Concept explainers

1.

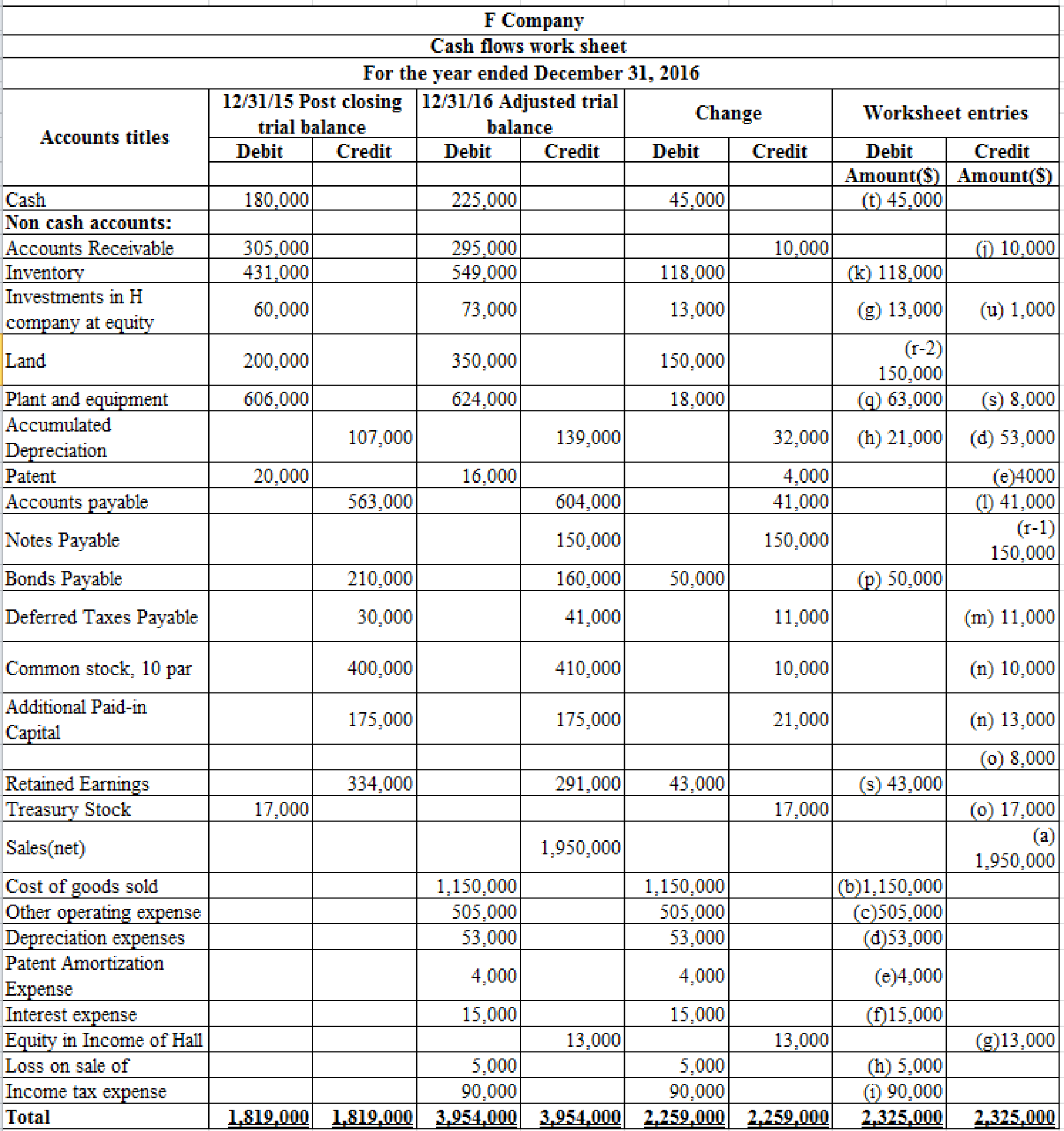

Prepare a spreadsheet to support the statement of

1.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Direct method: Under direct method, cash receipts from customers (

Prepare a spreadsheet to support the statement of cash flows under direct method.

Table (1)

Table (2)

Working notes:

a) Net sales for the year is $1,950,000.

b) Cost of goods sold is $1,150,000.

c) Other operating expenses is $505,000.

f) Interest expense is $15,000.

h) Loss on sale of equipment is $5,000.

i) Income tax expense is $90,000.

j) Calculate the accounts receivable.

k) Calculate the increase in inventory.

l) Calculate the accounts payable.

m) Calculate the

n) Calculate proceeds from sale of common stock.

o) Calculate proceeds from sale of

p) Calculate the payment to retire bonds.

q) Purchase of equipment is $63,000.

r-1) Issuance of long-term note is $150,000.

r-2) Calculate issuance of long-term note to purchase land.

s) Payment of cash dividends is $43,000.

t) Calculate net increase in cash.

Therefore, net increase in cash is $45,000.

2.

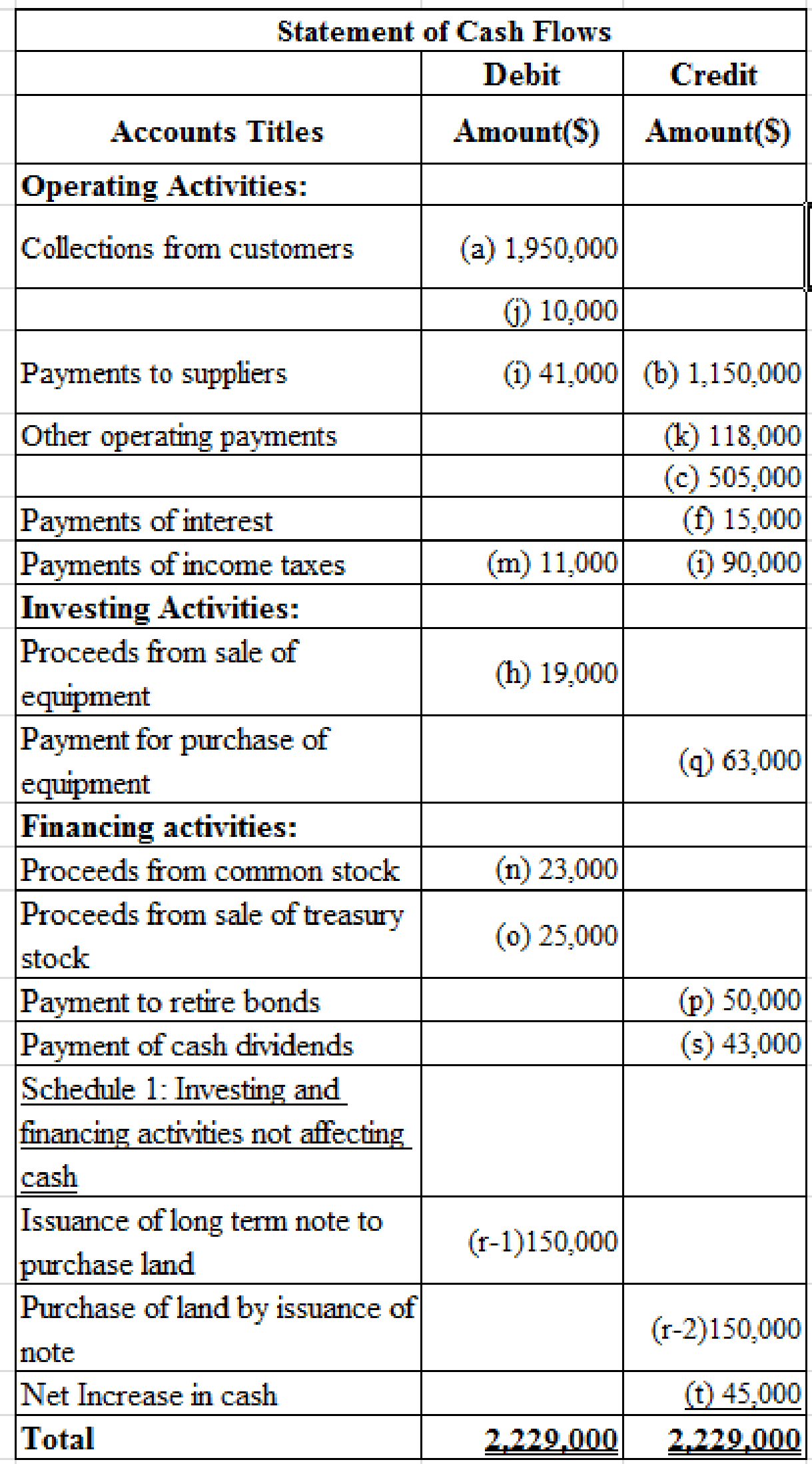

Prepare a statement of cash flows of F Company for the year 2016.

2.

Explanation of Solution

Prepare a statement of cash flows of F Company for the year 2016.

| F Company | ||

| Statement of cash flows | ||

| For Year Ended December 31, 2016 | ||

| Particulars | Amount($) | Amount($) |

| Operating Activities: | ||

| Cash inflows: | ||

| Collections from customers | 1,960,000 | |

| Cash inflows from operating activities | 1,960,000 | |

| Cash outflows: | ||

| Payments to suppliers | (1,227,000) | |

| Other operating payments | (505,000) | |

| Payments of interest | (15,000) | |

| Payments of income taxes | (79,000) | |

| Cash outflows from operating activities | (1,826,000) | |

| Net cash provided by operating activities | 134,000 | |

| Investing Activities: | ||

| Proceeds from sale of equipment | 19,000 | |

| Payment for purchase of equipment | (63,000) | |

| Net cash used for investing activities | (44,000) | |

| Financing Activities: | ||

| Proceeds from sale of common stock | 23,000 | |

| Proceeds from sale of treasury stock | 25,000 | |

| Payment to retire bonds | (50,000) | |

| Payment of cash dividend | (43,000) | |

| Net cash used for financing activities | (45,000) | |

| Net increase in cash (see Schedule 1) | 45,000 | |

| Cash, January 1, 2016 | 180,000 | |

| Cash, December 31,2016 | 225,000 | |

| Schedule 1: Investing and Financing Activities Not Affecting Cash | ||

| Investing Activities: | ||

| Purchase of land by issuance of long-term note | (150,000) | |

| Financing Activities: | ||

| Issuance of long-term note to purchase land | 150,000 | |

Table (3)

Therefore, the net increase in cash is $45,000.

Want to see more full solutions like this?

Chapter 21 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)arrow_forward

- The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardLyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.arrow_forward

- DOOKO Corporation’s, Statement of Financial Position as of December 31, 2018 shows the following account balances: Equipment P 40,000 Interest Expense 2,400 Interest Payable 600 Retained Earnings 214,680 Dividends 50,400 Land 137,320 Inventory 102,000 Bonds Payable 78,000 Notes Payable (due in 6 months) 14,400 Share capital–ordinary 60,000 Accum. Deprc’n. - Equipt. 10,000 Prepaid Advertising 5,000 Revenue 331,400 Buildings 80,400 Supplies 1,860 Taxes Payable…arrow_forwardBelow is some selected information from the financial statements of ManyFaces, Ltd: As of 12/31/2019 As of 12/31/2020 Total $4,500,320 $3,930,560 Assets Total ????? $2,063,990 Liabilities During the year ended 12/31/2020, the firm reported net income of $250,313, issued $17,000 of Common Stock at par value, and declared and paid $3,000 in Dividends. What is balance of Total Liabilities as of 12/31/2020? Group of answer choices $2,563,750 $2,619,500 $2,904,063 $2,369,437 $2,458,543arrow_forwardInc. identified the following selected transactions occurring during the year ended December 31, 2018: a. issued 850 shares of $4 par common stock for cash of $25,000. b. issued 4,800 shares of $4 par common stock for building with fair market value of $98,000. c. purchased new truck with fair market value of $31,000. financed it 100% with long-term note. d. retired short-term notes $27,000 by issuing 2,7000 shares of $4 par common stock. e. paid long-term notes of $10,000 to Bank of Tallahassee. issued new long-term note of $20,000 to Bank of Trust. Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing activities section of the statement of cash flows. Inc Statement of Cash Flows (partial) Year Ended December 31, 2018 Non-cash Investing and Financial Activities Total non-cash Investing and Financing Activitiesarrow_forward

- . The following are the amounts of Care Corporation’s assets and liabilities at May 31, 2010 and its revenue and expenses for the year ended on that date, listed in alphabetical order. Care Corporation had share capital of P50,000 and accumulated profits of P87,390 on June 1, the beginning of the fiscal year. During the year, the corporation paid cash dividends of P25,000. Accounts payable P 48,320 Accounts receivable 68,840 Advertising expense 14,600 Cash 40,150 Insurance expense 12,000 Land 150,000 Miscellaneous expense 3,140 Notes payable 22,000 Prepaid insurance 2,000 Rent…arrow_forwardBelton, Inc. had the following transactions in 2018, its first year of operations: Issued 37,000 shares of common stock. Stock has par value of $1.00 per share and was issued at $21.00 per share. Earned net income of $72,000. Paid no dividends. At the end of 2018, what is the total amount of paid-in capital? A. $777,000 B. $37,000 C. $849,000 D. $72,000arrow_forwardHere is the income statement for Teal Mountain Inc. TEAL MOUNTAIN INC.Income StatementFor the Year Ended December 31, 2020 Sales revenue $402,900 Cost of goods sold 256,700 Gross profit 146,200 Expenses (including $10,200 interest and $29,600 income taxes) 89,200 Net income $ 57,000 Additional information: 1. Common stock outstanding January 1, 2020, was 30,000 shares, and 39,000 shares were outstanding at December 31, 2020. 2. The market price of Teal Mountain stock was $15 in 2020. 3. Cash dividends of $24,700 were paid, $6,500 of which were to preferred stockholders. Compute the following measures for 2020. (Round all answers to 2 decimal places, e.g. 1.83 or 2.51%) (a) Earnings per share $enter a dollar amount (b) Price-earnings ratio enter Price-earnings ratio in times times (c) Payout ratio enter percentages % (d) Times interest earned enter Times interest…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning