Concept explainers

Equity Entries with Differential

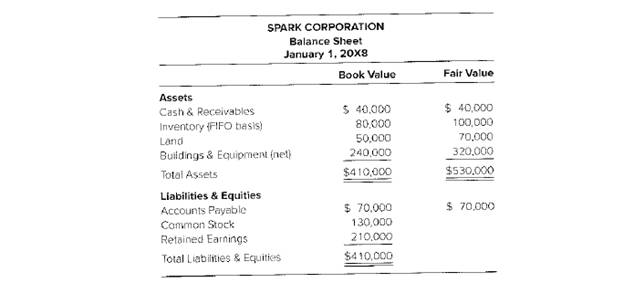

Plug Corporation acquired 35 percent of Spark Corporation’s stock on January 1,20X8, by issuing25,000 shares of its $2 par value common stock. Spark Corporation’s balance sheet immediatelybefore the acquisition contained the following items:

Shares of Plug were selling at $8 at the time of the acquisition. On the date of acquisition, the remaining economic life of buildings and equipment held by Spark was 20 years. The amountof the differential assigned to

Required

a. Give the

b. What balance will Plug report as its investment in Spark at December 31, 20X8?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Advanced Financial Accounting

- On January 1, 2023, Holland Corporation paid $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $5.00 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents $14,700 Liabilities 288,708 Common stock 199,100 Retained earnings $422,500 $222,500 100,000 100,000 $ 422,500 On January 1, 2023, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $62,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $226,900. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's…arrow_forwardOn January 1, 2023, Holland Corporation paid $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $5.00 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents On January 1, 2023, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $43,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $246,400. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's acquisition-date fair value over its book value was attributed to goodwill. The companies' financial statements for the…arrow_forwardOn January 1, 2023, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents $ 14,000 Liabilities 268,000 Common stock. 190,000 Retained earnings $ 212,000 100,000 160,000 $ 472,000 $ 472,000 es On January 1, 2023, Holland assessed the carrying amount of Zeetand's equipment (5-year remaining life) to be undervalued by $55,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $285,000. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's…arrow_forward

- On January 1, 2023, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents $ 14,800 Liabilities 268,800 Common stock 200,400 Retained earnings $ 224,000 100,000 160,000 $ 484,000 $ 484,000 On January 1, 2023, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $63,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $315,600. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's…arrow_forwardOn January 1, 2020, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland’s acquisition date balance sheet follows: Current assets $ 14,000 Liabilities $ 212,000 Property and equipment (net) 268,000 Common stock 100,000 Patents 190,000 Retained earnings 160,000 $ 472,000 $ 472,000 On January 1, 2020, Holland assessed the carrying amount of Zeeland’s equipment (5-year remaining life) to be undervalued by $55,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $285,000. Zeeland’s acquisition-date fair values for its current assets and liabilities were equal to…arrow_forwardOn January 1, 2020, Holland Corporation paid $9 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $8.00 per share both before and after the acquisition by Holland. Zeeland’s acquisition date balance sheet follows: Current assets $ 14,300 Liabilities $ 216,500 Property and equipment (net) 328,300 Common stock 100,000 Patents 193,900 Retained earnings 220,000 $ 536,500 $ 536,500 On January 1, 2020, Holland assessed the carrying amount of Zeeland’s equipment (5-year remaining life) to be undervalued by $58,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $300,600. Zeeland’s acquisition-date fair values for its current assets and liabilities were equal to…arrow_forward

- On January 1, 2020, Holland Corporation paid $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $5.50 per share both before and after the acquisition by Holland. Zeeland’s acquisition date balance sheet follows: Current assets $ 15,100 Liabilities $ 228,500 Property and equipment (net) 229,100 Common stock 100,000 Patents 204,300 Retained earnings 120,000 $ 448,500 $ 448,500 On January 1, 2020, Holland assessed the carrying amount of Zeeland’s equipment (5-year remaining life) to be undervalued by $66,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $254,600. Zeeland’s acquisition-date fair values for its current assets and liabilities were equal to…arrow_forwardOn January 2, 20Y7, Mikedes Company acquired 30% of the outstanding stock of Violet Company for $720,000. For the year ended December 31, 20Y7, Violet Company earned income of $190,000 and paid dividends of $40,000. On January 31, 20Y8, Mikedes Company sold all of its investment in Violet Company stock for $770,000. Required: Journalize the entries for Mikedes Company for the purchase of the stock, the share of Violet income, the dividends received from Violet Company, and the sale of the Violet Company stock. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardLamberson Cookie Corporation purchased 40% of the 325,000 outstanding shares of HC's Fine Foods, Inc. on January 1 of the current year. Lamberson Cookie acquired the shares at a price of $3.90 per share. HC's Fine Foods, Inc. reported net income of $71,000 and declared and paid cash dividends of $25,400 during the current year. At the time of acquisition, the book value of HC's Fine Foods' net assets equaled its market value. Requirement Prepare all journal entries necessary to account for this investment in HC's on Lamberson Cookie's books under the equity method. Prepare all journal entries necessary to account for this investment in HC's on Lamberson Cookie's books under the equity method. (Record debits first, then credits. Exclude explanations from any journal entries.) First, record Lamberson Cookie Corporation's acquisition of a 40% share of HC's Fine Foods, Inc on January 1 of the current year. Account January 1, Current Yeararrow_forward

- On May 1, Burns Corporation acquired 100 percent of the outstanding ownership shares of Quigley Corporation in exchange for $728,000 cash. At the acquisition date, Quigley's book and fair values were as follows: Cash Receivables Inventory Land Building and equipment (net) Patented technology Total assets Accounts payable Long-term liabilities Common stock ($5 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders equity Total assets Assets Book Value $ 112,000 $ 218,000 232,000 $ 177,000 323,000 0 $1,062,000 $ 162,500 $ 638,000 210,000 90,000 (38,500) $1,062,000 Burns directs Quigley to seek additional financing for expansion through a new long-term debt issue. Consequently, Quigley will issue a set of financial statements separate from that of its new parent to support its request for debt and accompanying regulatory filings. Quigley elects to apply pushdown accounting in order to show recent fair valuations for its assets. Prepare a separate…arrow_forwardOn January 1, 2030, ABS Co. acquired 70% of outstanding ordinary shares of Sky Inc. at a price of P1,000,000. ABS Co. incurred P200,000 cost related to acquisition. At acquisition date, the book value of net assets of Sky Inc. is P2,500,000 but building with useful life of 10 years is overstated by P500,000. For the year ended December 31, 2030, Sky Inc. reported net income of P350,000 and declared dividend in the amount of P100,000. The fair value of the Investment in Sky Inc. is measured at P1,700,000 on December 31, 2030 In the separate financial statement of ABS Co., the Investment in Sky Inc. shall be reported on December 31, 2030 at what amount under these models? Equity method Cost method Fair Value Model through P/L Fair Value Model through OCI Using the same data in number 6, in the separate financial statement of ABS Co., what is its income in relation to Investment in Sky Inc. for the year ended December 31, 2030 under these models? Equity method Cost method Fair…arrow_forwardOn January 1, 2030, ABS Co. acquired 70% of outstanding ordinary shares of Sky Inc. at a price of P1,000,000. ABS Co. incurred P200,000 cost related to acquisition. At acquisition date, the book value of net assets of Sky Inc. is P2,500,000 but building with useful life of 10 years is overstated by P500,000. For the year ended December 31, 2030, Sky Inc. reported net income of P350,000 and declared dividend in the amount of P100,000. The fair value of the Investment in Sky Inc. is measured at P1,700,000 on December 31, 2030. Using the same data in number 6, in the separate financial statement of ABS Co., what is its income in relation to Investment in Sky Inc. for the year ended December 31, 2030 under these models? Equity method Cost method Fair Value Model through P/L Fair Value Model through OCIarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning