College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4PA

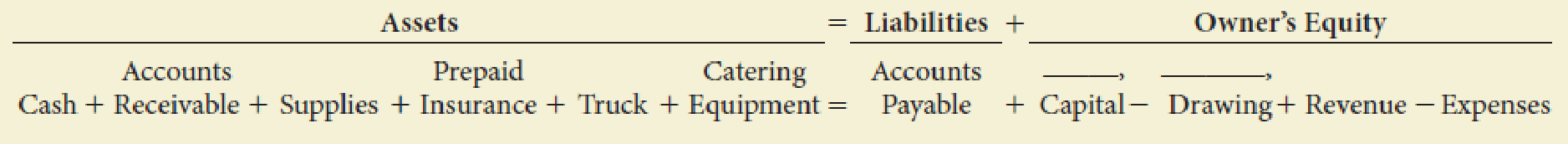

On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow.

- a. Gervais deposited $25,000 in a bank account in the name of the business.

- b. Bought a truck from Kelly Motors for $26,329, paying $8,000 in cash and placing the balance on account, Ck. No. 500.

- c. Bought catering equipment on account from Luigi’s Equipment, $3,795.

- d. Paid the rent for the month, $1,255, Ck. No. 501 (Rent Expense).

- e. Bought insurance for the truck for one year, $400, Ck. No. 502.

- f. Sold catering services for cash for the first half of the month, $3,012 (Catering Income).

- g. Bought supplies for cash, $185, Ck. No. 503.

- h. Sold catering services on account, $4,307 (Catering Income).

- i. Received and paid the heating bill, $248, Ck. No. 504 (Utilities Expense).

- j. Received a bill from GC Gas and Lube for gas and oil for the truck, $128 (Gas and Oil Expense).

- k. Sold catering services for cash for the remainder of the month, $2,649 (Catering Income).

- l. Gervais withdrew cash for personal use, $1,550, Ck. No. 505.

- m. Paid the salary of the assistant, $1,150, Ck. No. 506 (Salary Expense).

Required

- 1. In the equation, write the owner’s name above the terms Capital and Drawing.

- 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses.

- 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

S. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:-

2020

July 3 He purchases shop fittings for sh. 2,500 and pays by cheque.

July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000.

July 6 He buys stock for Sh. 1,500 and pays through bank.

July 8 He sells goods for cash Sh.1,000.

July 10 Buys goods on credit from XY & Co. for Sh. 1,200

July 12 Sells goods to A. Smith for Sh. 900 on credit

July 13 Pays wages Sh. 120 by cash

July 14 A. Smith returns goods worth Sh. 200

July 15 Pays to AB & Co. Sh. 3,000 by cheque

July 17 Goods returned to XY & Co. amounting to Sh. 350

July 21 Receives from A. Smith a cheque for Sh. 700

July 25 Sells goods for cash Sh. 300.

July 30…

S. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:-

2020

July 3 He purchases shop fittings for sh. 2,500 and pays by cheque.

July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000.

July 6 He buys stock for Sh. 1,500 and pays through bank.

July 8 He sells goods for cash Sh.1,000.

July 10 Buys goods on credit from XY & Co. for Sh. 1,200

July 12 Sells goods to A. Smith for Sh. 900 on credit

July 13 Pays wages Sh. 120 by cash

July 14 A. Smith returns goods worth Sh. 200

July 15 Pays to AB & Co. Sh. 3,000 by cheque

July 17 Goods returned to XY & Co. amounting to Sh. 350

July 21 Receives from A. Smith a cheque for Sh. 700

July 25 Sells goods for cash Sh. 300.

July 30…

Rick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - Prob. 1PBCh. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - Prob. 3PBCh. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forwardMs. Sara has started a Furniture Manufacturing Company and opened a Business bank account in Bank Muscat and every month end he checks his Cash book maintained by his accountant Mr. Ali in the company with the Bank book maintained by the banker. His Cash Book balance on 31st December 2019, was OMR 22,500, this did not agree with the balance as shown by the Bank Pass Book. In order to know why the balances are not equal in cash book and Bank book Sara asked his accountant Mr. Ali to do detail Examination of the Cash Book and Bank Statement. It reveals that the company has paid into bank on 26th December, four cheques of OMR 7,000; OMR 10,000; OMR 2,000 and OMR 13,000; of these the cheque of OMR 2,000 was credited in January 2020.Sara has invested money in shares of Al Maha Company and the bank has collected dividends and Credited in Bank Book, but not debited in Cash Book OMR 1,750.The Bank has debited Bank Charges in Bank book, not entered in Cash Book OMR 100.As per the instructions…arrow_forward

