Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134128528

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

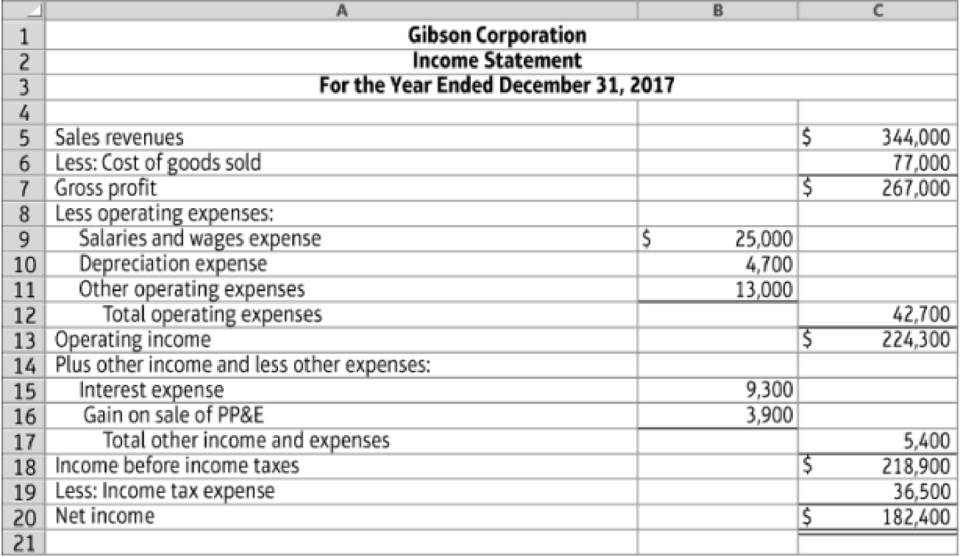

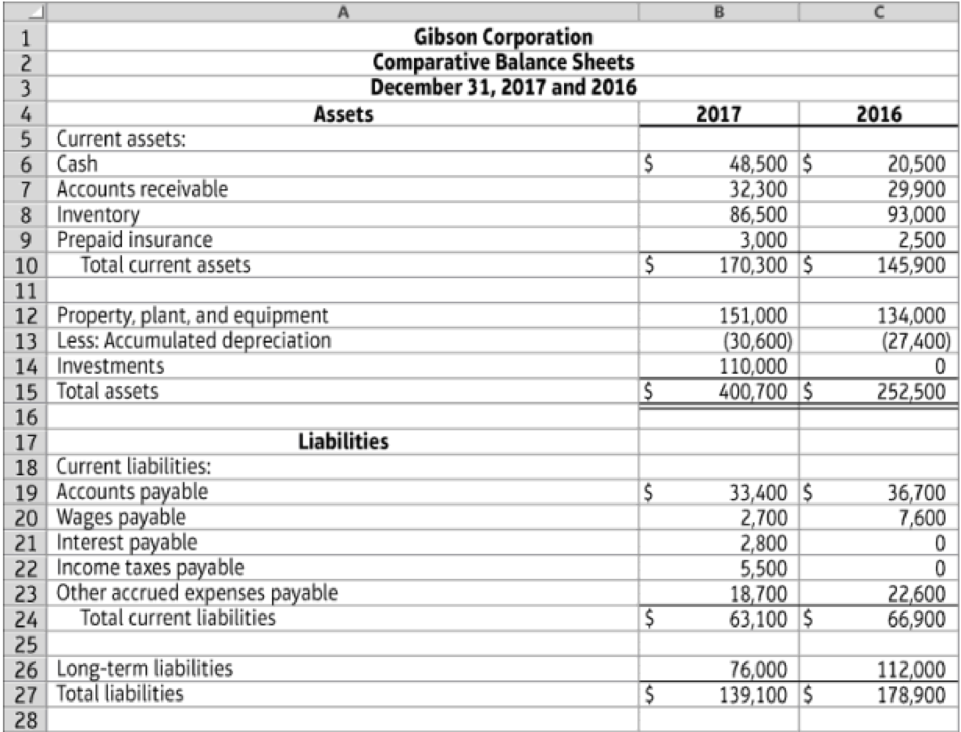

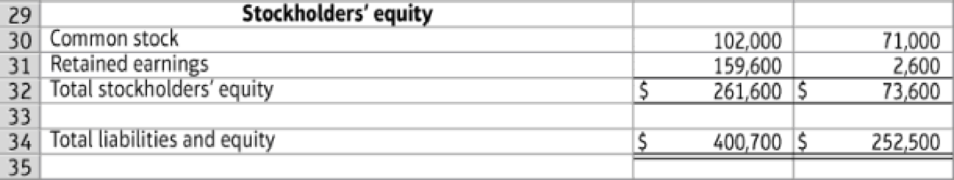

Chapter 13, Problem 13.37BP

Prepare statement of cash flows (indirect method) (Learning Objectives 1 & 2)

The 2017 and 2016 balance sheets of Gibson Corporation follow. The 2017 income statement is also provided. Gibson had no noncash investing and financing transactions during 2017. During the year, the company sold equipment for $15,200, which had originally cost $12,800 and had a book value of $11,300. The company did not issue any notes payable during the year but did issue common stock for $31,000. The company purchased plant assets and long-term investments with cash.

13.5-45 Full Alternative Text

13.5-46 Full Alternative Text

Requirements

- 1. Prepare the statement of cash flows for Gibson Corporation for 2017 using the indirect method.

- 2. Evaluate the company’s cash flows for the year. Discuss each of the categories of cash flows in your response.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate free cash flow for 2017 for Monarch Textiles, Inc., based on the financial information that follows. Assume that

all current liabilities are non-interest-bearing liabilities and that no fixed assets were sold or disposed of during 2017.

(Round your answer to 1 decimal places.)

Sales

Cost of sales

Income statement

Operating expenses

Depreciation

Interest expense

Earnings before taxes

Tax

Net income

Free cash flow

Monarch Textiles, Inc. ($ thousands)

2017

1,280

760

130

62

50

278.00

111.20

166.80

X Answer is complete but not entirely correct.

$ 140.9

Selected balance sheet items

Current assets

Net fixed assets

Current liabilities

2016

360

124

230

2017

490

248

310

The Garfield Ltd company uses the indirect method for preparing its statement of cash flows. It reported a net income of $100,000 for the year 2016.During the year 2016, the working capital accounts were changed as follows:Increase in accounts receivable: $22,000Increase in accounts payable: $18,600Increase in inventory: $14,800Decrease in non-trade notes payable: $30,000Increase in available for sale securities: $32,000The depreciation expense was $34,000 for the year 2016.

Calculate free cash flow for 2017 for Monarch Textiles, Inc., based on the financial information that follows. Assume that all current

liabilities and that no fixed assets were sold or disposed of during 2017. (Round your answer to 1

liabilities are non-interest-bearing

decimal places.)

Sales

Cost of sales

Operating expenses

Depreciation

Income statement

Interest expense

Earnings before taxes

Tax

Net income

Free cash flow

Monarch Textiles, Inc. ($ thousands)

2017

1,250

750

125

60

50

265.00

106.00

159.00

Selected balance sheet items

Current assets

Net fixed assets

Current liabilities

2016

350

120

225

2017

475

240

305

Chapter 13 Solutions

Managerial Accounting (5th Edition)

Ch. 13 - (Learning Objective 1) Which of the following is...Ch. 13 - Prob. 2QCCh. 13 - Prob. 3QCCh. 13 - Prob. 4QCCh. 13 - Prob. 5QCCh. 13 - Prob. 6QCCh. 13 - Prob. 7QCCh. 13 - Prob. 8QCCh. 13 - Prob. 9QCCh. 13 - (Learning Objective 3) Which one of the following...

