Concept explainers

1. and 2.

Calculate the basic earnings per share and diluted earnings per share.

1. and 2.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share.

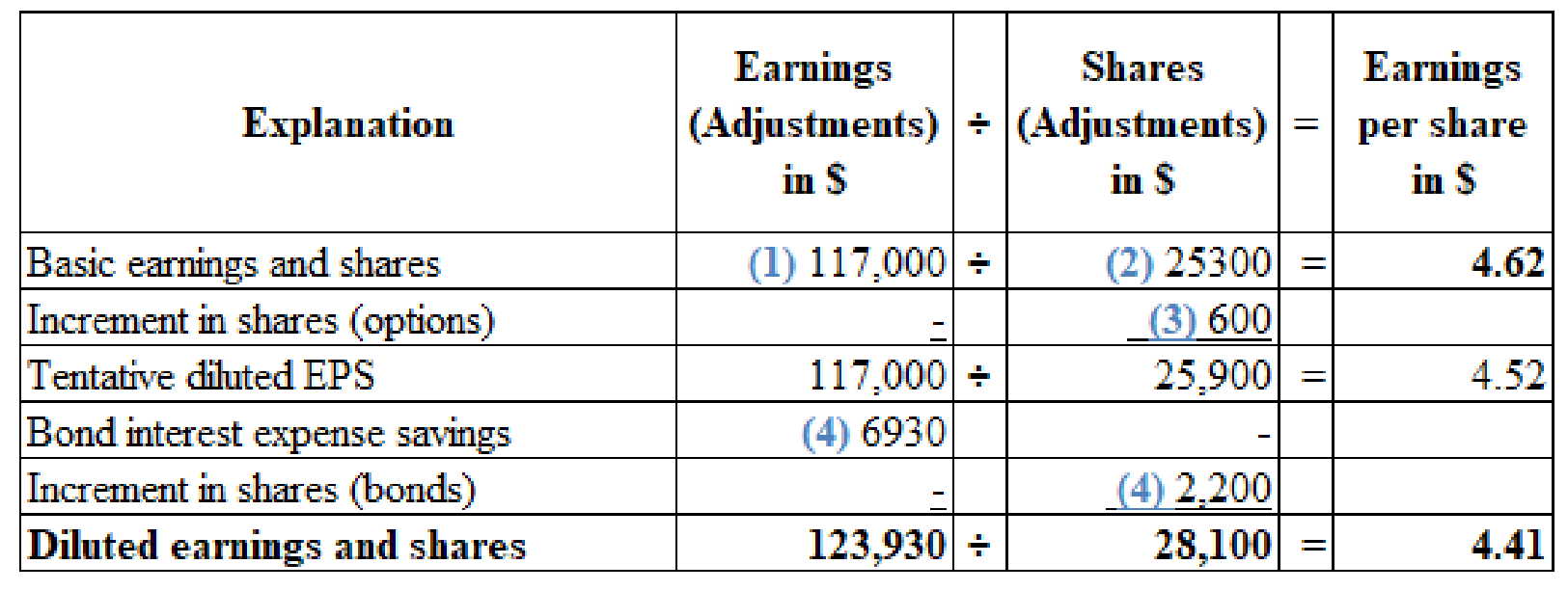

(Figure 1)

Working notes:

(1) Calculate the numerator for the basic earnings per share:

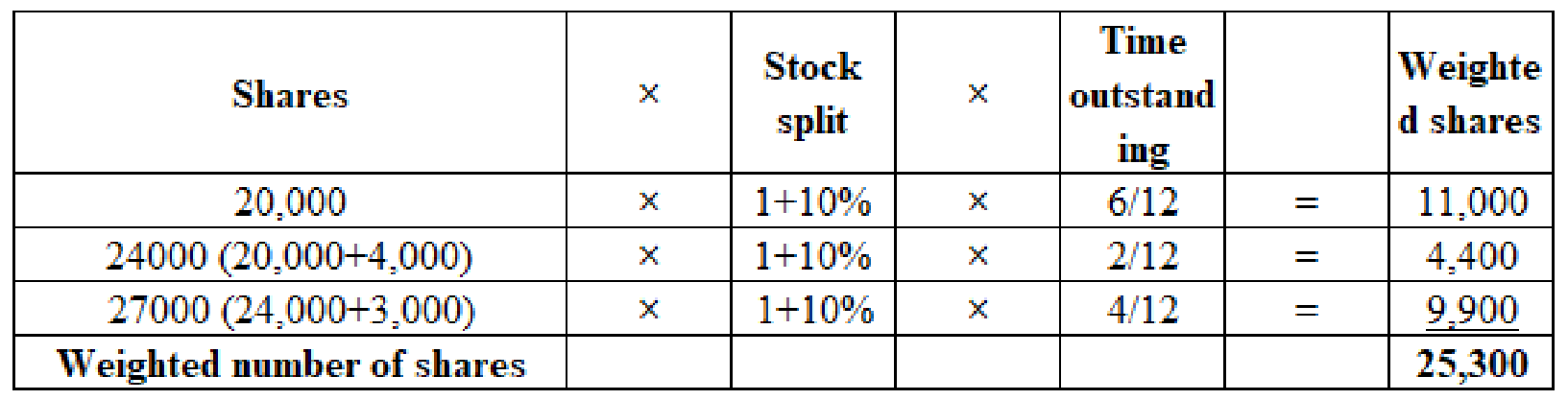

(2) Calculate the number of shares used in computing the basic earnings per share:

(Figure 2)

(3) Calculate the increase in the share options:

(4) Calculate the impact of 8% preferred on diluted earnings per share and ranking:

(5) Calculate the impact of 9.6% bonds on diluted earnings per share and ranking:

Note:

- The Company has occurred loss form the discontinuing operations, the impact of the convertible security is compared with earnings per share that is related to income from continuing operations.

- The percentage of stock dividend that is required to identify the assumed shared outstanding is ascertained using below formula :

3.

Identify whether basic or diluted earnings per share will be reported by the Company R on its 2016 income statement.

3.

Explanation of Solution

The Company R must report an amount of (6) $4.23 as basic earnings per share and (7) $4.05 as diluted earnings per share in its 2016 income statement.

Working notes:

(6) Calculate the basic earnings per share after deducting loss from discontinuing operations:

(7) Calculate the basic earnings per share after deducting loss from discontinuing operations:

Notes to financial statement:

Note 1: Basic earnings per share of the company are based on average common shares outstanding; 7% and 8% preferred dividends are deducted from net income to ascertain the earnings available to common shareholders. Diluted earnings per share are obtained from 600 shares of stock options and 2,200 shares of bonds that are convertible. Diluted earnings available to common shareholders are assumed to have no interest expense of $6,930 on the converted bonds.

Want to see more full solutions like this?

Chapter 16 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardThe San Diego Corporation reported profit of P2,400,000 for the year ended December 31, 2018. At the beginning of the year, the company had 200,000 ordinary shares outstanding. It issued an additional 30,000 shares on July 1, 2018 and reacquired as treasury shares 6,000 shares on November 1, 2018. 12. Required: What is the weighted number of ordinary shares that will be used to compute basic earnings per share?arrow_forward

- During 2018, Baird Corporation reported after-tax net income of $3,620,000. During the year, the number of shares of stock outstanding remained constant at 9,780 of $100 par, 10 percent preferred stock and 398,000 shares of common stock. The company’s total stockholders’ equity is $19,600,000 at December 31, 2018. Baird Corporation’s common stock was selling at $52 per share at the end of its fiscal year. All dividends for the year have been paid, including $5.00 per share to common stockholders. Required Compute the earnings per share. (Round your answer to 2 decimal places.) Compute the book value per share of common stock. (Round your answer to 2 decimal places.) Compute the price-earnings ratio. (Round intermediate calculations and final answer to 2 decimal places.) Compute the dividend yield. (Round your answer to 2 decimal places. (i.e., .2345 should be entered as 23.45).)arrow_forwardOriole Paper Mill, Inc., had, at the beginning of the current fiscal year, April 1, 2016, retained earnings of $ 322,525. During the year ended March 31, 2017, the company produced net income after taxes of $ 713,175 and paid out 41 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. (Round answers to 2 decimal places, e.g. 15.25. List items that increase retained earnings first.) Oriole Paper Mill, Inc.Retained Earnings for 2017arrow_forwardAce Company had 200,000 shares of common stock outstanding on December 31, 2021. During the year 2022, the company issued 8,000 shares on May 1 and retired 14,000 shares on October 31. For the year 2022, Ace Company reported net income of $249,690 after a loss from discontinued operations of $40,600 (net of tax). Instructions What earnings per share data should be reported at the bottom of its income statement?arrow_forward

- During 2016, Moore Corp. had the following two classes of stock issued and outstanding for the entire year: • 100,000 shares of common stock, $1 par. • 1,000 shares of 4% preferred stock, $100 par, convertible share for share into common stock. Moore’s 2016 net income was $900,000, and its income tax rate for the year was 30%. In the computation of diluted earnings per share for 2016, the amount to be used in the numerator is a. $896,000 b. $898,800 c. $900,000 d. $901,200arrow_forwardRudolph Corporation showed retained earnings of $400,000 on its balance sheet for 2016. In 2017, the company’s earnings per share (EPS) were $3.00 and its dividends paid per share (DPS) were $1.00. The company has 200,000 shares of stock outstanding. What will be the level of retained earnings on the company’s 2017 balance sheet?arrow_forwardThe following table gives abbreviated balance sheets and income statements for Walmart. At the end of fiscal 2017, Walmart had 3,060 million shares outstanding with a share price of $146. The company's weighted-average cost of capital was about 5%. Assume a tax rate of 35%. Balance Sheet (figures in $ millions) End of Year Start of Year Assets Current assets: Cash and marketable securities $ 6,956 $ 7,067 Accounts receivable 5,814 6,035 Inventories 43,983 43,246 Other current assets 3,711 2,141 Total current assets $ 60,464 $ 58,489 Fixed assets: Net fixed assets $ 115,018 $ 114,378 Other long-term assets 30,240 27,158 Total assets $ 205,722 $ 200,025 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $ 46,292 $ 41,633 Other current liabilities 32,629 25,695 Total current liabilities $ 78,921 $ 67,328 Long-term debt 37,025…arrow_forward

- The 2017 income statement of Wasmeier Corporation showed net income of $480,000 and a loss from discontinued operations of $120,000. Wasmeier had 100,000 shares of common stock outstanding all year. Prepare Wasmeier’s income statement presentation of earnings per share.arrow_forwardCarla Corporation reported net income of $644,000 in 2017 and had 234,000 shares of common stock outstanding throughout the year. Also outstanding all year were 63,300 options to purchase common stock at $10 per share. The average market price of the stock during the year was $15. Compute diluted earnings per share. (Round answer to 2 decimal places, e.g. 15.25.)arrow_forwardThe Esposito Import Company had 1 million shares of common stock outstanding during 2016. Its income statement reported the following items: income from continuing operations, $5 million; loss from discontinued operations, $1.6 million. All of these amounts are net of tax. Required: Prepare the 2016 EPS presentation for the Esposito Import Company.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning