Concept explainers

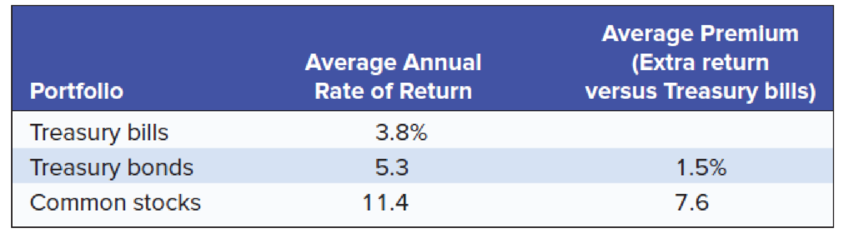

Risk Premiums and Discount Rates. Top hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500 will sell at year-end at a price of $50. The stock will pay a dividend at year-end of $2. What price should she be willing to pay for the stock today? Assume that risk-free Treasury securities currently offer an interest rate of 2%. Use Table 11.1 to find a reasonable discount rate.

TABLE 11.1

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Fundamentals of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Additional Business Textbook Solutions

Essentials of Corporate Finance

Foundations Of Finance

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

PRIN.OF CORPORATE FINANCE

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Bond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables Tasla stock recently paid a dividend of $0.75. The required rate of return is ke or rs = 10.5%, and the expected constant growth rate is g = 6.4%. What is the stock's current price?arrow_forwardTop hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500 will sell at year-end at a price of $49. The stock will pay a dividend at year-end of $3.00. Assume that risk-free Treasury securities currently offer an interest rate of 2.1%. Average rates of return on Treasury bills, government bonds, and common stocks, 1900–2020 (figures in percent per year) are as follows. Portfolio Average Annual Rate of Return (%) Average Premium (Extra return versus Treasury bills) (%) Treasury bills 3.7 Treasury bonds 5.4 1.7 Common stocks 11.5 7.7 What is the discount rate on the stock? Note: Enter your answer as a percent rounded to 2 decimal places. What price should she be willing to pay for the stock today? Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardMarket equity beta measures the covariability of a firms returns with all shares traded on the market (in excess of the risk-free interest rate). We refer to the degree of covariability as systematic risk. The market prices securities so that the expected returns should compensate the investor for the systematic risk of a particular stock. Stocks carrying a market equity beta of 1.20 should generate a higher return than stocks carrying a market equity beta of 0.90. Nonsystematic risk is any source of risk that does not affect the covariability of a firms returns with the market. Some writers refer to nonsystematic risk as firm-specific risk. Why is the characterization of nonsystematic risk as firm-specific risk a misnomer?arrow_forward

- The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows. REQUIRED RATE OF RETURN (Percent] 20.0 16.0 12.0 Return on HC's Stock 8.0 4.0O 0.0 0.5 1.0 1.5 2.0 RISK (Beta) CAPM Elements Value Risk-free rate (rRF) 4.0% Market risk premium (RPM) 4.4% Happy Corp. stock's beta Required rate of return on 7.6% 2.2% Happy Corp. stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML Calculate Happy Corp.'s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return isarrow_forwardThe following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: CAPM Elements Value Risk-free rate (rRF) Q1 Market risk premium (RPM) Q2 Happy Corp. stock’s beta Q3 Required rate of return on Happy Corp. stock Q4 An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.’s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst’s prediction. Happy Corp.’s new required rate of return is Q5.____ The SML helps determine the risk-aversion level among investors. The higher the level of risk aversion, the Q6.____ the slope of the SML. Q7. Which of the…arrow_forwardTop hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500 will sell at year-end at a price of $49. The stock will pay a dividend at year-end of $3.00. Assume that risk-free Treasury securities currently offer an interest rate of 2.1%. Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2017 (figures in percent per year) are as follows. Average Presium (Extra return versus Treasury bills) (%) Average Annual Rate of Return (K) Portfolio Treasury bills Treasury bonds Conmon stocks 3.8 5.3 1.5 11.5 7.7 a. What is the discount rate on the stock? (Enter your answer as a percent rounded to 2 decimal places.) Discount rate b. What price should she be willing to pay for the stock today? (Do not round intermedinte calculations. Round your answer to 2 decimal places.) Stock pricearrow_forward

- Top hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500 will sell at year-end at a price of $49. The stock will pay a dividend at year-end of $3.00. Assume that risk-free Treasury securities currently offer an interest rate of 2.1%. Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2017 (figures in percent per year) are as follows. Average Annual Rate of Return (%) Average Premium (Extra return versus Treasury bills) (%) Portfolio Treasury bills Treasury bonds Common stocks 3.8 5.3 1.5 11.5 7.7 a. What is the discount rate on the stock? (Enter your answer as a percent rounded to 2 decimal places.) Discount rate b. What price should she be willing to pay for the stock today? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardTop hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500 will sell at year-end at a price of $53. The stock will pay a dividend at year-end of $2.30. Assume that risk-free Treasury securities currently offer an interest rate of 2.3%. Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2017 (figures in percent per year) are as follows. Portfolio Treasury bills Treasury bonds Common stocks Discount rate Average Annual Rate of Return (1) 3.8 5.3 11.5 Stock price I a. What is the discount rate on the stock? (Enter your answer as a percent rounded to 2 decimal places.) % Average Premium (Extra return versus Treasury bills) () 1.5 7.7 b. What price should she be willing to pay for the stock today? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardYou're considering purchasing Proctor and Gamble Stock. Suppose the risk-free interest rate is 5.0% and the stock market's expected return is 13.50%. Also, suppose that if the stock market's value rises by 1%, stock in Proctor and Gamble typically rises by 1%. a. What is the percentage of Proctor and Gamble's risk premium? c. What is the correct discount rate to use according to the Capital Asset Pricing Model (CAPM) when analyzing the present value of future cash flows from this stock?arrow_forward

- A) What expected return should an investor expect from investments in common stock? You are given the following information: Risk free rate of return = 4%; market risk premium = 11%; Beta of the stock (assume CAPM holds) = 0.72. B) Stock A with beta of 0.8 offers a 11% return while stock B with a beta of 1.2 offers a 15% return. What is the risk-free rate? What is the common market return? Assume CAPM holds.arrow_forward← You are thinking of buying a stock priced at $109.31 per share. Assume that the risk-free rate is about 4.03% and the market risk premium is 6.48%. If you think the stock will rise to $118.76 per share by the end of the year, at which time it will pay a $3.48 dividend, what beta would it need to have for this expectation to be consistent with the CAPM? The beta is (Round to two decimal places.) ...arrow_forwardAs an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U): Fund T Fund U Forecasted Return 9.0% 10.0 CAPM Beta 1.20 0.80 a) If the risk-free rate is 3.9 % and the expected market risk premium is 6.1%, calculate the expected return for each mutual fund according to the CAPM. b) Using the estimated expected returns from Part a along with your own return forecasts, explain whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. Are Funds T and U overvalued, undervalued, or properly valued?arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning