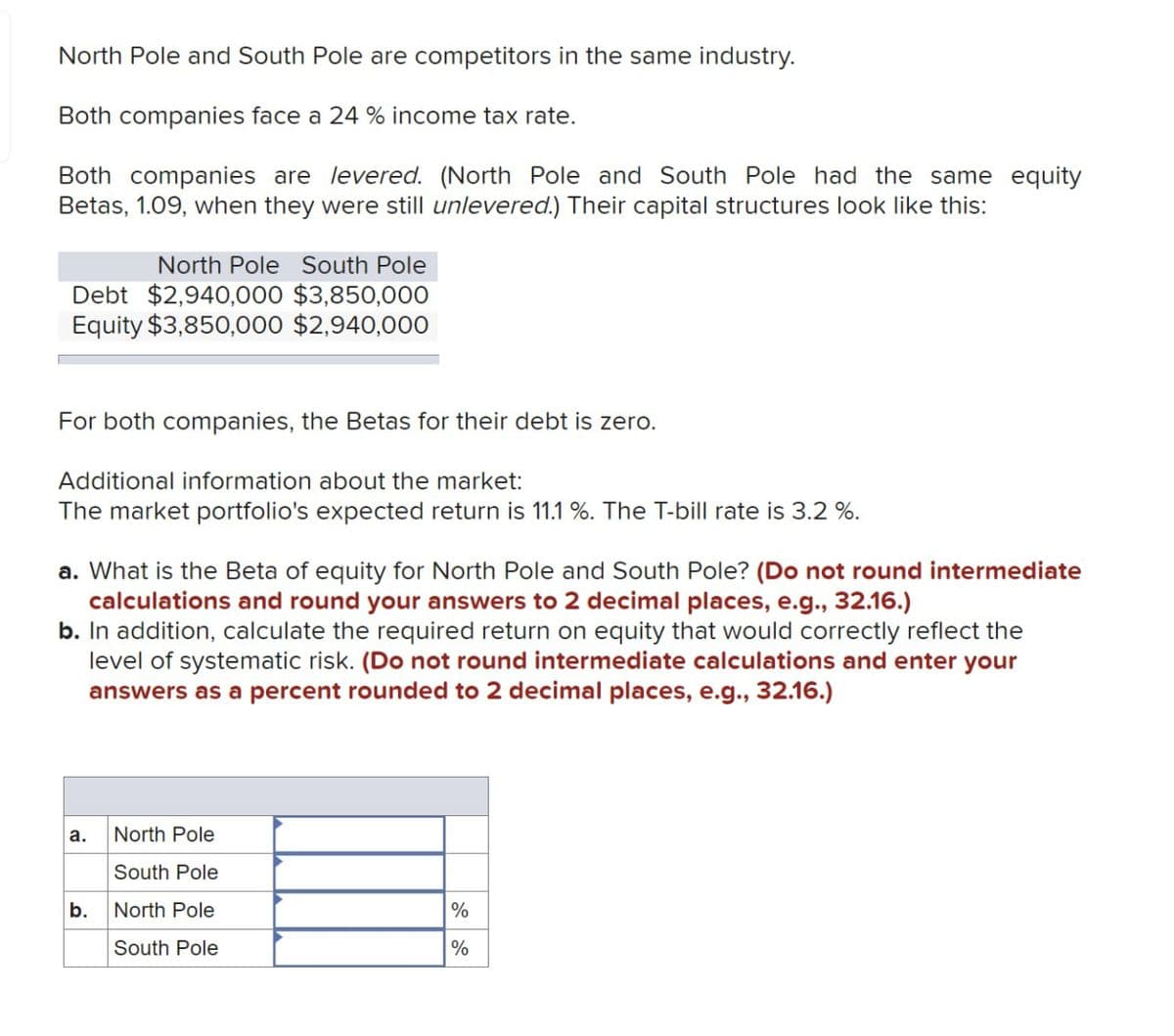

Transcribed Image Text:North Pole and South Pole are competitors in the same industry.

Both companies face a 24% income tax rate.

Both companies are levered. (North Pole and South Pole had the same equity

Betas, 1.09, when they were still unlevered.) Their capital structures look like this:

North Pole South Pole

Debt $2,940,000 $3,850,000

Equity $3,850,000 $2,940,000

For both companies, the Betas for their debt is zero.

Additional information about the market:

The market portfolio's expected return is 11.1 %. The T-bill rate is 3.2%.

a. What is the Beta of equity for North Pole and South Pole? (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

b. In addition, calculate the required return on equity that would correctly reflect the

level of systematic risk. (Do not round intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a.

North Pole

South Pole

b. North Pole

%

South Pole

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College