Ch. 13 - Prob. 13.1SECh. 13 - Prob. 13.2SECh. 13 - Prob. 13.3SECh. 13 - Prob. 13.4SECh. 13 - Prob. 13.5SECh. 13 - Calculate financing cash flows (Learning...Ch. 13 - Prob. 13.7SECh. 13 - Prob. 13.8SECh. 13 - Prob. 13.9SECh. 13 - Prob. 13.10SECh. 13 - Prob. 13.11SECh. 13 - Prob. 13.12AECh. 13 - Prob. 13.13AECh. 13 - Prob. 13.14AECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.16AECh. 13 - Prob. 13.17AECh. 13 - Prob. 13.18AECh. 13 - Prob. 13.19AECh. 13 - Prob. 13.20AECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.22BECh. 13 - Prob. 13.23BECh. 13 - Prob. 13.24BECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.26BECh. 13 - Prob. 13.27BECh. 13 - Prob. 13.28BECh. 13 - Prob. 13.29BECh. 13 - Prob. 13.30BECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.32APCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.34APCh. 13 - Prob. 13.35APCh. 13 - Prob. 13.36BPCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.38BPCh. 13 - Prob. 13.39BPCh. 13 - Prob. 13.40SCCh. 13 - Discussion Analysis A13-41 Discussion Questions...Ch. 13 - Prob. 13.42ACTCh. 13 - Ethics involved with statement of cash flows...Ch. 13 - Prob. 13.44ACTCh. 13 - Prob. 13.45ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2017, Simms Company redeemed $2,000,000 ofbonds payable for $1,880,000 cash. Indicate how thistransaction would be reported on a statement of cashflows, if at all.arrow_forwardColbert Corporation had the following 2017 income statement. Revenues $100,000 Expenses 60,000 $ 40,000 In 2017, Colbert had the following activity in selected accounts. Check the below image for selected account's activity. Prepare Colbert’s cash flows from operating activities section of the statement of cash flows using (a) the direct method and (b) the indirect method.arrow_forwardUsing the information below, complete the operating cash flow section of the Statement of Cash Flows for Peter Ltd using direct method. Your presentation must be consistent with the requirements of AASB107. Ignore tax. Reporting date is 30 June. The balances of selected accounts of Peter Ltd at 30 June 2021 and 30 June 2022 were ($000): 2021 2022 Cash 3850 1200 Inventory 3750 4250 Accounts receivable 2800 3500 Allowance for doubtful debts 320 260 Land 5000 5000 Plant 2750 2800 Accumulated depreciation 490 450 Accounts payable 3200 3500 Rent payable 100 130 Salaries payable 120 190 Share capital 1000 1000 Sales (on credit) 7750 6550 Cost of goods sold 1250 1100 Doubtful debts expense 280 300 Rent expense 540 450 Salaries expense 800 750 Depreciation expense 260 180 Required: Peter Ltd’s operating cash flow section extracted from the Statement of Cash Flows for year ended 30 June 2022 (Direct Method)arrow_forward

- Wainwright Corporation had the following activities in 2017.1. Sale of land $180,000. 2. Purchase of inventory $845,000. 3. Purchase of treasury stock $72,000. 4. Purchase of equipment $415,000. 5. Issuance of common stock $320,000. 6. Purchase of available-for-sale debt securities $59,000. Compute the amount Wainwright should report as net cash provided (used) by investing activities in its 2017 statement of cash flows.arrow_forward(Schedule of Net Cash Flow from Operating Activities—Indirect Method) Ballard Co. reported $145,000 of net income for 2017. The accountant, in preparing the statement of cash flows, noted the following items occurring during 2017 that might affect cash flows from operating activities.1. Ballard purchased 100 shares of treasury stock at a cost of $20 per share. These shares were then resold at $25 per share.2. Ballard sold 100 shares of IBM common at $200 per share. The acquisition cost of these shares was $145 per share. There were no unrealized gains or losses recorded on this investment in 2017.3. Ballard revised its estimate for bad debts. Before 2017, Ballard’s bad debt expense was 1% of its net sales. In 2017, this percentage was increased to 2%. Net sales for 2017 were $500,000, and net accounts receivable decreased by $12,000 during 2017.4. Ballard issued 500 shares of its $10 par common stock for a patent. The market price of the shares on the date of the transaction was $23…arrow_forwardUsing the four-year financial statements of Tesla 2017-2020 (Appendix 2), evaluate and explain the profitability, solvency, liquidity, activity and market dimensions of Tesla’s financial performance highlighting the main weaknesses and strengths of Tesla. Consolidated Statements of Cash Flows(in millions of $) Items 2017 2018 2019 2020 Cash Flows from Operating Activities Net income (loss) (2,241) (1,063) (775) 862 Adjustments to reconcile net income (loss) to net cash provided byoperating activities: Depreciation, amortization and impairment 1,636 1,901 2,154 2,322 Stock-based compensation 467 749 898 1,734 Amortization of debt discounts and issuance costs 91 159 188 180 Inventory and purchase commitments write-downs 132 85 193 202 Loss on disposals of fixed assets 106 162 146 117 Foreign currency transaction net loss (gain) 52 (2) (48) 114 Loss (gain) related to SolarCity acquisition 58 --- --- --- Non-cash interest…arrow_forward

- (Computation of Operating Activities—Direct Method) Presented below are two independent situations.Situation A: Annie Lennox Co. reports revenues of $200,000 and operating expenses of $110,000 in its first year of operations, 2017. Accounts receivable and accounts payable at year-end were $71,000 and $29,000, respectively. Assume that the accounts payable related to operating expenses. (Ignore income taxes.)InstructionsUsing the direct method, compute net cash provided by operating activities. Situation B: The income statement for Blues Traveler Company shows cost of goods sold $310,000 and operating expenses (exclusive of depreciation) $230,000. The comparative balance sheet for the year shows that inventory increased $26,000, prepaid expenses decreased $8,000, accounts payable (related to merchandise) decreased $17,000, and accrued expenses payable increased $11,000.InstructionsCompute (a) cash payments to suppliers and (b) cash payments for operating expensesarrow_forwardXS Supply Company is developing its annual financial statements at December 31, 2017. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized: 2017 2016 Balance Sheet at December 31 Cash $ 37,120 $ 30,800 Accounts Receivable 37,850 30,800 Merchandise Inventory 47,900 40,900 Property and Equipment 175,250 132,000 Less: Accumulated Depreciation (38,250 ) (33,000 ) $ 259,870 $ 201,500 Accounts Payable $ 42,850 $ 32,500 Wages Payable 1,430 2,050 Note Payable, Long−Term 32,700 44,100 Contributed Capital 104,500 80,600 Retained Earnings 78,390 42,250 $ 259,870 $ 201,500 Income Statement for 2017 Sales $ 202,000 Cost of Goods Sold…arrow_forwardDuring 2018, the cash flows related to Global Data, Inc.'s lending and borrowing activities are summarized as follows: Cash lent to borrowers Payment to retire bonds payable Proceeds from borrowing at bank (note payable) Interest received from borrowers Interest payments made on bonds payable SS S A Moving to the next question prevents changes to this answer. S S If Global Data's income statement for 2018 reports interest expense of $25,200, then Interest Payable decreased by $15,800 O True O False 132,600 367,500 220,500 31,500 41,000 Daning 2015, the cash flowy related to Global Dhes, lac's leading and borrowing activities are varied as follows Cash letto borrowers Payment to rebods payable Proceeds free borrowing at back cote payable) Interest received from borrowers we pays de onbeads payable True Ĉ D S S 5 367,500 220.500 31.500 41,000arrow_forward

- Splish Brothers Inc. engaged in the following cash transactions during 2017. Purchase of land $120,000 Purchase of treasury stock 43,000 Issuance of preferred stock 213,000 Sale of land and buildings 268,000 Payment of cash dividends 33,000 Purchase of equipment 68,000 Retirement of bonds 309,000 Splish Brothers reported net cash provided by operating activities of $590,000. Determine Splish Brothers's free cash flow. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Free cash flow $arrow_forwardST&C's financial statements for the 2015 and 2014 fiscal years contained the following information: Balance Sheets ($ in millions) 2015 2014 Current assets: Accounts receivable, net of allowances for doubtful accounts of $724 and $654 $ 16,732 $ 14,547 Income Statements ($ in millions) 2015 2014 Revenues $ 148,801 $ 132,667 In addition, the statement of cash flows disclosed bad debt expense of $1,436 million in 2015 and $1,052 million in 2014. Required: Determine the amount of actual bad debt write-offs made during 2015. Note: Enter your answer in millions and not in dollars. Determine the amount of cash collected from customers during 2015. Note: Enter your answer in millions and not in dollars. Compute the receivables turnover ratio for 2015. Note: Round your answer to 2 decimal places.arrow_forwardBT21 Inc. has recorded the following transactions on its book for the year 2021. How much total Cash Inflow from financing activities that BT21 should reflected on its Statement of Cash Flow:i. Payment for interest of the issued bonds on April 1, 2021, 900.ii. Cash dividend received on the short-term investment, 5,000iii. Depreciation on plant that manufactures goods for sale, 6,000.iv. Payment of income tax on gain on sale of treasury bills, 2,000.v. Issued 500 ordinary shares for 50,000.vi. Received cash from interest on the acquired treasury bonds of BigHit Corp, 2,400.vii. Payment for marketable securities, 12,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License