To determine: The net funds available to the parent corporation (a) if foreign taxes can be applied against the U.S. tax liability and (b) if they cannot.

Answer to Problem 19.1WUE

Explanation of Solution

Given information:

Subsidiary pretax income: $55,000

Local tax: 40.00%

Dividend withholding tax: 5.00%

US tax rate: 34.00%

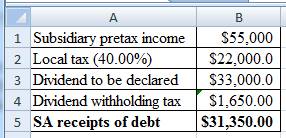

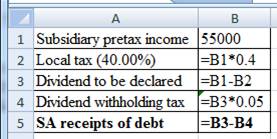

Calculation of the SA receipts of dividend:

Excel working:

Therefore, the SA receipt of debt is $31,250.

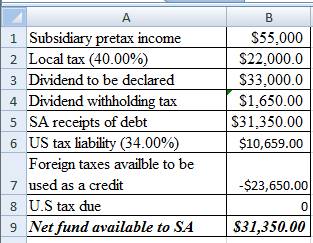

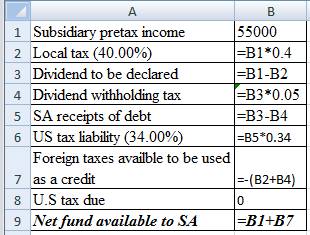

(a) if foreign taxes can be applied against the U.S. tax liability

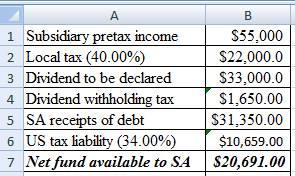

Calculation of the net fund available to SA:

Excel working:

Therefore, net fund available to SA is $31,500.

(b) if they cannot.

Foreign taxes cannot be applied against the U.S. tax liability

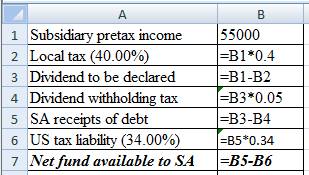

Excel working:

Therefore, Net fund available to SA is $20,691.00

Want to see more full solutions like this?

Chapter 19 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- With the same data given above, what is the income tax due if X corporation is a proprietary educational institution? P75,000 P1,000 P3,000 P2,000arrow_forwardP Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Private Proprietary Educational Institution majority of its income is from related activities. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was incurred in connection with non-related activities. Compute the income tax due if all the income of Qalvin is used for educational purposes. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was…arrow_forwardHow much is the total gross income subject to regular income tax if a domestic corporation reported the following income in 2019? Philippines Abroad P400,000 40,000 80,000 Service fee Interest income - bank P300,000 70,000 30,000 Royalties -franchisearrow_forward

- U.S. International Corporation (USIC), a U.S. taxpayer, has investments in Foreign Entities A-G. Relevant Information for these entities for the current fiscal year appears in the following table: Entity Country % Owned Activity Income before tax ($ millions) Income Tax Rate Dividend Withholding tax Rate Net Amount Received by Parent ($ millions) USIC United States 35.00% Argentina Brazil Canada Hong Kong 100% Liechtenstein 100% A B C D E F G 100% 100% 100% 51% Japan New Zealand 60% Manufacturing $10.00 Manufacturing $1.00 Manufacturing $2.00 Manufacturing $3.00 Investment $2.00 Distribution $3.00 Manufacturing $2.00 $4.00 Banking 35.00% 34.00% 26.00% 16.50% 10.00% 38.00% 28.00% 0% 0% 5% 0% 4% 5% 5% $0.20 $2.50 $1.00 $1.50 S- $0.50 $1.00 Additional Information 1. USIC's $10 million income before tax is derived from the production and sale of products in the United States. 2. Each entity is legally incorporated in its host country other than Entity A, which is registered with the…arrow_forwardA resident foreign corporation has the following income and expenses for the year: Philippines Abroad Gross sales P100,000,000 P40,000,000 Cost of sales 40,000,000 20,000,000 Operating expenses 30,000,000 12,000,000 1. How much is the income tax due assuming the taxable year is 2021?2. Assuming the corporation is a nonresident foreign corporation and the taxable year is 2021, how much is the income tax due?arrow_forwardENKANTADYA Corporation furnished you its financial data for 2018 as follows: Gross income, Philippines - P 800,500Expenses, Philippines - 450,000Gross income Singapore - 700,000Expenses, Singapore - 400,000Personal expenses - 150,000Interest from time deposits, BPI, Philippines - 20,000 Interest on money market placement, net of tax - 22,000How much is the amount of final withholding tax on passive income ?arrow_forward

- Problem 20. A Domestic Corporation subject to 25% RCIT had the following data on its Philippine and foreign operations in 2021: Taxable Income in the Philippines P1,800,000 1,500,000 Taxable Income from Taiwan Taxable Income from Japan 1,200,000 Net Loss from South Korea (500,000) 300,000 200,000 Quarterly Income tax paid in the Philippines Income tax paid in Taiwan Income tax paid in Japan Income tax paid in South Korea 400,000 What is the income tax still due after foreign tax credits?arrow_forwardWhat is the foreign tax credit X Corp, a US Corp, is able to take on its current year return based on the following facts: Taxable income: X Corp, 100% US income ---$10,000,000 X Corp's foreign branch, 100% non-US income ---$1,000,000 Foreign tax paid by the foreign branch--- $300,000arrow_forwardBUT PTE Singapore in Semarang obtained net income in 2021 as follows: Domestic Fiscal income IDR 400.000.000 Income from Deviden in Singapore (15% tax rate) IDR 100.000.000 Income from Loan in Vietnam (20% tax rate) IDR 250.000.000 Income from Royalti in Malaysia (35% tax rate) IDR 200.000.000 Loss Income from India (17% tax rate) (IDR 100.000.000) (Financial information of BUT PTE Singapore that Gross Income is Rp. 35.000.000.000 and Fiscal Costs are Rp 31.000.000.000) Calculate Tax Payable!arrow_forward

- 2. Individual earning income purely from business/profession Assume that for year 2023, a resident citizen has the following income from sources in the Philippines and abroad: In the Philippines - Sales Less: Cost of sales Gross income Less: Operating expenses Net income from operation Add: Other non-operating income Taxable income - Philippines Abroad - country X Taxable income Income tax paid P21,000,000.00 12,600,000.00 8,400,000.00 5,250,000.00 3,150,000.00 1,050,000.00 4,200,000.00 2,688,000.00 940,800.00 Required: Compute income tax still due or payable after tax credit for year 2023.arrow_forwardKatya Corporation had the following data in 2022: Gross Income, Philippines P 600,000 500,000 300,000 Gross Income, USA Expenses, Philippines Expenses, USA Interest from time deposit 300,000 10,000 21,000 interest on money market placement, net of tax Compute the income tax due and the final taxes payable if Katya is a: 1. Domestic Corporation 2. Resident Foreign Corporation 3. Nonresident Foreign Corporationarrow_forwardBelow is a snip from the Financial Statement of Angat Bunay Corporation for 2019: Philippines: Sales 3,000,000 Sales Discount 500,000 Cost of Sales 1, 200,000 Operating Expenses 700,000 Interest Income on Bank Deposits 60,000 Japan: Gross Income 1,000,000 Business Expenses 700,000 Assuming the corporation already operated for more than 4 years. How much will be its tax due? Select the correct response: 180,000 46,000 270,000 390,000arrow_forward