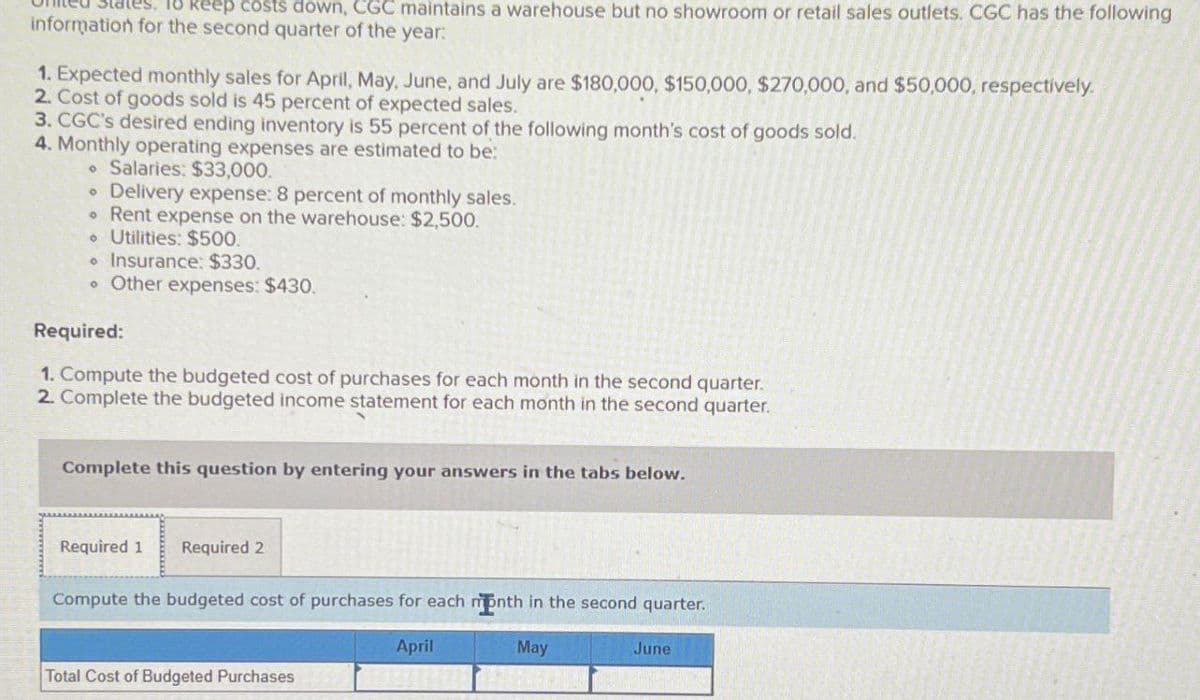

of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. • Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. . Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter.

of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. • Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. . Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter22: Master Budget (master)

Section: Chapter Questions

Problem 1R: Ranger Industries has provided the following information at June 30: Other information: Average...

Related questions

Question

Transcribed Image Text:keep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following

information for the second quarter of the year:

1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively.

2. Cost of goods sold is 45 percent of expected sales.

3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold.

4. Monthly operating expenses are estimated to be:

. Salaries: $33,000.

°

Delivery expense: 8 percent of monthly sales.

• Rent expense on the warehouse: $2,500.

• Utilities: $500.

• Insurance: $330.

• Other expenses: $430.

Required:

1. Compute the budgeted cost of purchases for each month in the second quarter.

2. Complete the budgeted income statement for each month in the second quarter.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the budgeted cost of purchases for each month in the second quarter.

Total Cost of Budgeted Purchases

April

May

June

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,