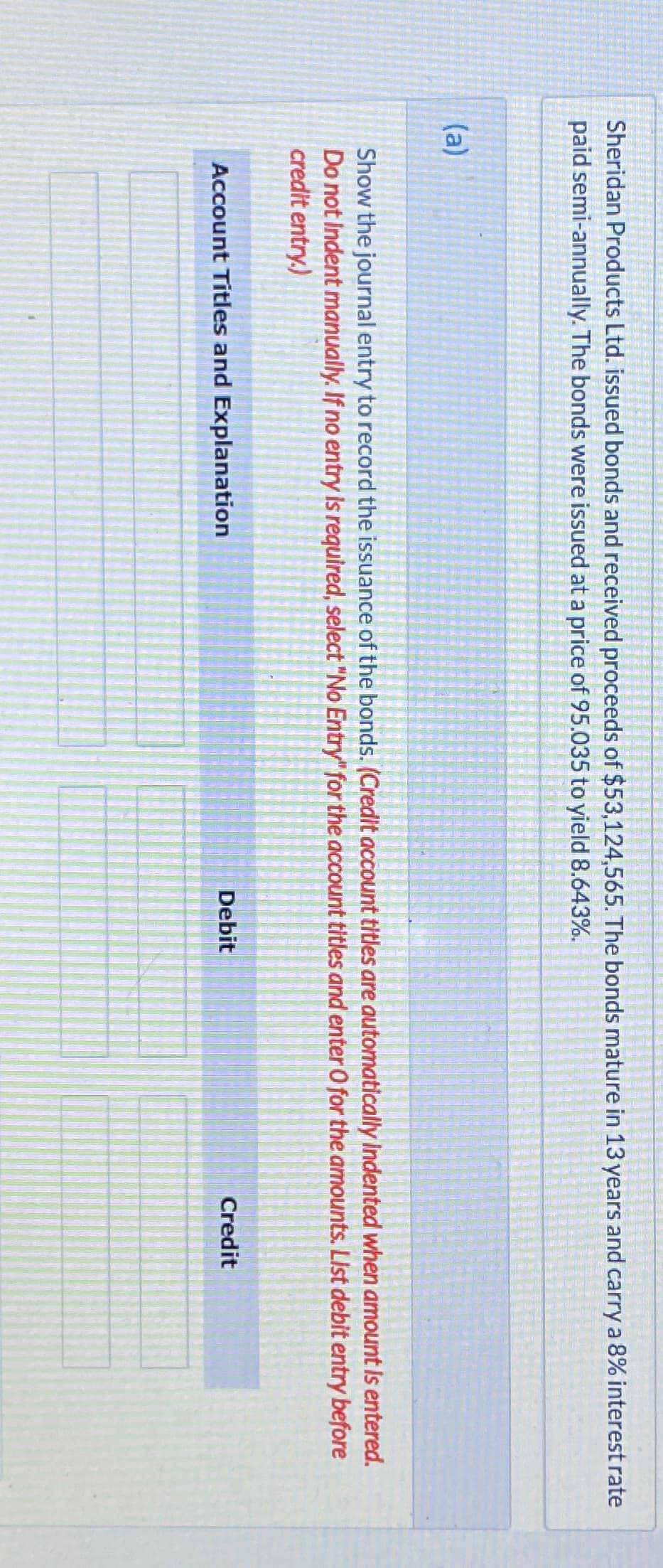

Sheridan Products Ltd. issued bonds and received proceeds of $53,124,565. The bonds mature in 13 years and carry a 8% interest rate paid semi-annually. The bonds were issued at a price of 95.035 to yield 8.643%. (a) Show the journal entry to record the issuance of the bonds. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Credit

Sheridan Products Ltd. issued bonds and received proceeds of $53,124,565. The bonds mature in 13 years and carry a 8% interest rate paid semi-annually. The bonds were issued at a price of 95.035 to yield 8.643%. (a) Show the journal entry to record the issuance of the bonds. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Credit

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Transcribed Image Text:Sheridan Products Ltd. issued bonds and received proceeds of $53,124,565. The bonds mature in 13 years and carry a 8% interest rate

paid semi-annually. The bonds were issued at a price of 95.035 to yield 8.643%.

(a)

Show the journal entry to record the issuance of the bonds. (Credit account titles are automatically Indented when amount is entered.

Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before

credit entry.)

Account Titles and Explanation

Debit

Credit

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning