Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 4MAD

Analyze and compare Hilton and Marriott

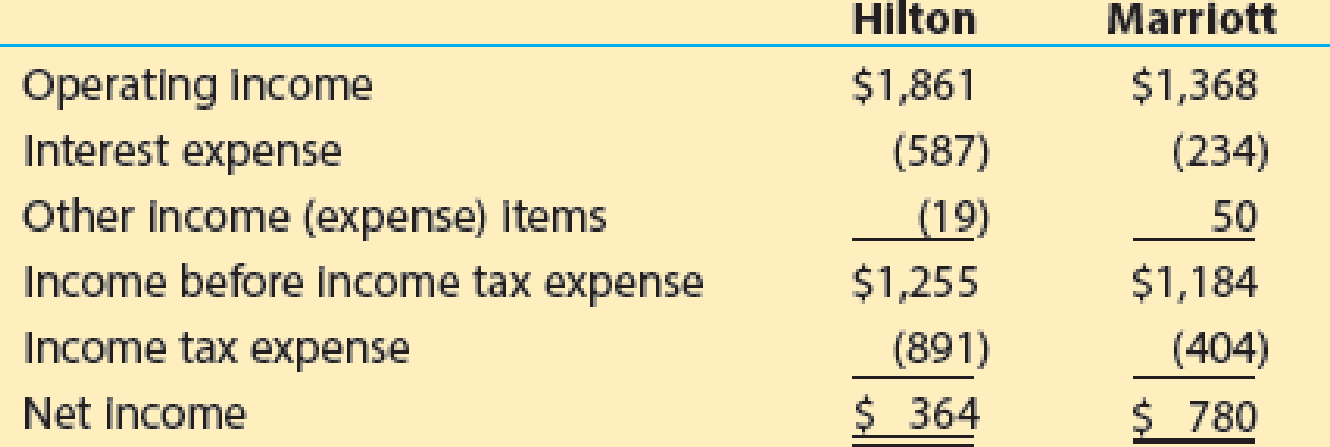

Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions):

- a. Compute the times interest earned ratio for each company. Round to one decimal place.

- b. Which company appears to better protect creditor interest? Why?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Identify the ratio that is relevant to answering each of the following questions.a. How much net income does the company earn from each dollar of sales?b. Is the company financed primarily by debt or equity?c. How many dollars of sales were generated for each dollar invested in fixed assets?d. How many days, on average, does it take the company to collect on credit sales made tocustomers?e. How much net income does the company earn for each dollar owners have invested in it?f. Does the company have sufficient assets to convert into cash for paying liabilities as theycome due in the upcoming year?

Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):Please see the attachment for details:1. Determine the following ratios for both companies, rounding ratios and percentages to one decimal place:a. Return on total assetsb. Return on stockholders’ equityc. Times interest earnedd. Ratio of total liabilities to stockholders’ equity2. Based on the information in (1), analyze and compare the two companies’ solvency and profitability.

Selected financial data for Surf City and Paradise Falls are as follows:Required:1. Calculate the debt to equity ratio for Surf City and Paradise Falls for the most recent year. Which company has the higher ratio?2. Calculate the return on assets for Surf City and Paradise Falls. Which company appears more profitable?3. Calculate the times interest earned ratio for Surf City and Paradise Falls. Which company is better able to meet interest payments as they become due?

Chapter 11 Solutions

Financial And Managerial Accounting

Ch. 11 - Describe the two distinct obligations incurred by...Ch. 11 - Explain the meaning of each of the following terms...Ch. 11 - If you asked your broker to purchase for you a 12%...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Fleeson Company needs additional funds to purchase...Ch. 11 - Prob. 9DQCh. 11 - Issuing bonds at face amount On January 1, the...

Ch. 11 - Issuing bonds at a discount On the first day of...Ch. 11 - Prob. 3BECh. 11 - Prob. 4BECh. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Times interest earned Averill Products Inc....Ch. 11 - Prob. 1ECh. 11 - Entries for issuing bonds Thomson Co. produces and...Ch. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Entries for issuing and calling bonds; gain Mia...Ch. 11 - Prob. 7ECh. 11 - Present value of amounts due Assume that you are...Ch. 11 - Prob. 9ECh. 11 - Present value of an annuity On January 1, you win...Ch. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Appendix 2 Amortize premium by interest method...Ch. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PACh. 11 - Entries for bonds payable, including bond...Ch. 11 - Appendix 1 and Appendix 2 Bond discount, entries...Ch. 11 - Prob. 5PACh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PBCh. 11 - Entries for bonds payable, including bond...Ch. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Analyze and compare Amazon.com and Wal-Mart...Ch. 11 - Analyze and compare Clorox and Procter Gamble The...Ch. 11 - Prob. 3MADCh. 11 - Analyze and compare Hilton and Marriott Hilton...Ch. 11 - Prob. 1TIFCh. 11 - Prob. 3TIFCh. 11 - Prob. 4TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forwardAlex is currently considering to invest his money in one of the companies betweenCompany A and Company B. The summarized final accounts of the companies for theirlast completed financial year are as follows: (please refer to the images) Required:a. Calculate the following ratios for Company A and Company B. State clearly theformulae used for each ratio:iv. Receivables Collection Period (days)v. Payables Payment Period (days)vi. Current Ratiovii. Quick Ratio + Comment on each of the ratios calculated in part (a) above.arrow_forwardAlex is currently considering to invest his money in one of the companies betweenCompany A and Company B. The summarized final accounts of the companies for theirlast completed financial year are as follows: (refer to the images) Required:a. Calculate the following ratios for Company A and Company B. State clearly theformulae used for each ratio:i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)v. Payables Payment Period (days)vi. Current Ratiovii. Quick Ratiob. Comment on each of the ratios calculated in part (a) above.arrow_forward

- DuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forward10. Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places. BEAN SUPERSTORE LEGUMES PLUS Comparative Balance Sheet December 31, 2017, 2018, and 2019 Comparative Balance Sheet December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Assets Cash $345,600 67,000 145,830 100,465 $330,460 62,000 178,011 101,202 $300,000 59,000 155,205 103,085 $407,000 85,430 128,080 182,006 $386,450 82,670 40,036 23,400 $356,367 79,230 52,142 111,701 Accounts Receivable Inventory Equipment Total Assets $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 Liabilities Salaries Payable Accounts Payable Notes Payable $ 91,455 $ 90,200 70,000 41,000 $ 88,563…arrow_forwardSolve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forward

- Calculate the current ratio for each company. Be sure to show your calculations. Current Assets Current Liabilities Company 1 89,378 80,610 Company 2 90,114 19,310 Company 1: Company 2: Comment on the results: Which company has the strongest liquidity position?arrow_forwardVII. Direction: Compute and interpret. The following comparative financial statements are provided by Avatar Industries. You were asked to compute the different financial ratios and provide your interpretations with regards to profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template below to input your answer and solution. AVATAR INDUSTRIES AVATAR INDUSTRIES Comparative Statement of Financial Position For the years 2019 and 2018 Comparative Income Statement For the years 2019 and 2018 2019 2018 2019 2018 ASSETS Current Assets: Sales P200,000 P210,000 Cash & Cash Equivalent P65,000 P70,000 Sales Returns and Allowances 40,000 25,000 Accounts Receivable 40,000 35,000 Net Sales 160,000 185,000 Marketable Secuities 40,000 35,000 Cost of Goods Sold 100,000 115,625 Inventory 100,000 80,000 Gross Profit 60,000 69,375 Total Current Assets 220,000 200,000 160,000 P445,000 P380,000 245,000 Operating Expenses: Fixed Assets Selling Expenses 22,000 25,000 Total…arrow_forwardBased on the Balance sheet calculate: 1.Current Ratio 2. Acid Test or Quick Ratio 3. Cash Ratio 4. Debt Ratio 5. Debt to Equity Ratio 6. Asset Turnover Ratio 7. Receivable Turnover Ratio and 8. Day Sales to Inventory Ratio. Based on the calculations presented above interpret the overall performance of BMW AG Group’s and the line items it must stay focused upon. Discuss its overall financial status having calculated the ratios across the years, considering the impact of Covid-19 while support decision-making related to its future growth and profitabilityarrow_forward

- VII. Direction: Compute and interpret. The following comparative financial statements are provided by Avatar Industries. You were asked to compute the different financial ratios and provide your interpretations with regards to profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template below to input your answer and solution. AVATAR INDUSTRIES AVATAR INDUSTRIES Comparative Statement of Financial Position For the years 2019 and 2018 Comparative Income Statement For the years 2019 and 2018 2019 2018 2019 2018 ASSETS Current Assets: Sales P200,000 P210,000 Cash & Cash Equivalent P65,000 P70,000 Sales Returns and Allowances 40,000 25,000 Accounts Receivable 40,000 35,000 Net Sales 160,000 185,000 Marketable Securities 40,000 35,000 Cost of Goods Sold 100,000 115,625 Inventory 100,000 80,000 Gross Profit 60,000 69,375 Total Current Assets 245,000 220,000 Operating Expenses: Fixed Assets 200,000 160,000 Selling Expenses 22,000 25,000 Total Assets P445,000…arrow_forwardQuestion 2Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows: a. Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio: i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)arrow_forwardSuppose you want to compare Palfinger AG to another heavy equipment manufacture, Caterpillar, Inc. To compare the companies, complete the table below and calculate common-sized numbers. To common-size balance sheet numbers, divide by total assets abd to common-size income statement numbers, divide by net sales. Comment on the trends over time and levels across companies.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Understanding Credit; Author: UCBStudentAffairs;https://www.youtube.com/watch?v=EBdXREhOuME;License: Standard Youtube License