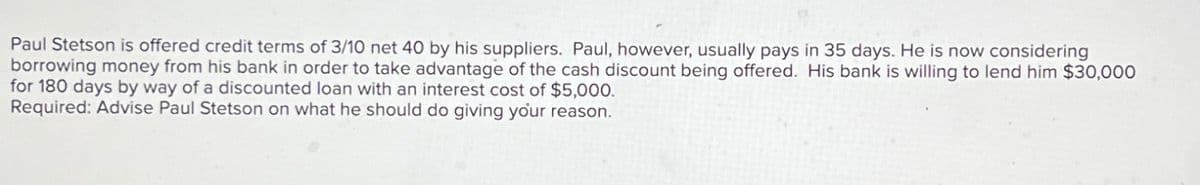

Paul Stetson is offered credit terms of 3/10 net 40 by his suppliers. Paul, however, usually pays in 35 days. He is now considering borrowing money from his bank in order to take advantage of the cash discount being offered. His bank is willing to lend him $30,000 for 180 days by way of a discounted loan with an interest cost of $5,000. Required: Advise Paul Stetson on what he should do giving your reason.

Q: At the end of the current year, the unadjusted trial balance of Branco, Incorporated, indicated…

A: 1Bad debts expense of current year$320,720.002Accounts receivable of current…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: The objective of the question is to evaluate the financial feasibility of a new project for Rare…

Q: A loan of $ 10,000 is amortized by equal annual payments for 30 years at an effective annual…

A: Loan amount = $10,000Period = 30 yearsEffective annual interest rate = 10%To find: The year in which…

Q: Nobility Homes, Incorporated, is a small maker of manufactured homes sold throughout the state of…

A:

Q: Consider the single-index model. The alpha of a stock is 2.00%. The return on the market index is…

A: Alpha of the stock = 2%Return on market (RM) = 12%Risk-free rate of return (RF) = 5.5%Actual return…

Q: If the annual interest rate is 2%, what is the present value of this opportunity?

A: The present value assists in determining the current value of a future sum of money. It accounts for…

Q: 52-WEEK VOLUME NET HI 75.43 LO 45.86 STOCK (DIV) RJW 175 YLD% PE 19 2.9 100s 10 CLOSE CHANGE ?? -.55…

A: Given Data: Stock Dividend 1.75Dividend Yield2.90%P/E Ratio19Net change-0.55

Q: Long lines of patients wait for CAT scanning service in a hospital. Patients arrive for scans at a…

A: The corrected answers are:1. Probability that the system is empty: 0.5382. Probability that a…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: The Sharpe ratio of the optimal Capital Allocation Line (CAL) indicates the risk-adjusted return of…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: To solve this problem, we need to calculate various financial metrics for the project. Let's break…

Q: In 2022, Deborah had a balance of $109,000 in her TFSA. That year, she withdrew $40,000 to fund her…

A: The objective of the question is to calculate the maximum amount that Deborah can contribute to her…

Q: For project A, the cash flow effect from the change in net working capital is expected to be $490.00…

A: Answer: None of the above is within $10 of the correct answer (but the closest option is $1,360.00).…

Q: Both Bond Bill and Bond Ted have 11 percent coupons, make semiannual payments, and are priced at par…

A: The relationship between bond price and yield is inverse. As the yield on a bond increases, the…

Q: Having heard about IPO underpricing, I put in an order to my broker for 1, 120 shares of every IPO…

A: Data given:IPOShares Allocated to mePrice per share ($)Initial Return…

Q: Assume that in 2020, a Liberty Seated half dollar issued in 1892 was sold for $197,000. What was the…

A: time value of money will be applied here. As per the concept of time value of money the worth of…

Q: Second decade: Al-Awael Islamic Bank purchased warehouses for an amount of 150,000 dinars on…

A: The scenarios presented highlight the application of Islamic finance principles in real estate…

Q: Mary's portfolio consists of two stocks. She invested $5,000 in BCD stock and $5,000 in EFG stock.…

A:

Q: Kwon Jewelers is evaluating a 1-year project that would involve an initial investment in equipment…

A: To calculate the net present value (NPV) of the project when Kwon Jewelers borrows $32,000 to pay…

Q: (Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 9 percent…

A: Par value: $1,000Coupon rate: 9%Maturity period: 15Price: $1125

Q: Suppose that the current rates on 60- and 120 - day GICs are 5.50% and 5.75%, respectively. An…

A: Expectations theory refers to the theory in finance that states that the yields on future securities…

Q: You have been hired to value a new 25-year, callable, convertible bond. The bond has a 7.10 percent…

A: Bond refers to the financial instruments issued by the bank or financial institutions for the funds…

Q: Emperor's Clothes Fashions can invest $7 million in a new plant for producing invisible makeup. The…

A: Sales price per jar = $2.70Variable cost per jar = $1.20Fixed costs = $2,100,000Opportunity cost of…

Q: The NASDAQ stock market bubble peaked at 4,865 in 2000. Two and a half years later it had fallen to…

A: The Nasdaq is an electronic stock exchange based in New York City. It's the second-largest stock…

Q: Help Chancellor Limited sells an asset with a $3.0 million fair value to Sophie Incorporated. Sophie…

A: Sale value (S) = $3,000,000Interest rate (r) = 0.06Number of payments (n) = 6Annual payment = ?Since…

Q: A bond has a $1,000 par value bond with a 4% annual coupon rate and it matures in 8 years. The…

A: Callable bonds are the type of bonds that can be redeemed before their maturity date. Not all bonds…

Q: You work as a loan officer for Auburn Bank. A couple has financed their mortgage with your bank. The…

A: To compute the amount of loan we can use PV(rate, nper, pmt) function of excel and value of the loan…

Q: Which of the following statements is correct? Credit spreads decrease with volatility Credit spreads…

A: The correct statement is: "Credit spreads increase with volatility.'' And the factor that is not…

Q: As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI…

A: A loan refers to a contract between two parties where money is forwarded by one party to the other…

Q: Returns for the Cabell's Company over the last 3 years are shown below. What's the standard…

A: Standard deviation quantifies the volatility in a stock's returns relative to its average return,…

Q: Yield to maturity The Salem Company bond currently sells for $1,213.45, has a coupon interest rate…

A: Given Data: Current Price 1213.45Coupon Rate15%Face Value1000Years (NPER)13

Q: Problem 14-02 What should be the prices of the following preferred stocks if comparable securities…

A: Price of the preferred stock = Present value of the future cash flowHere in case (a) , the preferred…

Q: For the cash flows shown, determine: (a) the number of possible i* values (b) the i* value displayed…

A: A time series of revenue and costs is provided. Use them to find the time series of net cash flow.…

Q: Using the FASB ASC, please answer the following questions. (a). The current guidance in the FASB…

A: (a) Cryptocurrency holdings should be classified as intangible assets on the balance sheet under…

Q: The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past…

A: Part A: Price of a 6-month Put Option To find the price of a 6-month put option using the…

Q: Consider four different stocks, all of which have a required return of 18.75 percent and a most…

A: The Dividend Discount Model (DDM) is a stock valuation technique that calculates a firm's intrinsic…

Q: Miller borrows $370,000 to be paid off in four years. The loan payments are semiannual with the…

A: Principal loan amount (P) = $370,000Semiannual interest rate (r) = 0.04 (i.e. 0.08 / 2)Semiannual…

Q: A firm is expected to grow at a rate of 5% per year in the next two years and slows down to 3% per…

A: The Dividend Discount Model (DDM) is a valuation method for determining a stock's intrinsic value…

Q: STEP: 2 of 2 Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$2.00 million…

A: As per the problem, we are required to compute the number of US dollars required to exchange the 2…

Q: On January 1, 2023, Resilient & Tough Company purchased bonds with a face amount of PS for…

A: Price of bond is present value of coupon payment plus present value of par value of the bond based…

Q: Compute the earnings after taxes for years 1 through 7 5. Compute the OCF for years 1 through 7 6.…

A: The idea employed in this issue is the capital budgeting approach, a procedure that businesses use…

Q: A proposed cost-saving device has an installed cost of $730,000. The device will be used in a…

A: Step 1: Calculate Annual Depreciation using MACRSYearMACRS Rate (%)Depreciation…

Q: Suppose you need $1,000 in one year and $2,000 more in two years. If you can earn 9%, how much do…

A: The objective of the question is to find out the present value of the future cash flows. In this…

Q: 5. On January 1, 2023, Crown Asia Company purchased bonds with face amount of P5,000,000 The bonds…

A: The price of a bond can be determined by taking the sum of the bond's present value of all the…

Q: Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. You are…

A: a) $170,000b) $195,000c)$220,000Explanation: Calculate the value of portfolio (net proceeds from the…

Q: You are analyzing the cost of debt for a firm. You know that the firm's 14-year maturity, 8.6…

A: YTM can be found by using the RATE function in the excel sheet where the NPER, PMT, price of the…

Q: A company is projected to generate free cash flows of $150 million next year and $210 million at the…

A: The following steps will be followed in order to get the share value:Terminal value will be…

Q: ABC's preferred stock has a par value of $100, a dividends rate of 5%, and a market price of $155;…

A: In case of paymentThe first payment is done to the debt holders of the company.So when company pays…

Q: Compute the FCF for years 1 through 7 8. Compute the NPV and IRR 9. Should the project be…

A: The procedures supplied must be followed in order to solve this issue, and the information provided…

Q: You run a construction firm. You have just won a contract to build a government office complex.…

A: The value of NPV is given in million The NPV of the opportunity cost is $3.63 million

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: To calculate the NPV (Net Present Value) of the project, we need to follow these steps:Calculate the…

Vijay

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of 50,000. First City has offered Hawley the alternatives listed here. Calculate the effective annual interest rate for each alternative. Which alternative has the lowest effective annual interest rate? a. A 12% annual rate on a simple interest loan, with no compensating balance required and interest due at the end of the year b. A 9% annual rate on a simple interest loan, with a 20% compensating balance required and interest due at the end of the year c. An 8.75% annual rate on a discounted loan, with a 15% compensating balance d. Interest figured as 8% of the 50,000 amount, payable at the end of the year, but with the loan amount repayable in monthly installments during the yearNow assume that it is several years later. The brothers are concerned about the firm’s current credit terms of net 30, which means that contractors buying building products from the firm are not offered a discount and are supposed to pay the full amount in 30 days. Gross sales are now running $1,000,000 a year, and 80% (by dollar volume) of the firm’s paying customers generally pay the full amount on Day 30; the other 20% pay, on average, on Day 40. Of the firm’s gross sales, 2% ends up as bad-debt losses. The brothers are now considering a change in the firm’s credit policy. The change would entail: (1) changing the credit terms to 2/10, net 20, (2) employing stricter credit standards before granting credit, and (3) enforcing collections with greater vigor than in the past. Thus, cash customers and those paying within 10 days would receive a 2% discount, but all others would have to pay the full amount after only 20 days. The brothers believe the discount would both attract additional customers and encourage some existing customers to purchase more from the firm—after all, the discount amounts to a price reduction. Of course, these customers would take the discount and hence would pay in only 10 days. The net expected result is for sales to increase to $1,100,000; for 60% of the paying customers to take the discount and pay on the 10th day; for 30% to pay the full amount on Day 20; for 10% to pay late on Day 30; and for bad-debt losses to fall from 2% to 1% of gross sales. The firm’s operating cost ratio will remain unchanged at 75%, and its cost of carrying receivables will remain unchanged at 12%. To begin the analysis, describe the four variables that make up a firm’s credit policy and explain how each of them affects sales and collections.The Patel Company has several financial issues to solve. As the company’s Financial Analyst you have been asked to answer the following 2 questions: Their bank will lend them $100,000 for 90 days at a cost of $1,200 interest. What is the company’s effective annual rate? A major supplier has granted credit terms of 1/10 N120. Assuming the company can borrow any amount of money at the rate you have calculated above (in part 1), should the company take the discount? (Your answer must be supported with a calculation of the cost of not taking the discount – using either simple or effective annual rate)

- You are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,500,000 for 90 days in order to purchase a large quantity of material at "closeout" prices. The interest rate for such loans at your bank, Rimrock Bank, is 15% using ordinary interest. What is the amount (in $) of interest on this loan? After making a few "shopping" calls, you find that Southside National Bank will lend at 15% using exact interest. What is the amount (in $) of interest on this offer? (Round your answer to two decimal places.) So that it can keep your business, Rimrock Bank has offered a loan at 14.5% using ordinary interest. What is the amount (in $) of interest on this offer? (Challenge) If Southside National wants to compete with Rimrock's last offer (part c) by charging $1,375 less interest, what rate (as a %), rounded to the nearest hundredths of a percent, must it quote using exact interest?You are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,100,000 for 90 days in order to purchase a large quantity of material at "closeout" prices. The interest rate for such loans at your bank, Rimrock Bank, is 15% using ordinary interest. What is the amount (in $) of interest on this loan? After making a few "shopping" calls, you find that Southside National Bank will lend at 15% using exact interest. What is the amount (in $) of interest on this offer So that it can keep your business, Rimrock Bank has offered a loan at 14.5% using ordinary interest. What is the amount (in $) of interest on this offer? (Challenge) If Southside National wants to compete with Rimrock's last offer (part c) by charging $1,875 less interest, what rate (as a %), rounded to the nearest hundredths of a percent, must it quote using exact interest?A merchant buys a bill of goods requiring the payment of $1,500 at the end of 180 days. He is offered a 5% discount for cash in 30 days.What is the highest rate at which he could afford to borrow money in order to take advantage of the discount?

- You are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,500,000 for 90 days in order to purchase a large quantity of material at "closeout" prices. The interest rate for such loans at your bank, Rimrock Bank, is 15% using ordinary interest. (a) What is the amount (in $) of interest on this loan? (b) After making a few "shopping" calls, you find that Southside National Bank will lend at 15% using exact interest. What is the amount (in $) of interest on this offer? (Round your answer to two decimal places.) (c) So that it can keep your business, Rimrock Bank has offered a loan at 14.5% using ordinary interest. What is the amount (in $) of interest on this offer? (d) (Challenge) If Southside National wants to compete with Rimrock's last offer (part c) by charging $1,375 less interest, what rate (as a %), rounded to the nearest hundredths of a percent, must it quote using exact interest?A small businessman is about to acquire a machine whose price is $ 15,000 with VAT included. If the cash purchase obtains a 15% discount, if you purchase it on credit you must pay an initial installment equivalent to 25% and the balance in six installments, with a grace period of one month without interest payment and the rest with a 3.8 % monthly. It asks:to. Payment in cash,b. The installment to pay on creditc. The total amount paid on creditA firm is offered credit terms of 2/10 net 45 by most of its suppliers. The firm also has a credit line available at a local bank at an interest rate of 12 percent. What is the cost of giving up the cash discount? Should the company take the cash discount or finance the purchase with the line of credit?

- A merchant buys a bill of goods requiring the payment of 1500php at the end of 180 days. He is offered a 5% discount for cash in 30 days. What is the highest rate at which he could afford to borrow money in order to take advantage of the discount?João, owner of a small clothing store, found that his company's cash needed funds in the form of money so that his employees' salary commitments could be settled. So the alternative he had at the moment was the discount of duplicates at a bank branch. The amount required for the payment of employees is $35,000.00, the amount held in duplicates is $42,000.00 with a maturity of 60 days. The bank is charging a discount rate of 60% per year. Will John be able to pay the employees? What is the annual interest rate charged by the bank?You are the owner of four Taco Bell restaurant locations. You have a business loan with Citizens Bank taken out 60 days ago that is due in 90 days. The amount of the loan is $50,000, and the rate is 9.5% using ordinary interest. You currently have some excess cash. You have the choice of sending Citizens $35,000 now as a partial payment on your loan or purchasing an additional $35,000 of serving supplies such as food containers, cups, and plastic dinnerware for your inventory at a special discount price that is "10% off" your normal cost of these items. (a) How much interest (in $) will you save on this loan if you make the partial payment and don't purchase the additional serving supplies? (Round your answer to two decimal places.) (b) How much (in $) will you save by purchasing the discounted serving supplies and not making the partial payment? (Hint: Find the difference of the savings on the supplies and the potential savings on the loan found in part (a). Round your…