Concept explainers

The University Club recently issued $1,500,000 of 10-year, 9% bonds at an effective interest rate of 10%. Bond interest is payable annually.

You have been asked to calculate the issuance price of the bonds and prepare amortization schedules for any discount or premium. The worksheet BONDS has been provided to assist you. Note that the worksheet contains a scratch pad at the bottom that has been preprogrammed to automatically compute and display the relevant cash flows needed for

Calculate the issue price of bonds and prepare amortization schedules for any discount or premium.

Explanation of Solution

Calculate the issue price of bonds and prepare amortization schedules for any discount and premium.

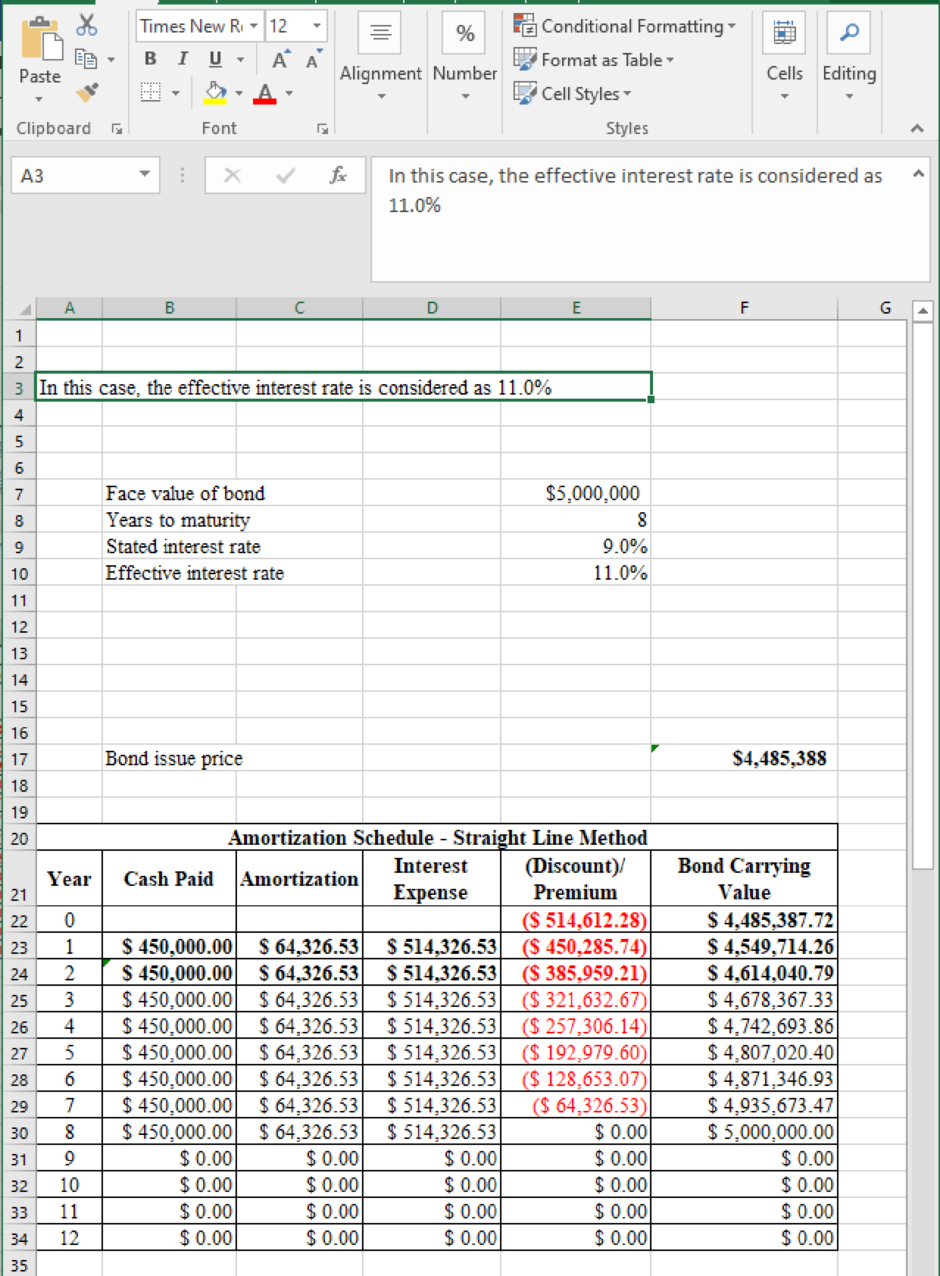

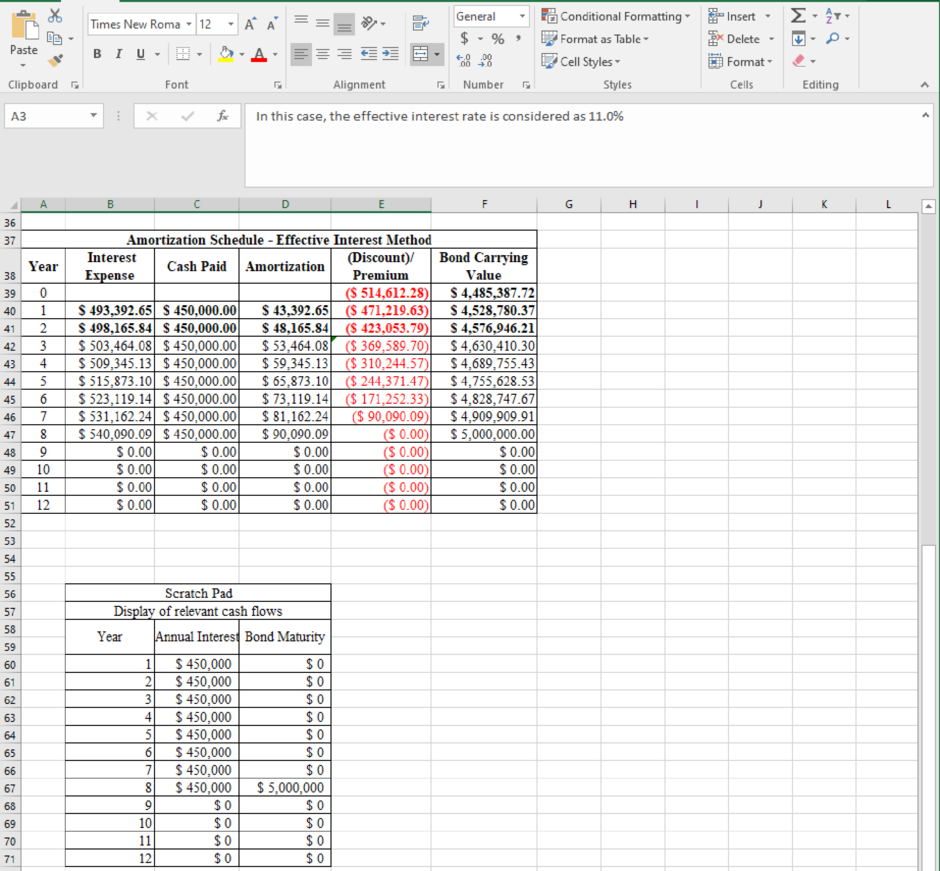

Table (1)

