B C M&S Partnership 1a Gross receipts Gross receipts or sales 534.410 b Less returns and allowances Cost of goods sold (attach Form 1125-A) Account Trial Balance December 31, 2023 Debit Credit Cash 23,140 Income Accounts and notes receivable 29,480 Furniture 68,910 8 Accumulated depreciation-furniture Prepaid assets 6,750 2,660 Long-term notes payable 14,700 Accounts payable 8,010 Other accrued current liabilities Stephanie Mulder, Capital 4,370 114,400 Stephanie Mulder, Drawing 22,840 53,550 Juan Scully, Drawing Sales 5,330 X 534,410 Sales returns and allowances 6,480 8,260 Business interest expense Partners' salaries 370,810 560 Deductions (see instructions for limitations) Gross profit. Subtract line 2 from line 1c. Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schedule F (Form 1040)) Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) Other income (loss) (attach statement) Total income (loss). Combine lines 3 through 7 Salaries and and wages (other than to partners) (less employment credits) Guaranteed payments to partners Repairs and maintenance 8.260 c Balance 1c 525.880 2 3 5 6 X 134,300 26,770 Rent expense 13,020 Supplies expense 7,720 Depreciation expense 6,750 Property taxes on business property 570 Payroll taxes 7,030 Delivery expense 4,430 Tax and Payment Bad debt expense 1,370 8 У 26.770 10 134.300 10 10 ન 11 11 12 12 Bad debts 12 12 13.020 13 Rent 13 14 Taxes and licenses 15 15 Interest (see instructions) 14 15 16a Depreciation (if required, attach Form 4562). bless 16a 17 Less depreciation reported on Form 1125-A and elsewhere on return Depletion (Do not deduct oil and gas depletion.) 16b 16c 17 18 Retirement plans, etc. 18 10 19 19 Employee benefit programs 19 20 Energy efficient commercial buildings deduction (attach Form 7205). 20 20 21 Other deductions (attach statement) 21 22 23 23 Total deductions. Add the amounts shown in the far right column for lines 9 through 21 Ordinary business income (loss). Subtract line 22 from line 8 22 02 23 24 25 26 BBA AAR imputed underpayment (see instructions) Interest due under the look-back method-completed long-term contracts (attach Form 8697) Interest due under the look-back method-income forecast method (attach Form 8866) BRA AAR imputed und 24 25 26 Other 27 Other taxes (see instructions) 27 28 Total balance due. Add lines 24 through 27 28 29 Elective payment election amount from Form 3800 29 30 Payment (see instructions) 30 31 32 Amount owed. If the sum of line 29 and line 30 is smaller than line 28, enter amount owed Overpayment. If the sum of line 29 and line 30 is larger than 31 28, enter overpayment 32 Store expenses 5,590 Advertising expense 5,970 Sign Taxable interest income 440 Here Charitable contributions Total 1,160 744,890 744,890 Signature of partner or limited liability company member Print/Type preparer's name Preparer's signature Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. Paid Preparer Use Only Firm's name Firm's address May the IRS discuss this return with the preparer shown below? See instructions. Yes No PTIN Check if self-employed Firm's EIN Phone no. Date Date On January 3, 2023, Stephanie Mulder (SSN 299-84-1945) and Juan Scully formed M&S general partnership (EIN 31-1204102). Mulder and Scully operate a business that sells various types of merchandise (business code 452300) at 1997 Twilight Street, Fairbanks, Alaska 99706. To form the partnership, each partner contributed an amount equal to their capital accounts on the trial balance. The agreement provides that Stephanie will participate in the partnership on a full-time basis and Juan on a part-time basis. The agreement further provides that Stephanie and Juan will receive guaranteed annual payments of $107,440 and $26,860, respectively. The remaining profits go 75% to Stephanie and 25% to Juan. Stephanie is the designated Partnership Representative. Her address is 1991 Anderson Way, Fairbanks, AK 99706. The accountant prepared the trial balance after all necessary adjustments with two exceptions. First, total inventory purchases during the year are shown on the trial balance. A physical inventory taken at the end of the year shows $60,260 of inventory. Second, the partners' capital accounts reflect the contributions the partners made in the first year and are not adjusted. The partners" "Drawings" accounts represent distributions above their respective guaranteed payments. The interest income is on an investment account. The partnership uses the accrual method of accounting. Worthless accounts were written off directly to bad debt expense during the year. The furniture was purchased on January 4, 2023. The partnership calculates depreciation using MACRS. The furniture was the only personal property purchased during 2023. The partnership does not elect Section 179 or bonus depreciation. Book depreciation is reported on the trial balance and is based on a different method than MACRS. On October 3, 2023, the partnership sold 50 shares of common stock in ZMT Corporation for a gain as stated on the trial balance. It purchased the stock for $2,700 on March 29, 2023. Juan Scully, Capital Gain on sale of stock Purchases Office and store salaries Trial Balance + eady Accessibility: Investigate For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11390Z Form 1065 (2023)

B C M&S Partnership 1a Gross receipts Gross receipts or sales 534.410 b Less returns and allowances Cost of goods sold (attach Form 1125-A) Account Trial Balance December 31, 2023 Debit Credit Cash 23,140 Income Accounts and notes receivable 29,480 Furniture 68,910 8 Accumulated depreciation-furniture Prepaid assets 6,750 2,660 Long-term notes payable 14,700 Accounts payable 8,010 Other accrued current liabilities Stephanie Mulder, Capital 4,370 114,400 Stephanie Mulder, Drawing 22,840 53,550 Juan Scully, Drawing Sales 5,330 X 534,410 Sales returns and allowances 6,480 8,260 Business interest expense Partners' salaries 370,810 560 Deductions (see instructions for limitations) Gross profit. Subtract line 2 from line 1c. Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schedule F (Form 1040)) Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) Other income (loss) (attach statement) Total income (loss). Combine lines 3 through 7 Salaries and and wages (other than to partners) (less employment credits) Guaranteed payments to partners Repairs and maintenance 8.260 c Balance 1c 525.880 2 3 5 6 X 134,300 26,770 Rent expense 13,020 Supplies expense 7,720 Depreciation expense 6,750 Property taxes on business property 570 Payroll taxes 7,030 Delivery expense 4,430 Tax and Payment Bad debt expense 1,370 8 У 26.770 10 134.300 10 10 ન 11 11 12 12 Bad debts 12 12 13.020 13 Rent 13 14 Taxes and licenses 15 15 Interest (see instructions) 14 15 16a Depreciation (if required, attach Form 4562). bless 16a 17 Less depreciation reported on Form 1125-A and elsewhere on return Depletion (Do not deduct oil and gas depletion.) 16b 16c 17 18 Retirement plans, etc. 18 10 19 19 Employee benefit programs 19 20 Energy efficient commercial buildings deduction (attach Form 7205). 20 20 21 Other deductions (attach statement) 21 22 23 23 Total deductions. Add the amounts shown in the far right column for lines 9 through 21 Ordinary business income (loss). Subtract line 22 from line 8 22 02 23 24 25 26 BBA AAR imputed underpayment (see instructions) Interest due under the look-back method-completed long-term contracts (attach Form 8697) Interest due under the look-back method-income forecast method (attach Form 8866) BRA AAR imputed und 24 25 26 Other 27 Other taxes (see instructions) 27 28 Total balance due. Add lines 24 through 27 28 29 Elective payment election amount from Form 3800 29 30 Payment (see instructions) 30 31 32 Amount owed. If the sum of line 29 and line 30 is smaller than line 28, enter amount owed Overpayment. If the sum of line 29 and line 30 is larger than 31 28, enter overpayment 32 Store expenses 5,590 Advertising expense 5,970 Sign Taxable interest income 440 Here Charitable contributions Total 1,160 744,890 744,890 Signature of partner or limited liability company member Print/Type preparer's name Preparer's signature Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. Paid Preparer Use Only Firm's name Firm's address May the IRS discuss this return with the preparer shown below? See instructions. Yes No PTIN Check if self-employed Firm's EIN Phone no. Date Date On January 3, 2023, Stephanie Mulder (SSN 299-84-1945) and Juan Scully formed M&S general partnership (EIN 31-1204102). Mulder and Scully operate a business that sells various types of merchandise (business code 452300) at 1997 Twilight Street, Fairbanks, Alaska 99706. To form the partnership, each partner contributed an amount equal to their capital accounts on the trial balance. The agreement provides that Stephanie will participate in the partnership on a full-time basis and Juan on a part-time basis. The agreement further provides that Stephanie and Juan will receive guaranteed annual payments of $107,440 and $26,860, respectively. The remaining profits go 75% to Stephanie and 25% to Juan. Stephanie is the designated Partnership Representative. Her address is 1991 Anderson Way, Fairbanks, AK 99706. The accountant prepared the trial balance after all necessary adjustments with two exceptions. First, total inventory purchases during the year are shown on the trial balance. A physical inventory taken at the end of the year shows $60,260 of inventory. Second, the partners' capital accounts reflect the contributions the partners made in the first year and are not adjusted. The partners" "Drawings" accounts represent distributions above their respective guaranteed payments. The interest income is on an investment account. The partnership uses the accrual method of accounting. Worthless accounts were written off directly to bad debt expense during the year. The furniture was purchased on January 4, 2023. The partnership calculates depreciation using MACRS. The furniture was the only personal property purchased during 2023. The partnership does not elect Section 179 or bonus depreciation. Book depreciation is reported on the trial balance and is based on a different method than MACRS. On October 3, 2023, the partnership sold 50 shares of common stock in ZMT Corporation for a gain as stated on the trial balance. It purchased the stock for $2,700 on March 29, 2023. Juan Scully, Capital Gain on sale of stock Purchases Office and store salaries Trial Balance + eady Accessibility: Investigate For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11390Z Form 1065 (2023)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:B

C

M&S Partnership

1a

Gross receipts

Gross receipts or sales

534.410 b Less returns and allowances

Cost of goods sold (attach Form 1125-A)

Account

Trial Balance December 31, 2023

Debit

Credit

Cash

23,140

Income

Accounts and notes receivable

29,480

Furniture

68,910

8

Accumulated depreciation-furniture

Prepaid assets

6,750

2,660

Long-term notes payable

14,700

Accounts payable

8,010

Other accrued current liabilities

Stephanie Mulder, Capital

4,370

114,400

Stephanie Mulder, Drawing

22,840

53,550

Juan Scully, Drawing

Sales

5,330

X

534,410

Sales returns and allowances

6,480

8,260

Business interest expense

Partners' salaries

370,810

560

Deductions (see instructions for limitations)

Gross profit. Subtract line 2 from line 1c.

Ordinary income (loss) from other partnerships, estates, and trusts (attach statement)

Net farm profit (loss) (attach Schedule F (Form 1040))

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797)

Other income (loss) (attach statement)

Total income (loss). Combine lines 3 through 7

Salaries and

and wages (other than to partners) (less employment credits)

Guaranteed payments to partners

Repairs and maintenance

8.260 c Balance

1c

525.880

2

3

5

6

X

134,300

26,770

Rent expense

13,020

Supplies expense

7,720

Depreciation expense

6,750

Property taxes on business property

570

Payroll taxes

7,030

Delivery expense

4,430

Tax and Payment

Bad debt expense

1,370

8

У

26.770

10

134.300

10

10

ન

11

11

12

12 Bad debts

12

12

13.020

13

Rent

13

14

Taxes and licenses

15

15

Interest (see instructions)

14

15

16a Depreciation (if required, attach Form 4562).

bless

16a

17

Less depreciation reported on Form 1125-A and elsewhere on return

Depletion (Do not deduct oil and gas depletion.)

16b

16c

17

18

Retirement plans, etc.

18

10

19

19

Employee benefit programs

19

20

Energy efficient commercial buildings deduction (attach Form 7205).

20

20

21

Other deductions (attach statement)

21

22

23

23

Total deductions. Add the amounts shown in the far right column for lines 9 through 21

Ordinary business income (loss). Subtract line 22 from line 8

22

02

23

24

25

26

BBA AAR imputed underpayment (see instructions)

Interest due under the look-back method-completed long-term contracts (attach Form 8697)

Interest due under the look-back method-income forecast method (attach Form 8866)

BRA AAR imputed und

24

25

26

Other

27

Other taxes (see instructions)

27

28

Total balance due. Add lines 24 through 27

28

29

Elective payment election amount from Form 3800

29

30

Payment (see instructions)

30

31

32

Amount owed. If the sum of line 29 and line 30 is smaller than line 28, enter amount owed

Overpayment. If the sum of line 29 and line 30 is larger than

31

28, enter overpayment

32

Store expenses

5,590

Advertising expense

5,970

Sign

Taxable interest income

440

Here

Charitable contributions

Total

1,160

744,890

744,890

Signature of partner or limited liability company member

Print/Type preparer's name

Preparer's signature

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of

which preparer has any knowledge.

Paid

Preparer

Use Only

Firm's name

Firm's address

May the IRS discuss this return

with the preparer shown below?

See instructions. Yes No

PTIN

Check if

self-employed

Firm's EIN

Phone no.

Date

Date

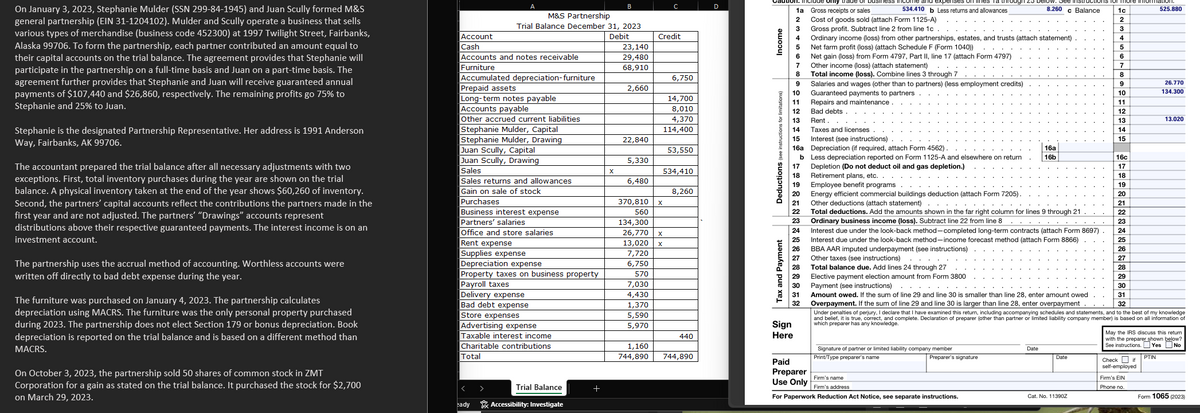

On January 3, 2023, Stephanie Mulder (SSN 299-84-1945) and Juan Scully formed M&S

general partnership (EIN 31-1204102). Mulder and Scully operate a business that sells

various types of merchandise (business code 452300) at 1997 Twilight Street, Fairbanks,

Alaska 99706. To form the partnership, each partner contributed an amount equal to

their capital accounts on the trial balance. The agreement provides that Stephanie will

participate in the partnership on a full-time basis and Juan on a part-time basis. The

agreement further provides that Stephanie and Juan will receive guaranteed annual

payments of $107,440 and $26,860, respectively. The remaining profits go 75% to

Stephanie and 25% to Juan.

Stephanie is the designated Partnership Representative. Her address is 1991 Anderson

Way, Fairbanks, AK 99706.

The accountant prepared the trial balance after all necessary adjustments with two

exceptions. First, total inventory purchases during the year are shown on the trial

balance. A physical inventory taken at the end of the year shows $60,260 of inventory.

Second, the partners' capital accounts reflect the contributions the partners made in the

first year and are not adjusted. The partners" "Drawings" accounts represent

distributions above their respective guaranteed payments. The interest income is on an

investment account.

The partnership uses the accrual method of accounting. Worthless accounts were

written off directly to bad debt expense during the year.

The furniture was purchased on January 4, 2023. The partnership calculates

depreciation using MACRS. The furniture was the only personal property purchased

during 2023. The partnership does not elect Section 179 or bonus depreciation. Book

depreciation is reported on the trial balance and is based on a different method than

MACRS.

On October 3, 2023, the partnership sold 50 shares of common stock in ZMT

Corporation for a gain as stated on the trial balance. It purchased the stock for $2,700

on March 29, 2023.

Juan Scully, Capital

Gain on sale of stock

Purchases

Office and store salaries

Trial Balance

+

eady

Accessibility: Investigate

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11390Z

Form 1065 (2023)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning