Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10.1WUE

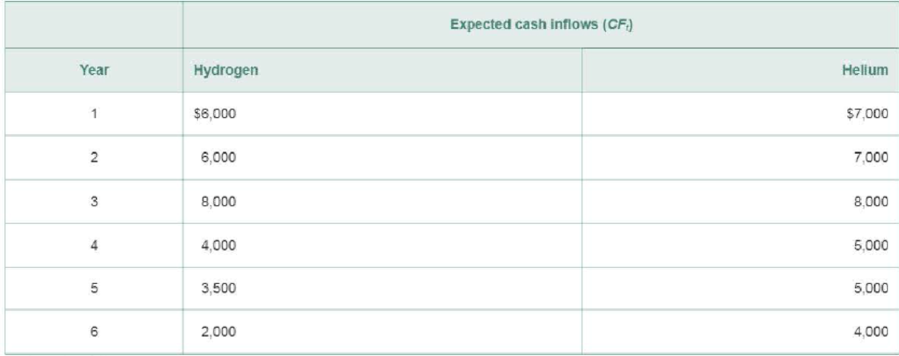

Elysian Fields Inc. uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $25,000; project Helium requires an initial outlay of $35,000. Using the expected

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $26,000; project Helium requires an

initial outlay of $35,000. Using the expected cash inflows given for each project in the following table, E, calculate each project's payback period. Which project meets Elysian's standards?

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of

$34,000. Using the expected cash inflows given for each project in the following table, . calculate each project's payback period. Which project meets Elysian's standards?

The payback period of project Hydrogen isOyears. (Round to two decimal places.)

i Data Table

(Cick on the icon here e in order to copy the contents of the data table below

into a spreadsheet.)

Expected cash inflows

Hydrogen

Year

Helium

$6,500

$8,000

$5,000

$8,500

$8,000

$7,000

2

3

$3,000

$4,500

$3,500

$5,000

6

$2,500

$4,000

Print

Done

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $30,000; project Helium requires an

initial outlay of $34,000. Using the expected cash inflows given for each project in the following table, E, calculate each project's payback period. Which project meets Elysian's standards?

The payback period of project Hydrogen is

years. (Round to two decimal places.)

Data Table

(Click on the icon here D in order to copy the contents of the data table below

into a spreadsheet.)

Expected cash inflows

Year

Hydrogen

$7,000

$5,500

$8,000

$4,000

$4,000

$2,500

Helium

$7,000

$8,000

$7,000

$5,000

$6,000

$4,500

1

3

4

5

Print

Done

Chapter 10 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 10.1 - What is the financial managers goal in selecting...Ch. 10.2 - What is the payback period? How is it calculated?Ch. 10.2 - What weaknesses are commonly associated with the...Ch. 10.3 - How is the net present value (NPV) calculated for...Ch. 10.3 - Prob. 10.5RQCh. 10.3 - Prob. 10.6RQCh. 10.4 - Prob. 10.8RQCh. 10.4 - Prob. 10.9RQCh. 10.4 - Prob. 10.10RQCh. 10.5 - How is a net present value profile used to compare...

Ch. 10.5 - Prob. 10.13RQCh. 10 - Prob. 1ORCh. 10 - All techniques with NPV profile: Mutually...Ch. 10 - Elysian Fields Inc. uses a maximum payback period...Ch. 10 - Prob. E10.1WUECh. 10 - Prob. 10.2WUECh. 10 - Prob. E10.2WUECh. 10 - Axis Corp. is considering investment in the best...Ch. 10 - Prob. E10.3WUECh. 10 - Prob. 10.4WUECh. 10 - Prob. E10.4WUECh. 10 - Cooper Electronics uses NPV profiles to visually...Ch. 10 - Prob. E10.5WUECh. 10 - Payback period The Ball Shoe Company is...Ch. 10 - Payback comparisons Nova Products has a 5-year...Ch. 10 - Prob. 10.3PCh. 10 - Long-term investment decision, payback method Bill...Ch. 10 - Prob. 10.5PCh. 10 - Prob. 10.6PCh. 10 - Prob. 10.7PCh. 10 - Prob. 10.8PCh. 10 - Prob. 10.9PCh. 10 - Prob. 10.10PCh. 10 - Prob. 10.11PCh. 10 - Prob. 10.12PCh. 10 - NPV and EVA A project costs 2,500,000 up front and...Ch. 10 - Prob. 10.14PCh. 10 - Prob. 10.15PCh. 10 - Prob. 10.16PCh. 10 - Prob. 10.17PCh. 10 - Prob. 10.18PCh. 10 - Prob. 10.19PCh. 10 - Prob. 10.20PCh. 10 - Prob. 10.21PCh. 10 - Prob. 10.22PCh. 10 - Prob. 10.23PCh. 10 - Prob. 10.24PCh. 10 - All techniques with NPV profile: Mutually...Ch. 10 - Integrative: Multiple IRRs Froogle Enterprises is...Ch. 10 - Integrative: Conflicting Rankings The High-Flying...Ch. 10 - Problems with IRR White Rock Services Inc. has an...Ch. 10 - ETHICS PROBLEM Diane Dennison is a financial...Ch. 10 - Spreadsheet Exercise The Drillago Company is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forwardIn an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects, Project T (which lasts for 2 years) and Project F (which lasts for 4 years): The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital. (1) What is each projects initial NPV without replication? (2) What is each projects equivalent annual annuity? (3) Apply the replacement chain approach to determine the projects extended NPVs. Which project should be chosen? (4) Assume that the cost to replicate Project T in 2 years will increase to 105,000 due to inflation. How should the analysis be handled now, and which project should be chosen?arrow_forwardElysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project He requires an initial outlay of $33,000. Using the expected cash inflows given for each project in the following table, 1, calculate each project's payback period. Which project meets Elysian's standards The payback period of project Hydrogen is years. (Round to two decimal places.) The payback period of project Helium is years. (Round to two decimal places.) Which project meets Elysian's standard? (Select the best answer below.) Only project Hydrogen meets Elysian's standard. O Only project Helium meets Elysian's standard. Both projects are acceptable because their payback periods are less than the 6 years criterion.arrow_forward

- Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $180,000. John Shell, president of the company, has set a maximum payback period of 4 years.The cash inflows associated with each project are shown in the following table attached; . a. Determine the payback period of each project. b. Which project is acceptable based on payback period?arrow_forwardElysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $27,000; project Helium requires an initial outlay of $34,000. Using the expected cash inflows given for each project in the following table, Expected cash inflows Year Hydrogen Helium 1 $5,500 $7,500 2 $5,500 $6,500 3 $7,000 $7,500 4 $3,500 $4,500 5 $4,000 $5,500 6 $2,500 $5,000 calculate each project's paybackperiod. Which project meets Elysian's standards? PLEASE DONT ROUNDarrow_forwardElysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of $34,000. Using the expected cash inflows given for each project in the following table, Expected cash inflows Year Hydrogen Helium 1 $6,500 $8,000 2 $5,000 $8,000 3 $8,500 $7,000 4 $3,000 $4,500 5 $3,500 $5,000 6 $2,500 $4,000 calculate each project's payback period. Which project meets Elysian's standards?arrow_forward

- The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $6,750 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,500 0.2 $0 0.6 $6,750 0.6 $6,750 0.2 $7,000 0.2 $19,000 BPC has decided to evaluate the riskier project at 12% and the less-risky project at 8%. What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ Project B: $ Project B's standard deviation (σB) is $6,157.52 and its coefficient of variation (CVB) is 0.78. What are the values of (σA) and (CVA)? Round your answers to two decimal places. σA = $ CVA =arrow_forwardThe Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $6,750 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,500 0.2 $0 0.6 $6,750 0.6 $6,750 0.2 $7,000 0.2 $19,000 BPC has decided to evaluate the riskier project at 11% and the less-risky project at 9%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ fill in the blank 2 Project B: $ fill in the blank 3arrow_forwardThe Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initial outflow of $6,500 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Probability Cash Flows Flows 0.2 $6,000 0.2 $ 0.6 6,500 0.6 6,500 0.2 7,000 0.2 17,000 BPC has decided to evaluate the riskier project at 12% and the less-risky project at 9%. a. What is each project's expected annual cash flow? Round your answers to the nearest cent. Project A: 2$ Project B: $ Project B's standard deviation (OB) is $5,464 and its coefficient of variation (CVB) is 0.75. What are the values intermediate calculations. Round your answer for standard deviation to the nearest cent and for coefficient of variation to two decimal (GA) and (CVA)? Do not round 2$ CVA: b. Based on their risk-adjusted NPVS, which project should BPC choose? -Select- c.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License