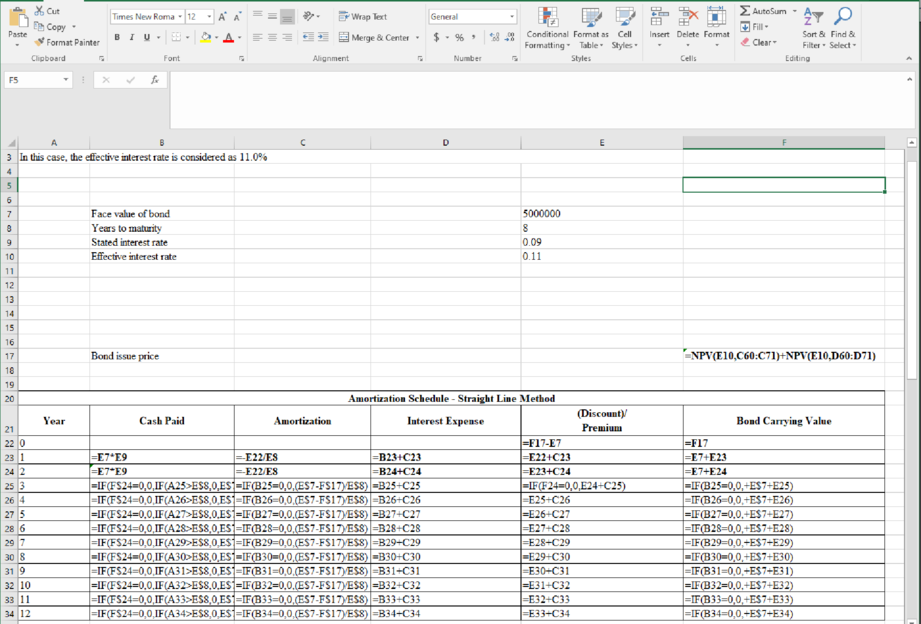

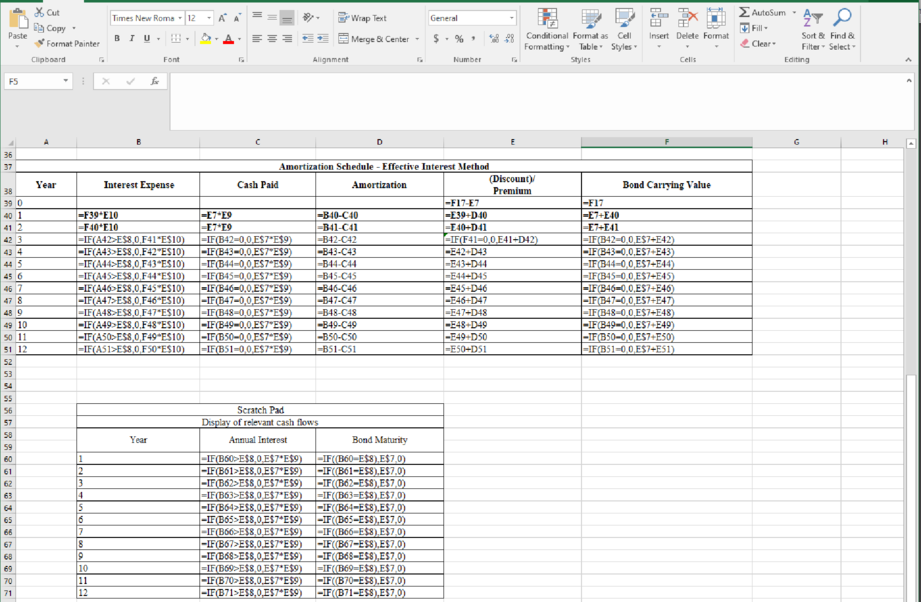

The formulae for the above calculation are as follows:

Figure (2)

Want to see more full solutions like this?

Chapter 11 Solutions

Excel Applications for Accounting Principles

- Compute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $37,000,000 of three-year, 11% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: A. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. B. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. C. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. D. The amount of the bond interest expense for the first year. Do not…arrow_forwardBoyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $83,000,000 of five-year, 8% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Ex Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: A. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $4 B. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. C. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. D. The amount of the bond interest expense for the first year. Round your answer to the nearest dollar.arrow_forwardCompute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ 73,969,806 X $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. 468,339 X $ 442,581 X d. The amount of the bond…arrow_forward

- Compute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $26,000,000 of 4-year, 11% bonds at a market (effective) interest rate of 9%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. d. The amount of the bond interest expense for the first year. Round your answer to the…arrow_forwardCompute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $88,000,000 of three-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ fill in the blank 2 The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ fill in the blank 3 The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ fill in…arrow_forwardCompute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $42,000,000 of four-year, 12% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ fill in the blank 2 The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ fill in the blank 3 The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ fill in the…arrow_forward

- Compute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ d. The amount of the bond interest expense for the first…arrow_forwardCompute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $44,000,000 of 5-year, 13% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. d. The amount of the bond interest expense for the first year. Round your…arrow_forwardBefore you begin, print out all the pages in this workbook. Otter Products Inc. issued bonds on January 1, 2019. Interest is to be paid semi-annually. Other information is as follows: Term in years: 2Face value of bonds issued: $200,000Issue price: $206,000Specified interest rate each payment period: 6%Required: Calculate: a. The amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use the straight-line method). Complete this amortization table by calculating interest expense, and beginning and ending bond carrying amounts at the end of each period over three years. Amortization TableA B C D E(A + D)Year Period ending Beg. bond carrying amount Periodic interest expense Actual cash interest paid Periodic discount (prem.) amort. Ending bond carrying amount2019 Jun. 30 Dec. 31 2020 Jun. 30 Dec. 31 2021 Jun. 30 Dec. 31 Calculate the actual interest rate under the straight-line method of amortization for each…arrow_forward

- City Slicker Corporation pays $55,000 into a bond sinking fund each year for the future redemption of bonds. During the first year, the fund earns $1,475. When the bonds mature, there is a sinking fund balance of $612,000, and $600,000 is needed to redeem the bonds. Required:Prepare the following general journal entries. a. The initial sinking fund deposit. b. The first year's earnings. c. The redemption of the bonds. d. The return of excess cash to the corporation.arrow_forwardPinder Co. produces and sells high-quality video equipment. To finance its operations, Pinder issued $20,000,000 of 4-year, 9% bonds, with interest payable semiannually, at a market (effective) interest rate of 11%. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the question below. Determine the present value of the bonds payable. Round your answer to the nearest dollar.arrow_forwardPinder Co. produces and sells high-quality video equipment. To finance its operations, Pinder issued $30,000,000 of four-year, 9% bonds, with interest payable semiannually, at a market (effective) interest rate of 10%. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the question below. Determine the present value of the bonds payable. Round your answer to the nearest dollar.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning