Project Management: The Managerial Process (Mcgraw-hill Series Operations and Decision Sciences)

7th Edition

ISBN: 9781259666094

Author: Erik W. Larson, Clifford F. Gray

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

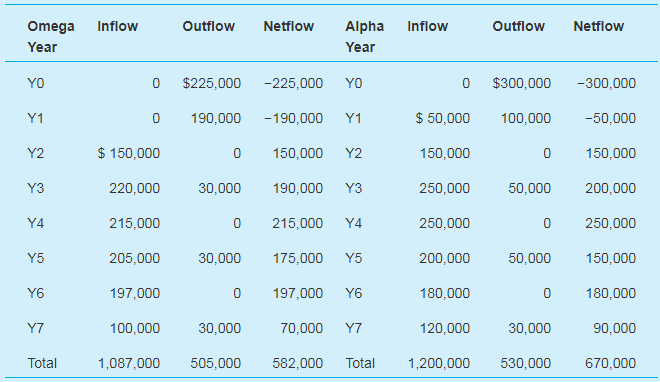

Chapter 2, Problem 4E

You work for the 3T company, which expects to earn at least i8 percent on its investments. You have to choose between two similar projects. The following chart shows the cash information for each project. Which of the two projects would you fund if the decision is based only on financial information? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Two new Internet site projects are proposed to a young start -up company. Project A will cost $250,000 to implement and is expected to have annual net cash flows of $75,000. Project B will cost $150,000 to implement and should generate annual net cash flows of $52,000. The compnay is very concerned about their cash flow. Using the payback period, which project is better, from a cash flow standpoint?

Suppose you're a financial analyst at a company, and you are recommending whether the company

should invest in Project A or Project B.

Each of the two projects has been proposed by a lead engineer, but the company can only invest in

creating one of them this year, and so your manager wants you to give her advice on which one to

invest in. Your company's WACC is 9%.

Project A

Project 8

Year

Cash Flow

Year

Cash Flow

$3 ilio, ntialinvestment

$2 milion proft

$4 ilion pofit

$A milion proft

$2 milion proft

$0, projet loseout

$3 ilion, ntia ivestment

$0

$0

$0

$0

$14 milion poit

1

1

2

2

3

3

4

4

5

5

Calculate the net present value (NPV) of and decide which one is better.

S 유

4. Transrail is bidding on a project that it figures will cost $400,000 to perform. Using a 25% markup, it will charge $500,000, netting a profit of $100,000. However, it has been learned that another company, Rail Freight, is also considering bidding on the project. If Rail Freight does submit a bid, it figures to be a bid about $470,000. Transrail really wants this project and is considering a bid with only a 15% markup to $460,000 to ensure winning regardless of whether or not Rail Freight submits a bid.

a. Prepare a profit payoff table from Transrail’s point of view. (6 points)

b. For this payoff table find Transrail’s optimal decision using (1) the pessimistic approach, (2) the optimistic approach, and (3) minimax regret approach. (10 points)

c. If Rail Freight is known to submit bids on only 25% of the projects it considers, what decision should Transrail make? (5 points)

d. Given the information in (c), what is EVPI? (5 points)

Chapter 2 Solutions

Project Management: The Managerial Process (Mcgraw-hill Series Operations and Decision Sciences)

Ch. 2 - Describe the major components of the strategic...Ch. 2 - Explain the role projects play in the strategic...Ch. 2 - How are projects linked to the strategic plan?Ch. 2 - The portfolio of projects is typically represented...Ch. 2 - Why does the priority system described in this...Ch. 2 - Why should an organization not rely only on ROI to...Ch. 2 - Discuss the pros and cons of the checklist versus...Ch. 2 - You manage a hotel resort located on the South...Ch. 2 - Two new software projects are proposed to a young,...Ch. 2 - A five-year project has a projected net cash flow...

Ch. 2 - You work for the 3T company, which expects to earn...Ch. 2 - You are the head of the project selection team at...Ch. 2 - You are the head of the project selection team at...Ch. 2 - The Custom Bike Company has set up a weighted...Ch. 2 - What is our major problem?Ch. 2 - Identify some symptoms of the problem.Ch. 2 - What is the major cause of the problem?

Additional Business Textbook Solutions

Find more solutions based on key concepts

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (12th Edition)

Much of risk management consists of reducing risky behavior. What kinds of risky behavior have you observed amo...

Understanding Business

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

What Kinds of systems are illustrated in this case study? Where do they obtain their data? What do they do with...

Essentials of MIS (13th Edition)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (11th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- Discuss the most common sources of risk in IT projects, as well as mitigation strategies. How do decision trees and Monte Carlo analysis quantify risk?arrow_forwardRisk management involves identification, assessment, control, and response to project risks to minimize the likelihood of occurrence and/or potential impact of adverse events on the accomplishment of the project objective. Risk identification includes determining which risks may adversely affect the project objective and estimating what the potential impacts of each risk might be if they occur. Describe the steps involved to manage risk on a project. How can a risk assessment matrix help in this process? What risks for a project have the highest priority? Does the priority for a risk change as the project progress?arrow_forwardYou are managing a construction project that is currently being initiated. Youmet with the sponsors and several important stakeholders, and have startedto work on the preliminary scope statement. You’ve documented several keyassumptions that have been made, and identified project constraints andinitial risks. Before you can finish the preliminary scope statement, you mustmake a rough order of magnitude estimate of both time and cost, so that thesponsor can allocate the final budget. What’s the range of a rough order ofmagnitude (ROM) estimate?A. (-10%) to +10%B. (-50%) to +100%C. (-50%) to +50%D. (-100%) to +200%arrow_forward

- 5. Describe one issue that potentially limits the effectiveness of project management software in businesses. How can this issue be overcome? 6. You have been assigned as the project manager for the SuperMegaExtraBig Systems Upgrade project. As part of your project risk analysis, you determined the top 10 risks in this project based on their expected monetary value (EMV). The data is below: Risk EMV $45,000 $38,000 $32,000 $21,500 $14,500 $12,200 $8,000 $6,500 $4,000 $4,000 A C F How much risk reserve (risk contingency) should you budget for this project? Justify your response. DEEGHI -→arrow_forwardEstimating project costs seems to be the main problem for Project 14321. You are to advise a reward mechanism for TSC management that will help with improving project cost estimationarrow_forwardInvestment timing option: left Table shows the investment made now (year 0); right Table shows the investment made 1 year later. Discount rate is r = 10%. Probability Year 0 0.50 -$28 0.50 -$10 $11 None of the others is correct $10 Year 1 $55 $22 If this project's uncertainty in Year 0 (two scenarios with 50% chance each) is completely gone right after the end of year 0, i.e., you will know which scenario turns out to be true right after Year 0, then what is the value of this investment timing option today? [Hint: value of the option = E[NPV with option] - E[NPV] =?] 3 Year 2 $0 Probability Year 0 0.50 $0 0.50 Year 1 -$28 -$28 Year 2 $55 $22arrow_forward

- Do the engineers face the decision problem involving the selection of the best course of action when there are several ways to meet a project's requirements?arrow_forwardToo High Tech ("Smoke and Mirrors" or Real Sales)?Staci Sutter works as an analyst for Independent Investment Bankshares (IIBS), which is a largeinvestment banking organization. She has been evaluating an IPO that IIBS is handling for atechnology company named ProTech Incorporated. Staci is essentially finished with her analysis, andshe is ready to estimate the price for which the stock should be offered when it is issued next week.According to her analysis, Staci has concluded that ProTech is financially strong and is expected toremain financially strong long into the future. n fact, the figures provided by ProTech suggest thatthe firm's growth will exceed 30 percent during the next five years. For these reason, Staci isconsidering assigning a value of $35 per share to ProTech's stock.Staci, however, has an uneasy feeling about the validity of the financial figures she has beenevaluating. She believes the ProTech's CFO has given her what he believes are quality financialstatements.…arrow_forwardGiven a project with the following characteristics, answer the following questions:You are the project manager of a project to build fancy birdhouses.You are to build two birdhouses a month for 12 months.Each birdhouse is planned to cost $100.Your project is scheduled to last for 12 months.It is the beginning of month 10. You have built 20 birdhouses and your CPI is 9091. a. Assuming that the COST variance experienced so far in the project will continue, how much more moneywill it take to complete the project? b. If the variance experienced so far were to stop, what is the project's estimate at completion?arrow_forward

- You are working on a manufacturing project having a budget of PKR 3,600,000 and the expected time of its completion is one year. There is an ideal condition that your budget and work are evenly spread across the duration of the project that is twelve months. At the end of the fourth month, the senior management has called a meeting and invited all the stakeholders to brief about the status of the project. You being the PM of this project are giving the presentation to all the attendees and informed them that the project is on schedule and PKR 1,800,000 has already been spent on the project. Calculate Cost and Schedule Variance What is SPI and CPI of the project? Estimate at completion and Estimated time to complete?arrow_forwardBobby is an employee of a publicly traded corporation, and holds stock and stock options. As a member of the product development team, he has been working on the design of a new product at the company. For its part, the company has been pinning most of its future economic hopes on thesuccess of the release of the product. However, the development of the product has not gone public yet. The company is keeping the entire project a complete secret until it releases it publicly. The company has been so secretive about the new product that no one but Bobby knows the releasedate yet. When Bobby realizes this, he decides to use this information to profit heavily by purchasing as much stock as he can afford in the company right before the product goes public. Then, when the stock prices rise after the successful release of the product, he plans to sell it all. What kinds of information are considered "material information" when discussing insider trading? Would the information Bobby used to…arrow_forwardProject Direct costs are the costs related with utility expenses in the project. true or false?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON

Inventory Management | Concepts, Examples and Solved Problems; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=2n9NLZTIlz8;License: Standard YouTube License, CC-BY