- JECAF Convenience Store: Sole Proprietorship John Emmanuel is the owner of JECAF Convenience Store. The store was established on January 2, 20Z1. John Emmanuel deposited P50,000 to a bank account in the name of JECAF Convenience Store. HE made four more deposits of P3,000 each during the year from his personal account. The store generated net income of P63,435 in 20Z1. John Emmanuel regularly withdraws P1,000 per month from the store’s bank account for his personal use. Requirements: 1. Determine the 20Z1 year-end balance of the John Emmanuel, Drawings account. 2. Prepare a Statement of Changes in Equity for the year ended December 31, 20Z1.arrow_forwardValley Hardware (Mr. M. Jordan is the sole proprietor) established a petty cash fund on January 1, 2018. A cheque for $400 payable to cash was given to Kate, the petty cashier, who went to the bank and brought back $400 and put it in the petty cash box. The following transactions were completed during January. Jan 1 Purchased business cards for $36 (this business records office supplies as expenses upon purchase) Jan 10 Paid $60 for repairs to the office photocopier Jan 15 Paid $66 COD charges on merchandise to be resold to customers (the business uses the periodic inventory system) Jan 15 Purchased paper for the printer, $37 Jan 20 Paid $45 for an advertisement in the local January newspaper Jan 25 M. Jordan took $90 from the cash box to pay for a personal gift for his mother Jan 26 Paid $40 delivery charges on merchandise inventory sold to a customer Jan 28 Paid $16 for stamps used for mailing cheques to its suppliers. The money in the petty cash box was counted…arrow_forwardB. Mr. Abdullah formed Al-Noor Enterprises on February 2021. During the month, the following financial transactions occurred: Review and find the mistake of the following transactions which is recorded in general journal and rewrite them. 2021, February 10 Paid the month's rent OR 700 16 Withdrew OR 10,000 for personal use. 23 Collected OR 9,000 from Bahwan Company. 28 Sold goods for cash - OMR 15,000 Al-Noor Enterprises for January Date Particulars Ref. Debit Credit 2020 Feb. 11 Rent Expense 700 Cash 700 16 Abdullah, Withdrawal 10,000 Expense 10,000 10,000 Cash Accounts Payable 23 10,000 30 Sales 15,000 Cash 15,000arrow_forward

- In order to produce a set of accounts for a business, the total sales and purchases must be known. A business can often provide details of cash sales and purchases. In order to find the total credit sales and credit purchases, control accounts can be used. Elizabeth Berry provided the following information: At the beginning of the financial year debtors were £5,610. During the year receipts from debtors amounted to £69,630. At the end of the year debtors owed her £7,710. We can find the total credit sales by constructing a control account.arrow_forwardCreate journal entries for sage 50. ? 1.The owner Jasmine, had the bank transfer (by the bank memo) $20000 from the personal savings account to the business bank account to start the business. 2. Negotiated a 5-year bank loan of $40000 at an annual interest rate of 9.50% with Loyal Bank. The money was deposited in the bank account today. 3.Received invoice 402 for $1200 plus HST from Captain Insurance, for a one-year business Insurance Policy, commencing Aug 1, 2018. Issued cheque #1001 to pay this invoice.arrow_forwardKindly answer in good accounting form. Also show journal entries. On January 01, 2020 Kitkat Company, Inc. establishes a branch in Buang.During the year, Kitkat Inc. transfers cash and merchandise to the branchworth P15,000 and P45,000 respectively. Freight was paid by the homeoffice worth P1,500 included in the cost of merchandise. The home officealso incurred P5,700 expenses of which 30 percent was allocated to thebranch. On December 31, 2020, the branch incurred a loss of P4,000. What is the balance of the branch account as per home office booksarrow_forward

- Pita purchased a small roadside inn in April with inheritance money he received from his wealthy aunt. Help him prepare his T accounts for his first month of operations using the information provided. a. Pita invested P5,000,000 cash in the inn.Cash Owners’ Equityb. Pita purchased a P50,000 point of sale (POS) system with P5,000 cash and P45,000 notes payable.Cash POS system Notes Payablec. Pita generated P75,000 in revenues with P52,000 cash and P23,000 accounts receivable.Cash Accounts Receivable Revenuesd. Pita paid utilities of P750 in cash.Cash Utilities Expensearrow_forwardChulu own a retail shop. The following information is available from the few records kept for the beginning and end of 2020. 1 January 31 December K K Cash in shop till 350 250 Bank overdraft 800 300 Inventory 2,600 3,300 Owed by customers 4,500…arrow_forwardArnina established a service business to be known as Arnina Photography on July 1, 2021. During the first month, the following transactions occurred: July 1: Arnina transferred cash of P300,000 from her personal bank account to an account to be used for her business. She also invested the following: digital camera, P45,000; manual camera, P25,000; desktop computer, P28,000; photo papers and ink, P14,000. July 4: paid six-month advance rent to Cyrene Commercial Complex, P30,000 July 6: Received a statement of account from Brian News for advertising this month, P5,500. July 8: Bought photo enhancing and editing equipment from Mirzi Outlet for P40,000. Arnina paid 30% down payment and the balances on account. July 12: Hired office assistant with a monthly salary of P6,000. The office assistant officially started on July 16, 2014. July 13: Photography services rendered totaled P180,000. Terms 25% cash and the balance settled on account. July 14: Purchased office sofa set from Renzo…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY