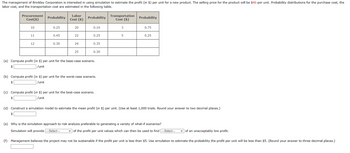

The management of Brinkley Corporation is interested in using simulation to estimate the profit (in $) per unit for a new product. The selling price for the product will be $46 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated in the following table. Procurement Cost($) Probability Labor Cost ($) Probability Transportation Cost ($) Probability 10 0.25 20 0.10 3 0.75 11 0.45 22 0.25 5 0.25 12 0.30 24 0.35 25 0.30 (a) Compute profit (in $) per unit for the base-case scenario. $ /unit (b) Compute profit (in $) per unit for the worst-case scenario. /unit (c) Compute profit (in $) per unit for the best-case scenario. /unit (d) Construct a simulation model to estimate the mean profit (in $) per unit. (Use at least 1,000 trials. Round your answer to two decimal places.) (e) Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios? Simulation will provide ---Select--- of the profit per unit values which can then be used to find ---Select--- of an unacceptably low profit. (f) Management believes the project may not be sustainable if the profit per unit is less than $5. Use simulation to estimate the probability the profit per unit will be less than $5. (Round your answer to three decimal places.)

The management of Brinkley Corporation is interested in using simulation to estimate the profit (in $) per unit for a new product. The selling price for the product will be $46 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated in the following table. Procurement Cost($) Probability Labor Cost ($) Probability Transportation Cost ($) Probability 10 0.25 20 0.10 3 0.75 11 0.45 22 0.25 5 0.25 12 0.30 24 0.35 25 0.30 (a) Compute profit (in $) per unit for the base-case scenario. $ /unit (b) Compute profit (in $) per unit for the worst-case scenario. /unit (c) Compute profit (in $) per unit for the best-case scenario. /unit (d) Construct a simulation model to estimate the mean profit (in $) per unit. (Use at least 1,000 trials. Round your answer to two decimal places.) (e) Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios? Simulation will provide ---Select--- of the profit per unit values which can then be used to find ---Select--- of an unacceptably low profit. (f) Management believes the project may not be sustainable if the profit per unit is less than $5. Use simulation to estimate the probability the profit per unit will be less than $5. (Round your answer to three decimal places.)

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately, your question violates our terms of use. Try rephrasing your question or asking a new one below. We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:The management of Brinkley Corporation is interested in using simulation to estimate the profit (in $) per unit for a new product. The selling price for the product will be $46 per unit. Probability distributions for the purchase cost, the

labor cost, and the transportation cost are estimated in the following table.

Procurement

Cost($)

Probability

Labor

Cost ($)

Probability

Transportation

Cost ($)

Probability

10

0.25

20

0.10

3

0.75

11

0.45

22

0.25

5

0.25

12

0.30

24

0.35

25

0.30

(a) Compute profit (in $) per unit for the base-case scenario.

$

/unit

(b) Compute profit (in $) per unit for the worst-case scenario.

/unit

(c) Compute profit (in $) per unit for the best-case scenario.

/unit

(d) Construct a simulation model to estimate the mean profit (in $) per unit. (Use at least 1,000 trials. Round your answer to two decimal places.)

(e) Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios?

Simulation will provide ---Select---

of the profit per unit values which can then be used to find ---Select---

of an unacceptably low profit.

(f) Management believes the project may not be sustainable if the profit per unit is less than $5. Use simulation to estimate the probability the profit per unit will be less than $5. (Round your answer to three decimal places.)

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,